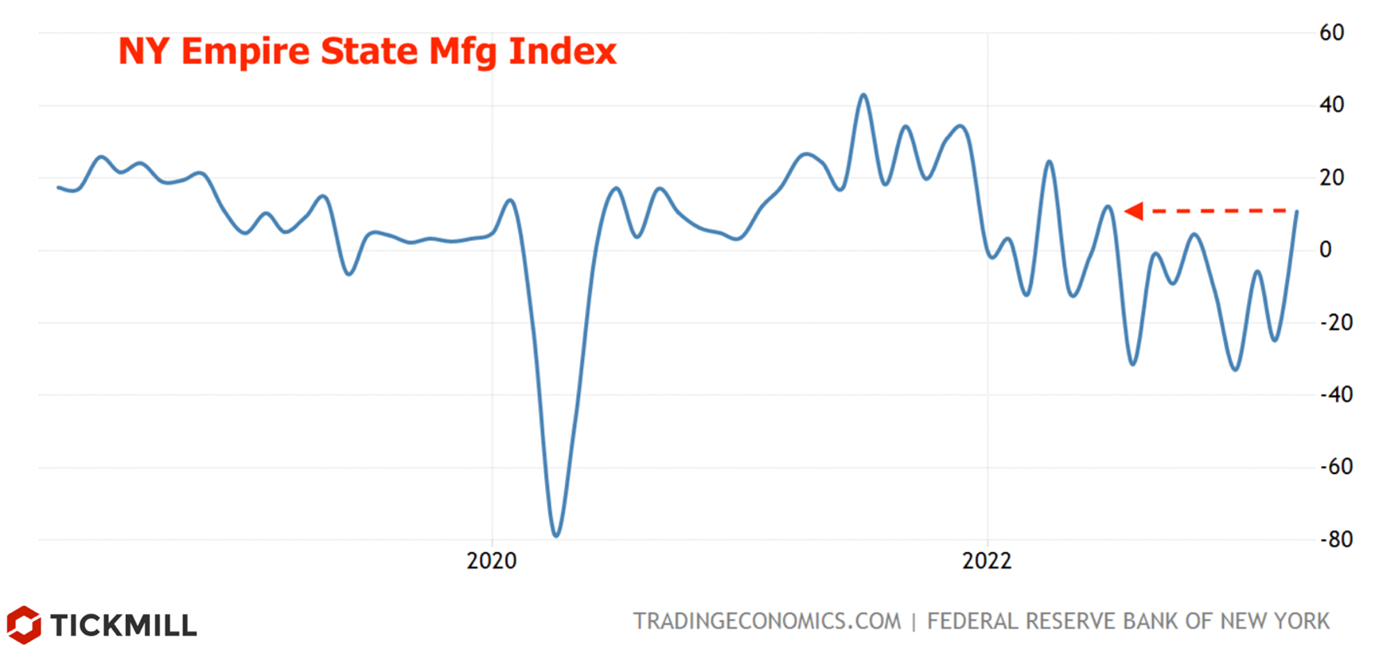

NY Empire State Manufacturing Index Surprises with Acceleration in April

The NY Empire State Manufacturing Index surprised with its acceleration in April, as the main index not only did not decrease as predicted by the forecast from -11.5 to -18.0 points, but even jumped to 10.8 points, which is the highest point of expansion since July 2022:

The forecasts of 34 experts ranged from -25 to -11.5 points, with a median forecast of -18 points, so the change in the indicator became the second most unexpected in the history of observations (the first was in one of the post-COVID months).

The leading indicator of new orders changed sharply in a positive direction - from -21.7 to 25.1 points. In second place was the shipments index, which changed from -13.1 to 23.9 points.

The weak point of the report was the employment data - the hiring index remained at -8 points for the third month in a row, and the average workweek index fell by -6.4 points. The data confirmed the worrying trend that emerged in early March: at that time, the number of job openings sharply decreased (JOLTS data), and the growth of initial claims for unemployment benefits accelerated:

Yesterday was another positive day in risk asset markets, and today the rally continues, while the dollar is on the defensive. As expected, the upward correction of the dollar did not develop, and EURUSD found support near 1.09. Sentiments significantly improved after today's economic data from China exceeded expectations, pushing talks of a recession to the background for a while. China's GDP grew by 4.5% in the first quarter of 2023, which is significantly higher than the forecast of 4.0%, also indicating a sharp acceleration compared to the previous quarter (2.9%). Retail sales in March grew by 10.6% in annual terms, with a forecast of 7.4% (a two-year high), and the pace of industrial production growth was the highest in 5 months. Unemployment, according to a population survey, dropped to a 7-month low.

The UK labour market data significantly strengthened the position of the pound ahead of the upcoming Bank of England meeting. The number of employed increased by 169K in March, which was significantly higher than the forecast of 50K. However, the unemployment rate did not meet expectations and increased to 3.8% with a forecast of 3.7%. The key point of the report was the 5.9% increase in wage growth in annual terms, which was 0.8% higher than forecast. Taking into account that consumer spending correlates with income growth (there is a linear relationship between them, but the coefficient is less than 1, since a portion goes to savings), we can expect consequences for inflation, which means that the Bank of England may need to exert more effort to keep price pressure under control. GBPUSD strengthened by about half a percent today and buyers are likely to test the 1.25 zone again. From a technical point of view, the pair has broken out of the formed flag and has the potential to rise to the 1.265 level, where the trend line passes:

GBPUSD Chart, 1D

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.