Markets Brace for 100 bp July Rate Hike and the Room for Dovish Surprise Grows

EURUSD volatility around the round 1.00 level remains elevated which creates ripple waves in other USD cross-pairs. After yesterday's "shocking" CPI release, markets shifted expectations of the upcoming July rate hike from 75bp to 100bp. Earlier, the Bank of Canada surprised markets with a front-loaded 100 bp rate hike, highlighting seriousness of the inflation threat and the need for decisive response. European currencies are set to remain in the shadow of a strong dollar for a while as the factor of interest rate differential, until the Fed's policy stance is clarified on July 27, should keep these currencies under pressure. EURUSD consolidation near the 1.00 level with very weak attempts to rebound indicates a growing risk of a bearish breakout with a target of 0.98-0.99.

At least one Fed official signaled that a 100 bp rate hike at the upcoming meeting is on the table. Speaking yesterday, Atlanta Fed chief Rafael Bostic said that “everything is at play”. Bank Nomura made a 100 bp outcome as a baseline scenario for the upcoming FOMC meeting.

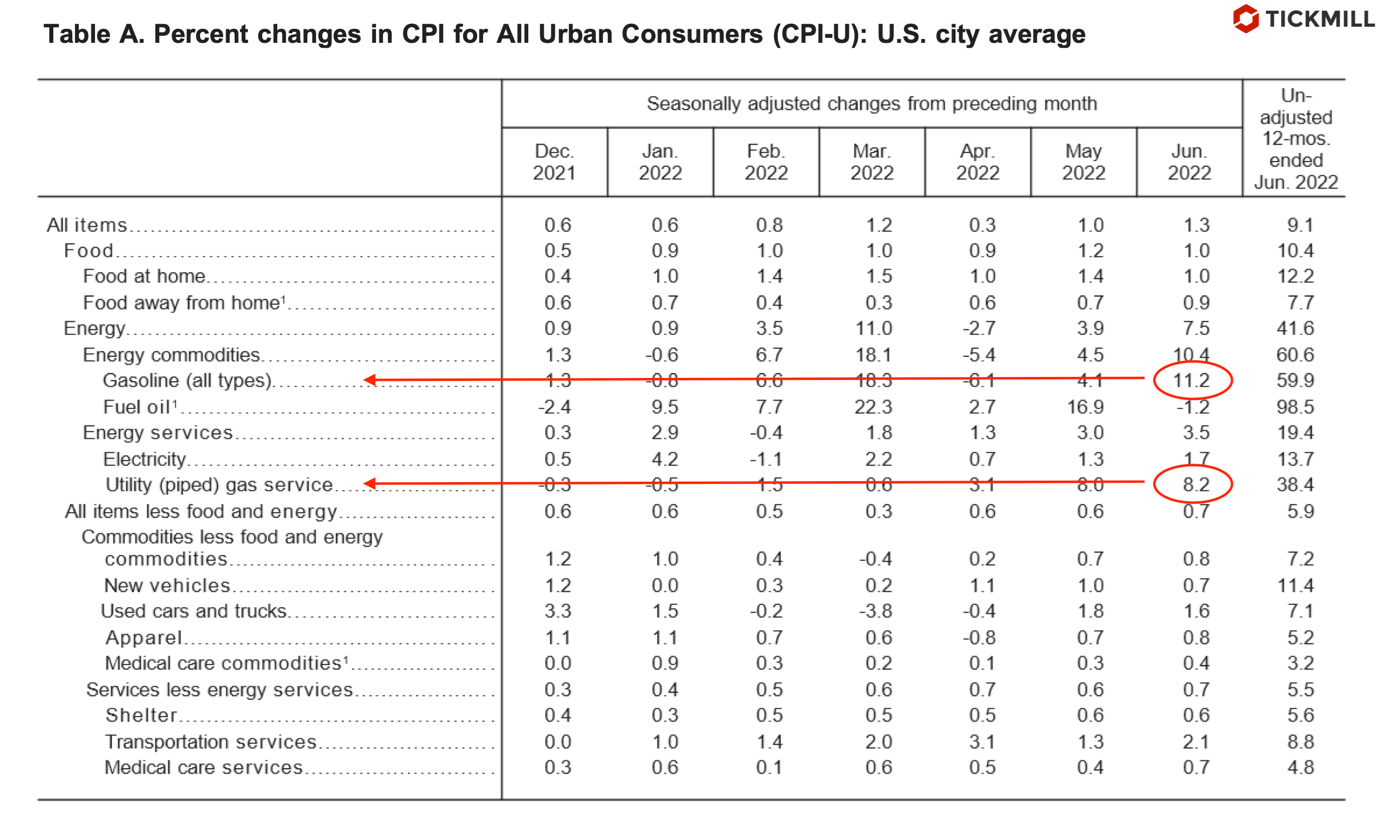

However, there is a risk that the market reaction to the upside surprise in the CPI report was excessive and may be prone to correction. Looking at the details, one can see a strong heterogeneity of inflation by components: prices in two categories, gasoline and utility gas, rose significantly more than others:

In other categories, monthly price growth in most cases did not exceed 1%.

The fact that gasoline prices jumped in June was known long before the release of the inflation report, so the surprise on the upside, in truth, does not look so unexpected. Due to the high dispersion in component price increases and the fact that the prices of goods known for their high volatility were the main contributors to the "shocking" June figure, a decline in inflation in subsequent months could be quite rapid. There is already information that gasoline price inflation began to slow down in July, so from this point of view, too sharp Fed tightening, and even more so a 100 bp step may be unreasonable and do more harm to the economy than good. It is also important to keep in mind that inflation generated by fuel prices growth is not the kind of inflation that can be effectively regulated by raising interest rate (via demand destruction), moreover, the pass-through effect of gasoline inflation into other categories, judging by the numbers, is not so strong.

Considering that futures on the Fed rate price in the 100 bp outcome at the upcoming meeting with an 84% chance, the decision to raise the rate by 75 bp may be regarded as dovish surprise and eventually lead to an overdue downward correction of USD.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.