NZD Rocked By Surprise .50% RBNZ Rate Cut!

Perhaps the recent USD experience in reaction to the Fed’s latest rate cut was a learning curve for the RBNZ. At its August meeting held overnight, the bank was widely expected to cut rates, with a .25% cut priced in. However, the RBNZ took markets by surprise as it announced a .50% rate cut, sending NZD crashing lower. The headline New Zealand interest rate now stands at record lows of 1%.

Growth Forecasts Cut

RBNZ governor, Arian Orr, cited slowing economic growth and subdued inflation as the key reasons for such a drastic cut. In the post-decision press conference, Orr noted "Global economic activity continues to weaken, easing demand for New Zealand’s goods and services,"

The governor continued, saying "Heightened uncertainty and declining international trade have contributed to lower trading-partner growth. Central banks are easing monetary policy to support their economies… Global long-term interest rates have declined to historically low levels, consistent with low expected inflation and growth rates into the future."

Future Easing Still Possible

Indeed, along with the larger than forecast rate cut, the RBNZ governor was also keen to stress the likelihood of further easing if necessary saying “It’s easily within the realms of possibility that we might have to use negative interest rates”. Although Orr noted that such a cut at this juncture reduced the probability of having to use negative rates, when asked if this cut would be the last, Orr responded by saying “No, today’s decision doesn’t rule out any future action.”

Employment Growth Still Subdued

Orr was also keen to stress the more subdued outlook for employment growth which has been steadily declining in New Zealand since 2016. Indeed, a strong injection of fiscal stimulus as well as steadily lower interest rates has failed to increase economic growth in line with the bank’s projections. The RBNZ has now cut its growth forecasts for the coming years and has pushed out its timeframe for inflation coming back to the mid point of its 1% - 3% range.

The RBNZ noted that “Growth has slowed over the past year and growth headwinds are rising. In the absence of additional monetary stimulus, employment and inflation would likely ease relative to our targets,” Adding “Global economic activity continues to weaken, easing demand for New Zealand’s goods and services.”

Late Decision

The RBNZ’s decisions to make such a large reduction likely came at a late stage. Recent developments have certainly created the landscape in which such a cut would be necessary. The RBNZ will have seen how the Fed was recently punished for cutting by just the expected amount, along with more neutral guidance. Furthermore, the fresh escalation in trade war hostilities over the last week and subsequent equities dump, will no doubt have played a part in the bank’s decisions process. With the RBA having opted to keep rates on hold, now was a good time for the RBNZ to gain the most impact with such a cut.

Technical Perspective

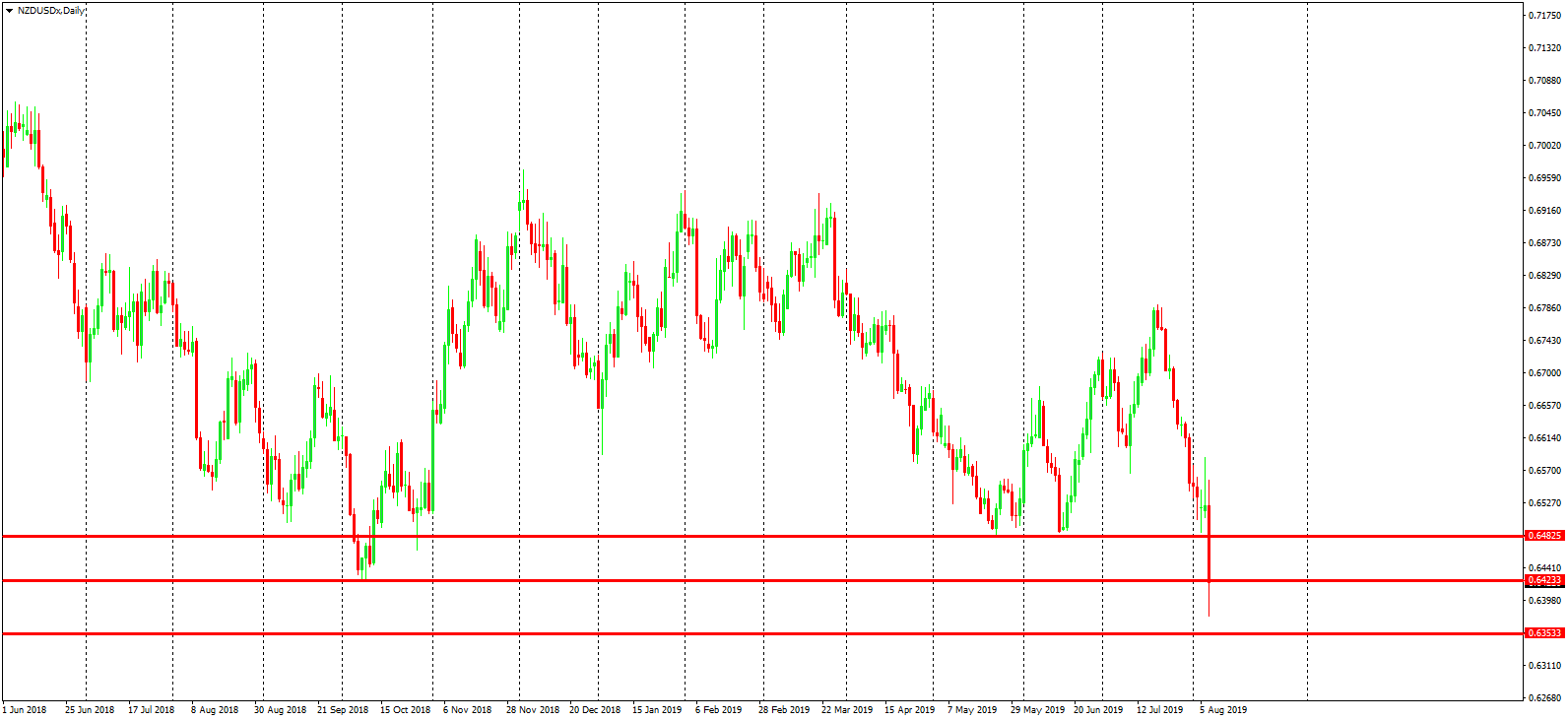

The collapse in NZDUSD has seen price falling to its lowest level since 2016 this week. Breaking down through both the 2019 and 2018 lows of .6482 and .6422 respectively. For now the .6482 becomes resistance, with further losses expected unless price can break back above that level. To the downside, the next key level to watch is the .6353 2016 low.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.