NFP Preview: US Employment Resilience Persists Amid Mixed Labor Market Signals

In the latter half of the week, bearish pressure on European currencies has somewhat eased, with EURUSD consolidating in the range of 1.0750-1.08 and GBPUSD at 1.25-1.26. This hints that the upcoming direction may be influenced, to some extent, by the Non-Farm Payrolls, and the upcoming Federal Reserve meeting next week. Recent economic activity indicators in the EU have convinced the European Central Bank to signal that the tightening cycle is nearing its end.

Several officials from the Governing Council made unequivocal comments this week, stating that "further rate hikes are unlikely." However, market expectations for the ECB to shift towards rate cuts in March are deemed somewhat fantastical by one official. The market anticipates a 125 basis point reduction in the ECB interest rate by the end of next year, suggesting a relatively aggressive pace of rate cuts. From this perspective, the potential for further weakening of the European currency is limited, as incorporating anything more aggressive seems challenging

The third GDP estimate for the Eurozone in the third quarter was revised downward again to 0%, contrary to the forecast of 0.1%. Weak growth was corroborated by EU retail sales for October, showing a year-on-year decrease of 1.2%, below the projected -1.1%. A surprising figure was Germany's factory orders, contracting by 3.7% on a monthly basis against the expected 0.2% increase. German economic exports also decreased by -0.2% in October, while a growth of 1.1% was anticipated for the month.

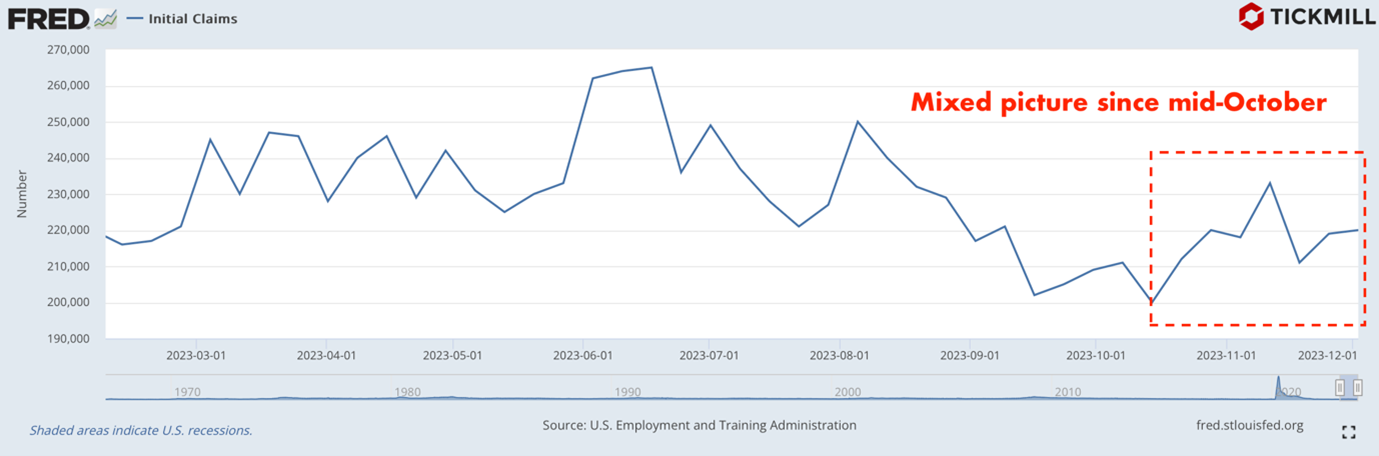

Shifting focus to the U.S. economy, all eyes are currently on the labor market, as employment indicators are the only ones preventing markets from forgetting completely about the threat of an inflation comeback. Alongside signs of weakening, some indicators are surprising on the upward side. One such indicator is initial claims for unemployment benefits, which, despite a gradual increase since mid-October, showed improvement in the latest report:

The extended claims for unemployment benefits, indicating the average duration of unemployment, sharply declined after a significant increase in the preceding week, from 1925 to 1861K against a forecast of 1910K. Earlier this week, market reactions were notable due to JOLTS job openings and ISM's services PMI data. While JOLTS indicated labor market weakness with a sharp decline in job openings (well below expectations), the services PMI surprised on the upside, with respondents noting an increase in hiring compared to the previous month.

Wednesday's ADP report showed modest job growth of only 103K, below the slightly higher forecast of 130K. Wage growth slowed, and weak job growth was observed in both manufacturing and services. Although the connection between ADP surprises and deviations from the unemployment forecast is weak, considering other indicators, the risks for today's report lean towards a negative surprise.

What will happen to the dollar and risk assets if NFP job growth disappoints? A moderately lower-than-expected outcome will reduce divergence in the short-term policy stance between the ECB and the Fed, lessening the expected gap in the pace of monetary policy easing and providing clear support to European currencies. On the other hand, very weak or strong job figures may lead to dollar strengthening – the former due to risk aversion, where the dollar's role as a safe haven increases, and the latter due to an expected divergence in the pace of monetary policy easing between the ECB and the Fed.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.