Market Spotlight: BOE's Pill In Focus Following UK Inflation Fall

Inflation Falls Again

Yesterday’s weaker-than-forecast UK inflation reading has put the emphasis back on a BOE pivot. On the back of the BOE’s most recent .5% hike, taking rates to their highest level in 14 years, market pricing has swung in favour of a smaller .25% hike at the upcoming March meeting. The BOE has signalled a desire to ease out of tightening and with inflation having dropped once again last month, there are growing risks that the BOE will opt for a pause at the next meeting.

Will Pill Talk GBP Down?

With this in mind, traders will be paying close attention to BOE chief economist Huw Pill who speaks later today. On the back of the latest drop in inflation (UK inflation has now fallen for three straight months), GBP will likely be highly sensitive to any suggesting that the BOE might either hold off from hiking for further or look to hike one lats time and then pause. Either way, it would likely take a hawkish surprise from Pill today to rive GBP higher near-term.

Where to Trade GBP Weakness?

If GBP does fall on the back of Pill’s comments today, GBPAUD looks to be a good candidate for GBP shorts. AUD has been rallying recently on the back of an unexpected uptick in Aussie inflation which has fuelled expectations of further RBA rate hikes to come. With clear divergence between BOE and RBA expectations, GBPAUD looks vulnerable to further weakness near-term.

Technical Views

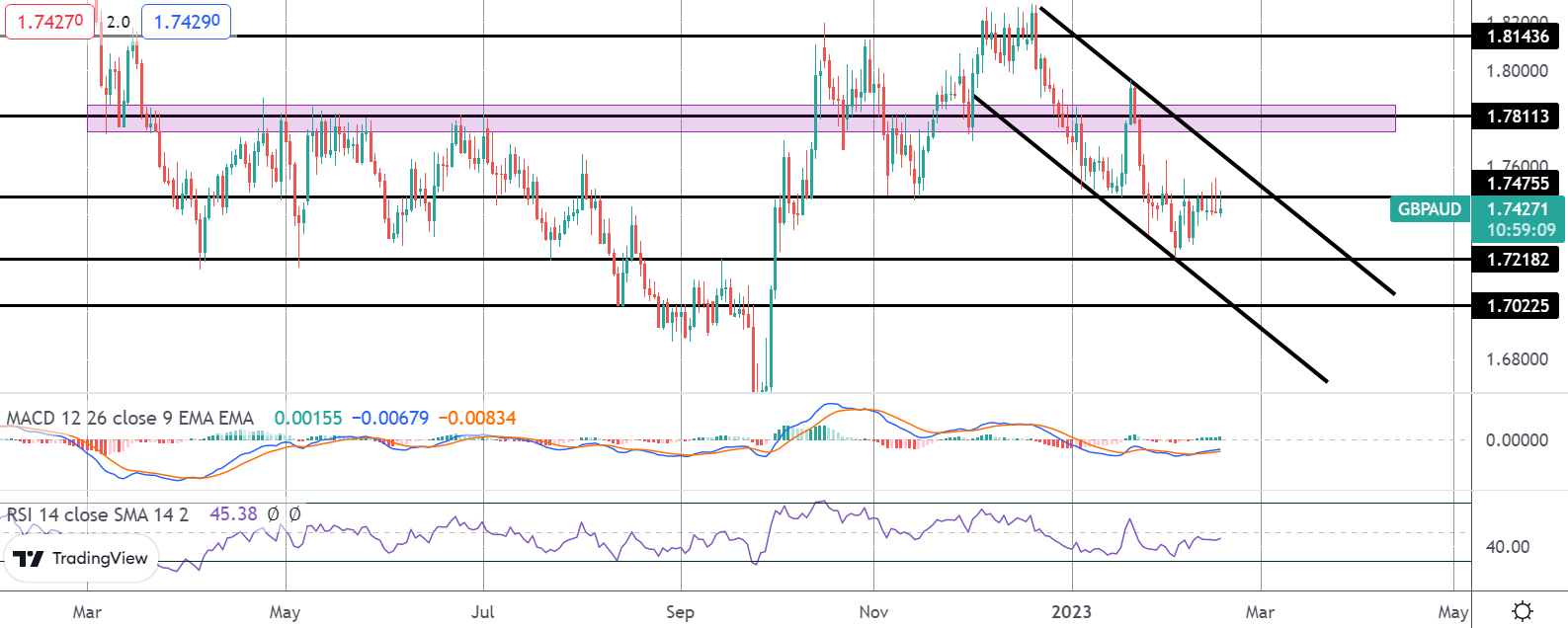

GBPAUD

The sell off in GBPAUD from December highs has been framed by a well-defined bear channel. The recent correction higher off the bear channel lows has stalled for now into a test of the 1.7475 level. While this level holds, the focus is on a continuation lower and a break of the 1.7218 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.