Key Takeaways from the Fed Meeting for Equity Markets

The Fed meeting was not convincing enough to stop the rise in market rates. The yield on 10-year US Treasuries again renewed its local peak, exceeding 1.7% on Thursday. Acknowledging that GDP and inflation will grow at faster pace than previously forecasted, the Fed generally left its forecasts for a first rate hike unchanged - no earlier than 2024. QE at the current volume of $120 billion / month (80 billion Treasuries + 40 billion MBS) will continue until there is "significant progress in achieving unemployment and inflation targets."

The Fed significantly raised its forecast for GDP growth - from 4.2% to 6.5% (Q4 2021 compared to Q4 2020), and inflation - from 1.8% to 2.2%. Nevertheless, the dot plot showed that the majority of FOMC members would not have voted for a rate hike before 2024. That is, the opinion of the majority, compared to the last meeting, has not changed. The number of FOMC participants awaiting an increase by the end of 2023 increased from 5 to 7, and those who would vote for an increase by the end of 2022 - from 1 to 4 participants.

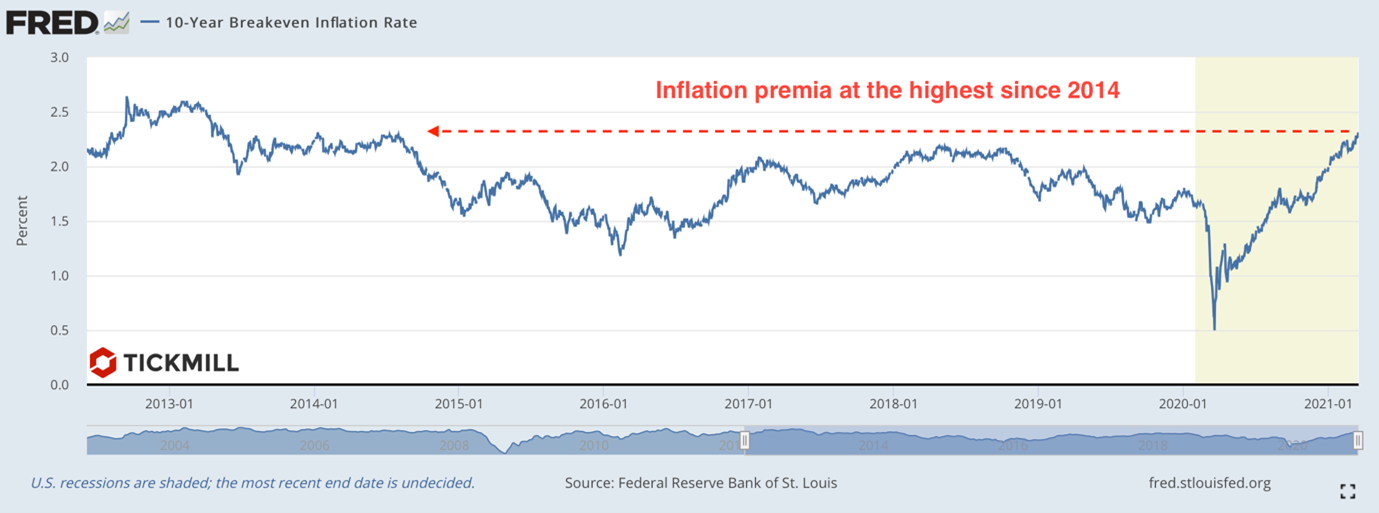

The situation is not easy for the Fed. On the one hand, recent economic data trumpet expansion and market participants demand that the Fed admit it by hinting at an earlier rate hike. We see this through the rise in market interest rates, growing inflation premium in bonds, various inflation swaps, etc.:

If the Fed pretends that early rate hikes are out of the question, inflation expectations will accelerate growth (low Fed rate + strong economy = high inflation). On the other hand, if the Fed hints at earlier QE tapering or a rate hike - the expectation that the Fed will start selling bonds from the balance sheet earlier => another jump in yields upward (“the Fed will soon join the bond sale”). In both cases, rising market interest rates (borrowing costs) will slow recovery. It would seem, why not then declare that it is still not so rosy and low rates are justified? This would contain the rise in bond yields, but it could sow anxiety among market participants and derail the recovery as well due to wrong guidance. In general, Powell has to carry out a difficult balancing work at press conferences - to combine recognition of expansion, uncertainty about the future and, as it were, leave the possibility of an early increase in rates.

