Key Reasons why Weak August NFP Wasn’t a Surprise. EURUSD Weekly Setup

The odds of a September Fed shift in policy retreated further after release of August NFP report last Friday. The payrolls gain was a big miss as it was three times less than consensus of 725K. Judging by the greenback’s price action on Friday and Monday, there was no serious change in expectations: investors continue to expect that the Fed will taper QE this year, however expectations of the announcement completely shifted to November or December.

The US economy created 235K thousand jobs in August, against the forecast of 750K. If it had happened a month ago, traders would probably have crossed out the Fed's tightening from the list of expectations, but August was not easy for the economy due to the action of an exogenous factor - the delta strain of the coronavirus. Consumer mobility declined in early August, and the service sector in some states faced restrictions again. The peak of impact was just in the reporting week for the NFP. Therefore, with regard to the service sector, it is probably correct to say that job growth did not slow down, but was restrained.

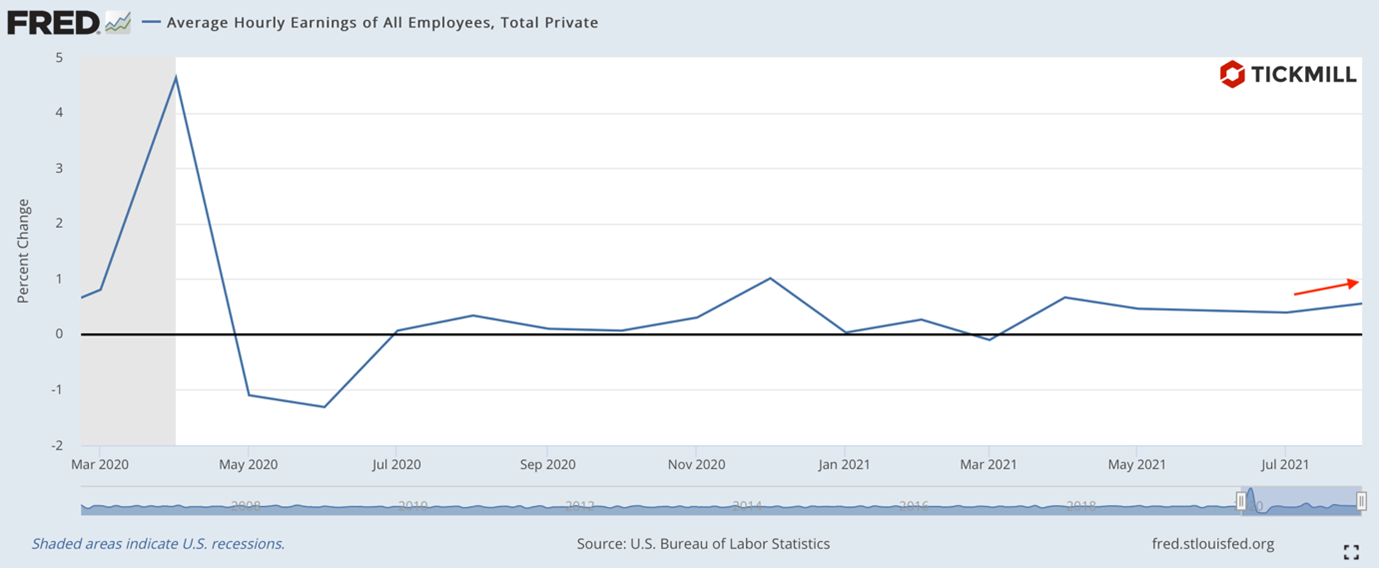

Other aspects of the report also point to a temporary slowdown in job growth. For example, the growth of jobs over the previous month was revised up to 1.053 million, and wages rose surprisingly in both monthly and annual terms. For example, in August, the average hourly wages increased by 0.6% against the forecast of 0.3%:

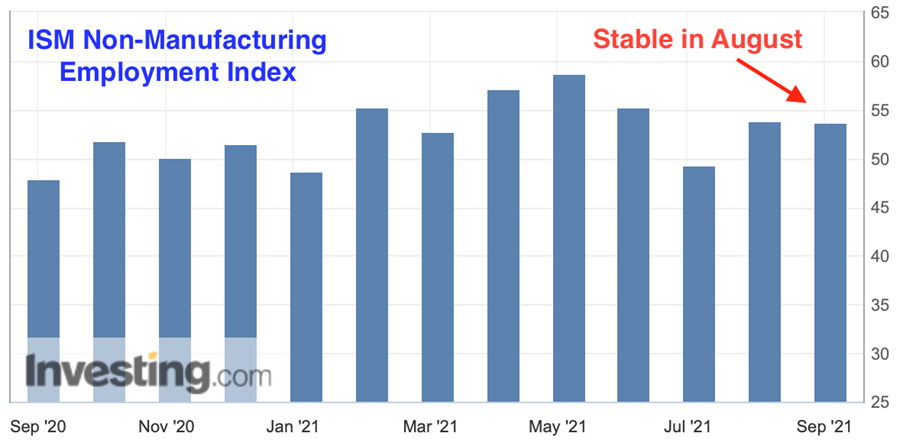

It is unlikely that we would have seen such a dynamic if thedemand for labor was weak. Also released on Friday, ISM's US service sectoractivity index exceeded forecast, with the hiring component only slightlychanged from the previous month (53.7 vs. 53.8 points in July):

Again, weak labor demand would send the index below 50 points, which as we can see didn’t happen despite the fact that hiring slowed down.

The dollar index tested the level of 92 after release of the NFP. Despite the attempt to break through, the price failed to gain a foothold below despite the large downbeat surprise in the data. Today buyers are developing an upward rebound amid weak trading activity. The rise will most likely fizzle out in the area of 92.40:

The main risk event this week will be the ECB meeting. Last week, some of the ECB's monetary policymakers said publicly that they are ready to discuss cutting asset purchases. Considering EURUSD, it is clear that the main events on the side of the dollar have been priced in, therefore, for some time the pair may be influenced by events related, among other things, to the position of the ECB.

This week, a meeting of the European regulator will take place on Thursday, and if Lagarde speaks about the possibility that in the near future it is worth starting to discuss cuts in anti-crisis measures, the euro will receive additional support amid expectations of an increase in European bond rates due to a decrease in ECB activity in the debt market.

In my opinion, the risks for EURUSD are skewed towards more upside this week due to the upcoming ECB meeting, targets above 1.19 remain relevant, especially if the European Central Bank offers hawkish surprise this week.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.