Little Surprise in China’s “forced imports” Plan

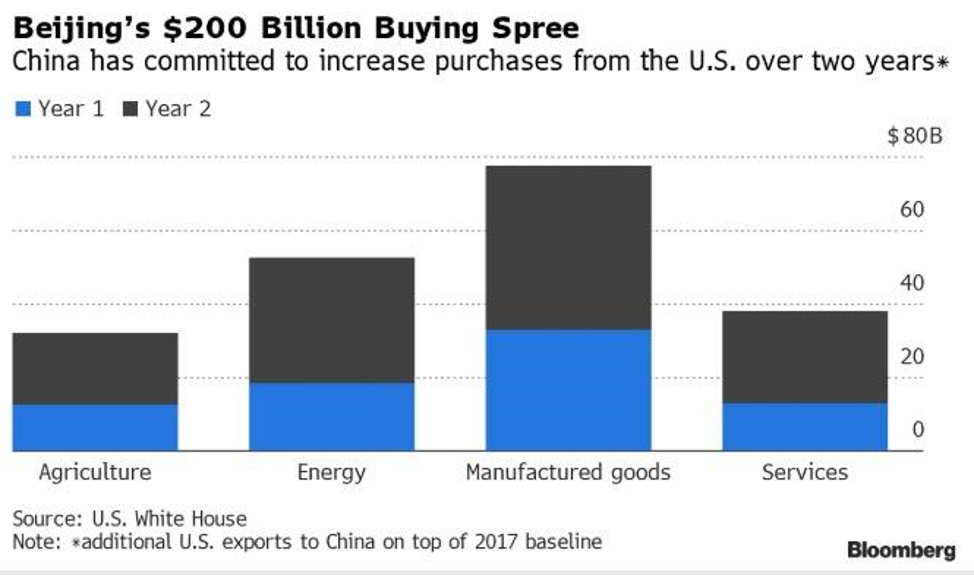

So, the “Phase One” trade agreement was signed on Wednesday and markets got some concrete figures to digest. They had to shed light (though a dim one) to China’s plans to correct the trade imbalance with the United States (which is almost $500 billion a year). The figures, though, contained little surprise, if any - annual China imports from the US will have to increase by $200 billion in 2021 (compared with the baseline year of 2017), the key trade categories are agricultural products, finished goods, energy and services:

Additional China purchases will be the largest in manufactured goods category, energy takes the second place, imports of the US services and farm products will increase by about the same amount. The graph also shows that the bulk of the “forced growth” of imports will happen in 2021.

Agricultural products will include meat, cereals, cotton, oilseeds. In the first year, additional imports will amount to $12.5 billion, in the second - $19.5 billion. It is still unclear how this will happen without destroying the supply chains from Latin America. China will also “do its best” to purchase $5 billion additional farm goods.

From the energy category, China will have to boost imports of the US LNG, petroleum products, coal and nuclear equipment. In the first year, additional imports will amount to $18.5 billion, in the second - $33.9 billion.

China will also accelerate the opening of its financial sector to foreign firms: The country is committed to lift in an expedited fashion the foreign equity cap in life, health and pensions insurance firms by April 1, 2020. US companies will be able to apply for asset management licenses, which will allow them to acquire non-performing loans directly from Chinese banks. China will also allow US rating agencies to enter the market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 70% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.