Oil: Buy OPEC Meeting Rumors? Market Backwardation the First Time Since February

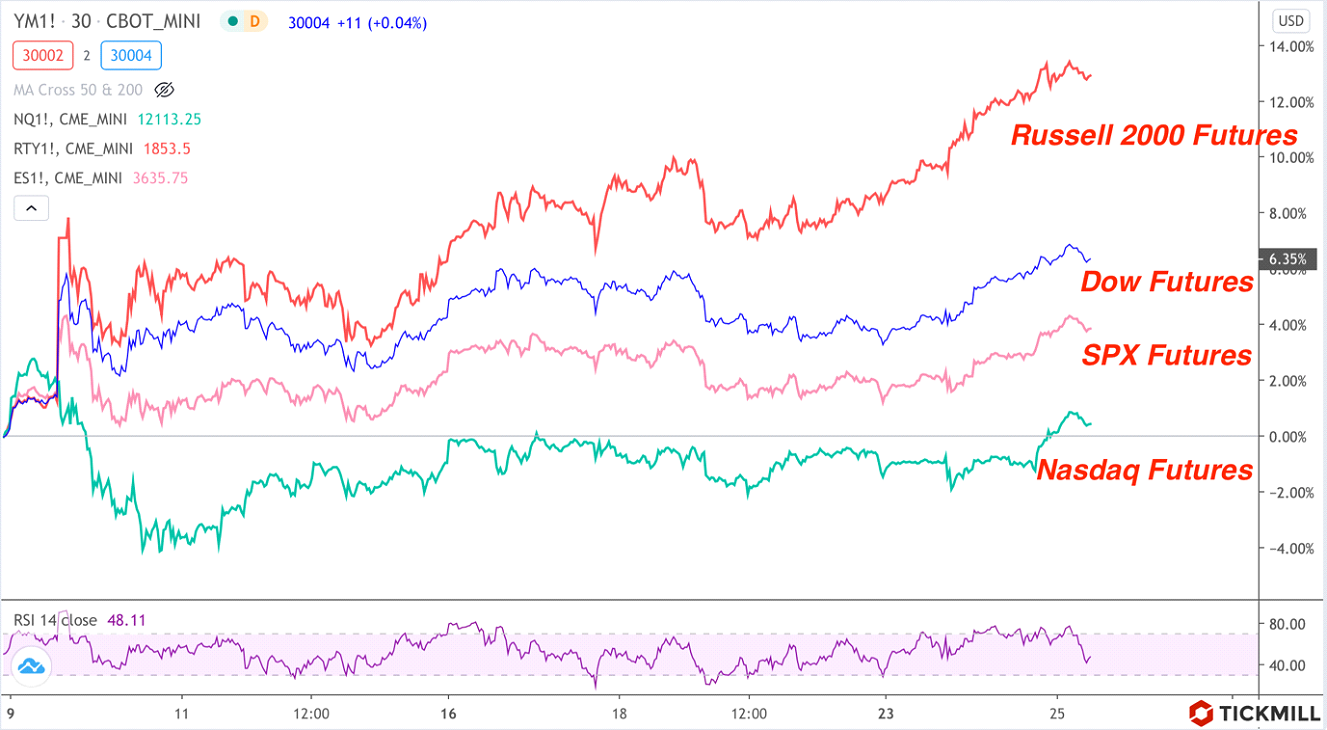

European markets and US index futures remain in consolidation after spectacular Tuesday advance. Small-cap stocks (Russell 2000 posted the best performance among its peers over the past two weeks, which is comprised of the companies more sensitive to the fluctuations in business cycle:

