Last Chance for Trump to Narrow the gap

Biden’s lead in polls declined last week, albeit slightly, which still kept markets under pressure. The event which jumps into the foreground this week is the second presidential debate. It is Trump's last big chance before the election to leap forward and narrow the lead. In my opinion, if Trump manages to weaken Biden’s advantage, it will be a risk-off event since this outcome increases the chance of contested elections (which is a great source of uncertainty). Extension of Biden’s lead should be a boon for the markets helping them to extend the rally.

Important data on the US economy this week will be new home sales, the Fed's Beige Book and, of course, the initial jobless claims, which will receive a little more attention as the jobs market exhibited some weakness last week. The rest of the calendar for America is not particularly remarkable.

On Monday, the USD index began to decline aggressively, continuing the downward trend from September 25. Recall that at the same time the probability of Biden's victory and the probability of a complete victory for the Democrats began to rise:

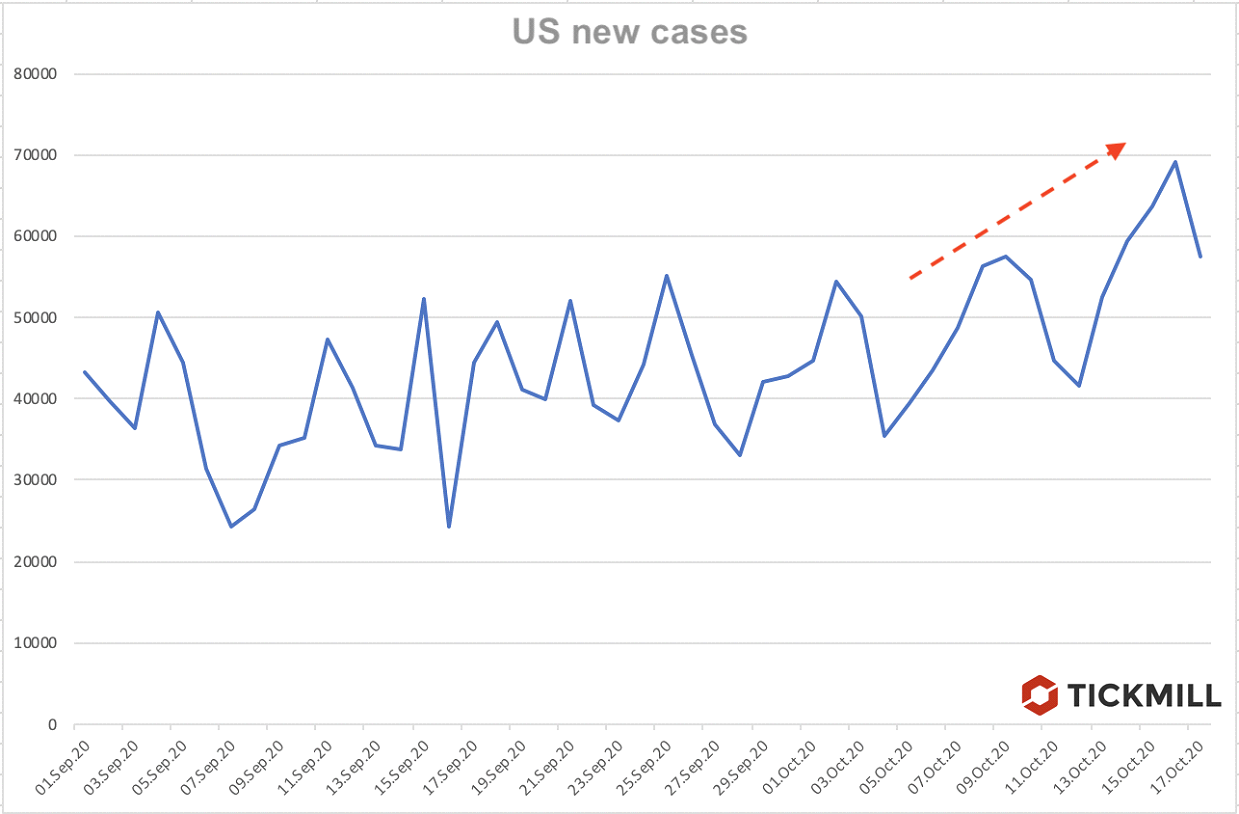

The Covid situation in the United States was generally calm in September, but became alarming in early October:

The numbers are not so critical yet to tighten measures (and crash the market), but let’s keep the finger on the pulse.

In my opinion, there are little grounds to expect some surprise in Trump performance on the debates and expectations that Biden will extend or retain its lead should drive USD decline this week. The target for USD index is 93.00 level and 1.1830 - 1.1850 in EURUSD.

The data on Chinese economy left a mixed impression. GDP in the third quarter increased by 4.9% (forecast 5.2%), but the growth of industrial production in September (which is tied to external demand) beat expectations - 6.9% against the forecast of 5.8%. Retail sales jumped 3.3% YoY last month, against a more modest forecast of 1.8%. Unemployment has dropped.

Today, a meeting of the OPEC + joint monitoring commission is scheduled, at which it will be discussed how responsibly the participants are approaching production cuts. Europe has tightened measures due to rising incidence of Covid-19, which curbs fuel demand and OPEC is increasingly aware of the need to adjust supply. Specific decisions, however, may happen at the full OPEC+ meeting due on November 30 - December 1, but today's meeting should contribute to the discussion about what OPEC + will do at the full meeting.

COT data showed that long positions of Brent speculators increased by 37,531 lots in the last reporting week. The net position increased to 120,108 lots. Most of the changes occurred in short covering - 28K out of 37K (~ 75%). It looks like speculators were unwilling to stay short ahead of news from OPEC + this week which creates opportunity for prices to test some monthly resistance levels:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.