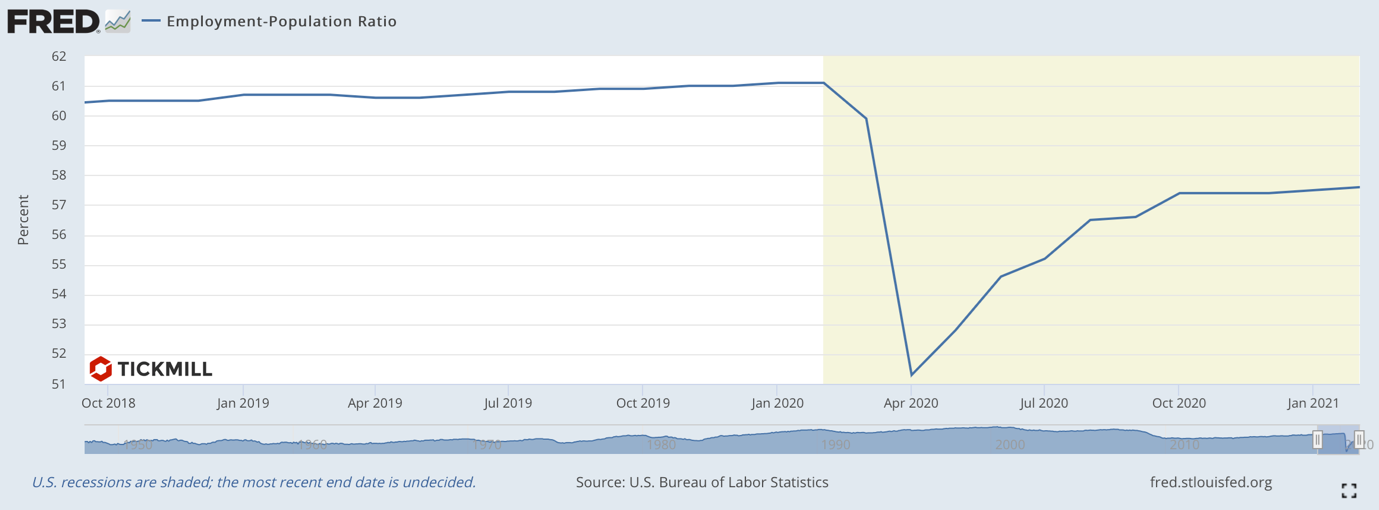

The US economy is currently experiencing an increase in consumer spending and the number of jobs in the US, but on the other hand, the economy is still 9.5 million fewer jobs than it was a year ago. The unemployment rate shows an incomplete picture, as it does not take into account the unemployed who are not looking for work. So, for example, if unemployment in the United States fell from 10% to 6%, the labor force participation rate recovered from a minimum of 60.2% (May 2020) to only 61.4%, which is below the pre-crisis level of 63.4%. And if we look at the share of the employed in the working-age population (an even broader indicator), then it recovered even worse after the crisis:

In my opinion, the Fed would like to see this figure at 60% before starting to normalize policy. The catch is, it's hard to predict when this will happen. With fiscal incentives - maybe this year. Then the markets will have to prepare for a rate hike. This is why markets tend to get ahead of the curve now.

As a result of the meeting, one thing became clear - long-term rates will continue to grow, which will neutralize the positive effect of fiscal stimulus on stock markets. Waves of sales in bonds, which, apparently, will still occur, since the path of yields upward is open, will cause, according to the well-known scenario, corrections in the stock markets as well. Growth is likely to be, but not as smooth as we would like.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.