US stocks indices returns

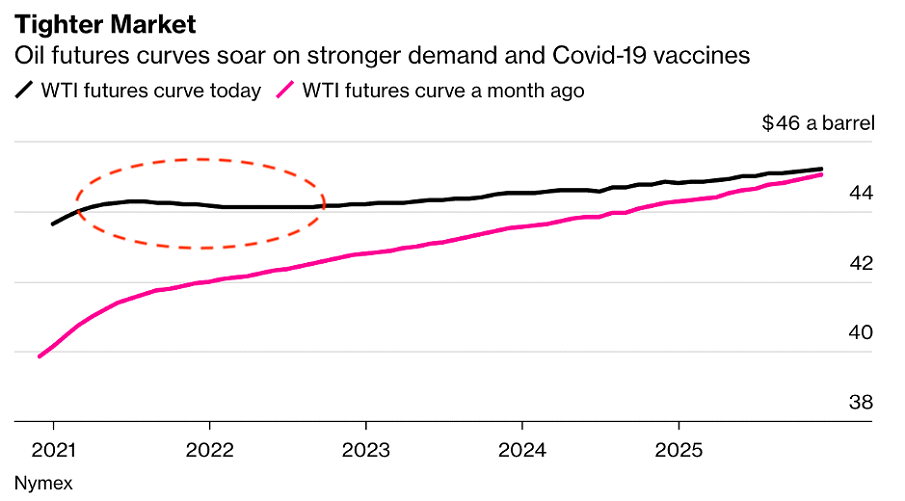

Oil continues to climb higher ahead of an anticipated positive OPEC decision. WTI quotes surged above $45 per barrel on Wednesday, while Brent pierced through $ 48.5 per barrel, the highest level since the rout in March. Accelerating rally in prices suggests that “buy the rumor” story accounts for a part of this rally, besides, backwardation in the market (oil contracts for delivery in the first half of 2021 are more expensive than for the delivery in the second half of 2021-22), on the contrary, makes sense for OPEC to gradually pull output upward:

Oil futures curves and backwardation

Another important fact is that the economic forecast for the first half of 2021 has changed not only dramatically but swiftly and it’s still unclear from available information what the OPEC thinks about it in terms of oil demand impact.

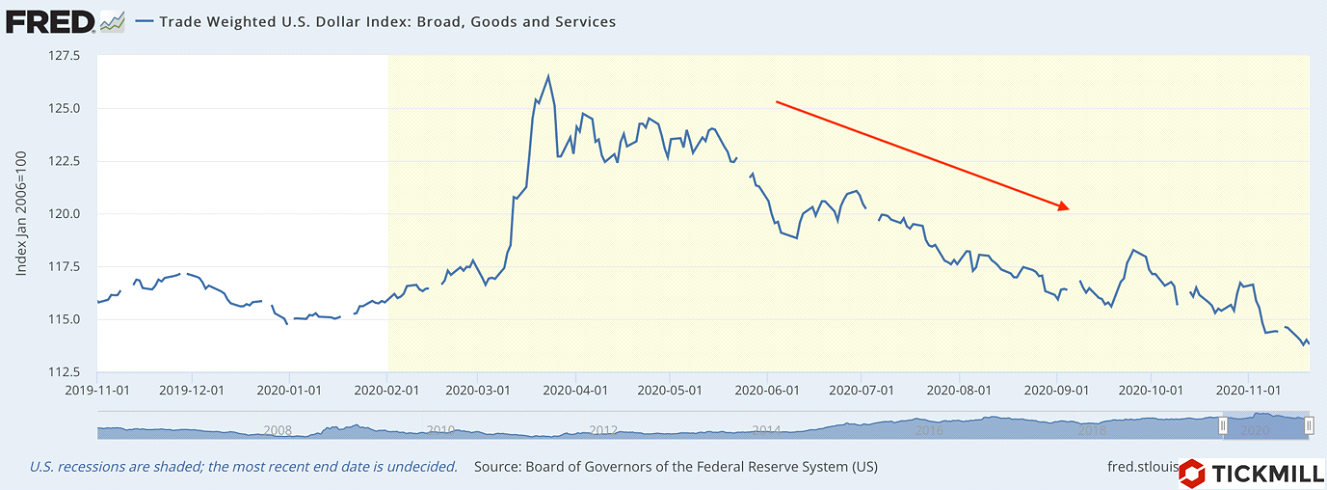

The dollar naturally continues to lose ground, as risk appetite grows, and positive forecasts for 2021 increase the flow from the dollar to other cyclical currencies. The dollar exchange rate, weighted by the volume of trade with major partners, continues to fall rapidly and has already returned to pre-crisis levels:

Trade weighted USD index

It’s a big question what the drivers are to push the currency lower at the same speed.

Today the focus is on the minutes of the November Fed meeting. Nothing new is expected, however, if we try to imagine possible surprises, they all boil down to the December easing of credit conditions (increase in QE). This turn of events should increase the pressure on the US currency.

Business climate and corporate sentiment indices in Europe in November were better than expected despite the restrictions. GDP in Germany grew at a slightly faster pace in the third quarter than expected. At the same time, the data on the US economy did not live up to expectations, in particular, the Conference Board's consumer sentiment index strongly disappointed, which, despite the fact that the United States avoided the worst-case scenario in the restrictions, fell from 101.4 to 96.1 points. The scale of the second coronavirus shock in the EU is consistently revised lower, which provides support for EURUSD. In this situation, long positions on the pair from the levels of 1.1850 and below with the target at 1.20 in December seem quite attractive.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.