Lingering Covid Uncertainty Will Likely Keep Markets Under Pressure Next Week

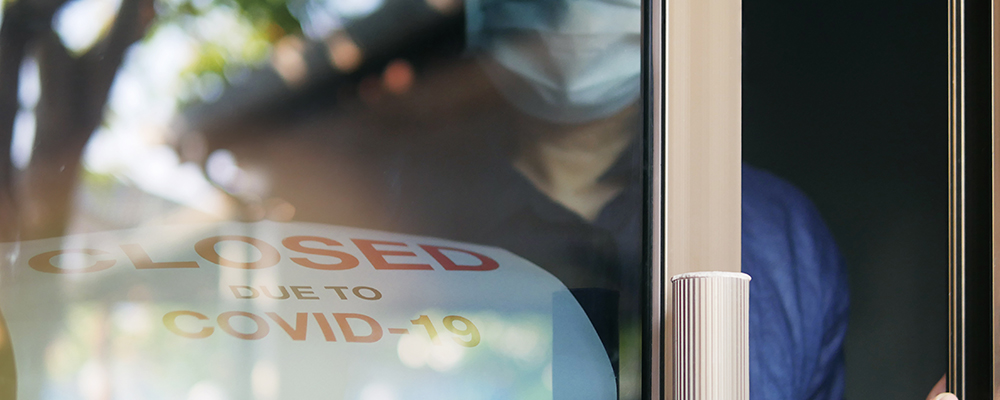

Financial markets have gone into full-blown correction on Friday. Oil collapsed, bond yields of major economies plummeted, indicating a strong demand for risk protection. Interestingly, the dollar is also falling, which until recently also served as a safe haven. It looks like the relatively high Treasury rates took away from it this status. The oversold yen, Swiss franc led growth in FX while pro-cyclical currencies (which growth correlates with expansion of the world economy) are falling strongly. It's not clear what could have caused such a dramatic change in sentiment, but it looks like the coronavirus is again involved. News media buzz about a new strain spreading in South Africa that may be resistant to existing vaccines. The number of daily covid cases caused by the new strain is still low, but the coronavirus pandemic in 2020 also began with a few cases. This idea, apparently, led some investors to decide to price in the risk of a repeat of the pandemic. The fall was intensified by speculative selling, given that loosened monetary policy of central banks + inflation drove risk assets to new historical highs and until recently they were swaying near ATH.

Several countries were quick to halt flights to the country, signaling that other governments may be ready to impose travel restrictions. This risk looks to be the key reason of downcast mood that swayed markets today.

In the short term, investors are likely to keep a close watch on news about whether the new strain will be able to supplant the existing ones in the country (as the Delta has done in some countries), as well as whether any vaccine developers will make a statement that the vaccine can be modified for this strain. This variable will influence the risk of new social and air travel restrictions in other countries. Protective assets should remain bid until those events, in particular, in the foreign exchange market, it is worth taking a closer look at the short positions on CADJPY, AUDJPY, NZDJPY, NZDCHF, CADCHF next week, as well as long positions in gold, which has corrected well after the recent rally and is ready for a new rally leg:

It should also be borne in mind that US markets were closed yesterday due to Thanksgiving, and today the trading session will be shortened. As a consequence, the markets may continue to absorb the new covid shock early next week.

Of the short-term technical scenarios, we can note the rebound in EURUSD from the previously indicated support level of 1.1170. European investors who have invested in US Treasuries due to the growing rate differential seem to be returning back, which puts pressure on the dollar and increases demand for the euro. Investment flows could allow the euro to develop momentum and test the upper limit of the main trend line for EURUSD - the 1.15 mark:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.