Minor Upside Surprise in US CPI is Likely Priced as Fuel Prices Continued to Rise in June

Today is a specialday for financial markets as the US Bureau of Labor Statistics releases CPI forJune. It's no secret that the Fed tied monetary policy to developments ininflation, so its acceleration will mean that the Fed's lead in the policytightening race will only increase, and vice versa, an inflation print belowconsensus should promote expectations that the gap in the pace of policynormalization between the Fed and other central banks will narrow somewhat. Infact, this will be the driver of price changes in almost all asset classes.

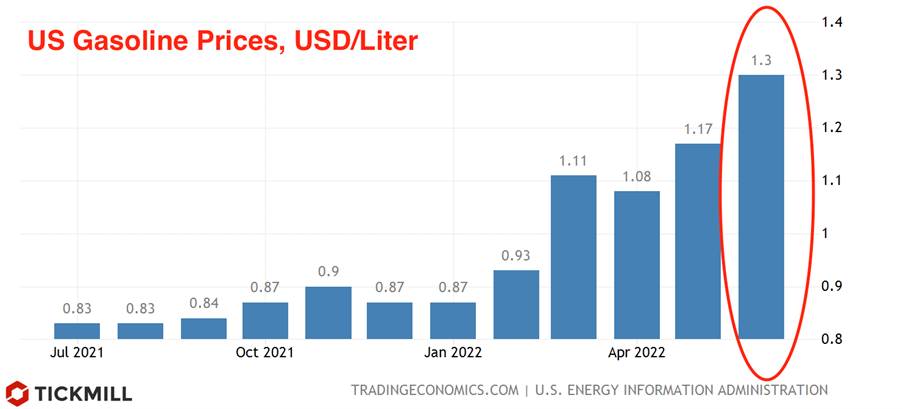

Headline inflation is expected to hit a newhigh of this business cycle (8.8%) and core inflation to slow from 6% to 5.7%.The expected acceleration in headline inflation is due to the jump in US fuelprices in June from $1.17 to $1.3 per liter:

Given thiscircumstance, a small positive inflation surprise will unlikely triggersizeable shift in tightening expectations; much more unexpected will beinflation below the forecast of 8.8%, as well as a stronger slowdown in coreinflation which is less volatile and characterizes key consumer trends.

If headlineinflation accelerates above 9.0%, a bearish breakout of the EURUSD level of1.00 can be expected while inflation reading in line with the forecast willlikely lead to a false breakout and there is a risk that “sell on the facts” scenario will happen inthe US dollar, given the significant overbought dollar in the medium term (RSIon the daily timeframe above 74 points).

Currencies showinghigh sensitivity to expectations of global business cycle - the NorwegianKrone, the Australian dollar, the New Zealand dollar, are rising today, theJapanese yen is consolidating near highs against the dollar (level 137).Futures for US indices show a slight increase, European stock indices are inthe red.

Oil prices aretrying to recover, but reports that China may be facing a fresh outbreak ofcovid vases (400 new cases in Shanghai) and risk of tightening of sanitarymeasures increase concerns about demand from the key consumer. OPEC saidyesterday that demand for oil will exceed supply by 1 million barrels thisyear, but events in China have likely overshadowed that message. There is arisk of further decline in prices, as the threat of a new lockdown in China'smajor industrial and financial center grows.

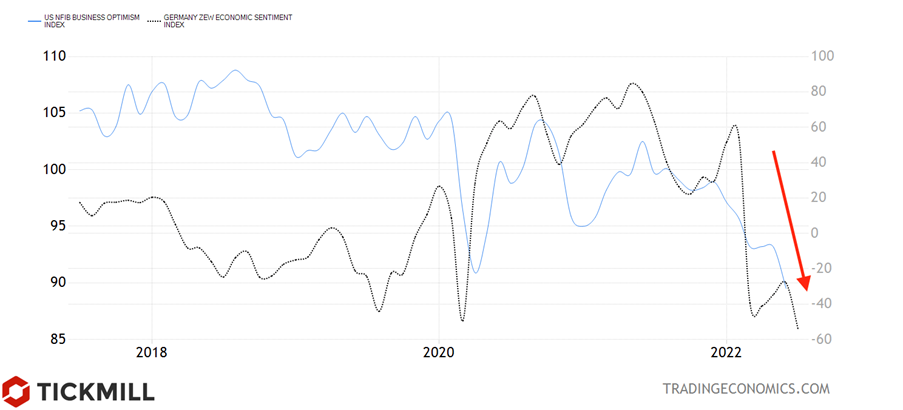

Leading survey-basedindicators of investor and business sentiment deteriorated in June. Shortlyafter the publication of investor confidence in Germany on Tuesday, which fellto the lowest level since the debt crisis in the EU in 2011 (-53 points), inthe US, the index of small business optimism came out, the fall of which alsomarkedly exceeded expectations as inflation climbed to the first the place ofuncertainty factors among US small firm owners:

The risk of a new wave of risk aversion is rising, and a policy tightening by central banks will only reduce risk appetite in equity markets and increase demand for safety plays. The RBNZ raised the rate by 50 bp, the Bank of Canada is expected to raise the rate by 75 bp today. If US inflation jumps above 9.0%, risk assets are likely to come under serious pressure, and the dollar will continue to rally.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.