Oil Rally: How Low Can It Go?

Good day!

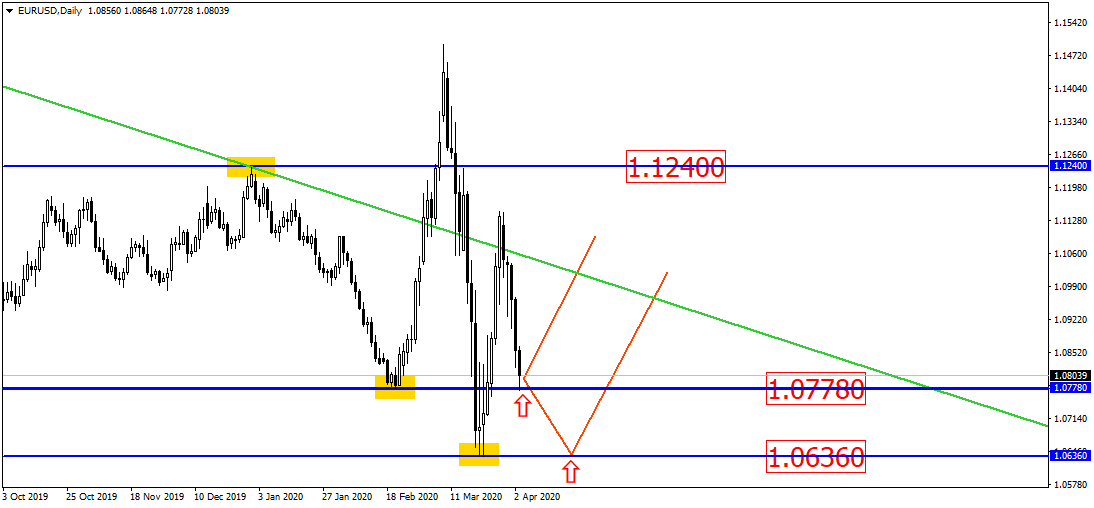

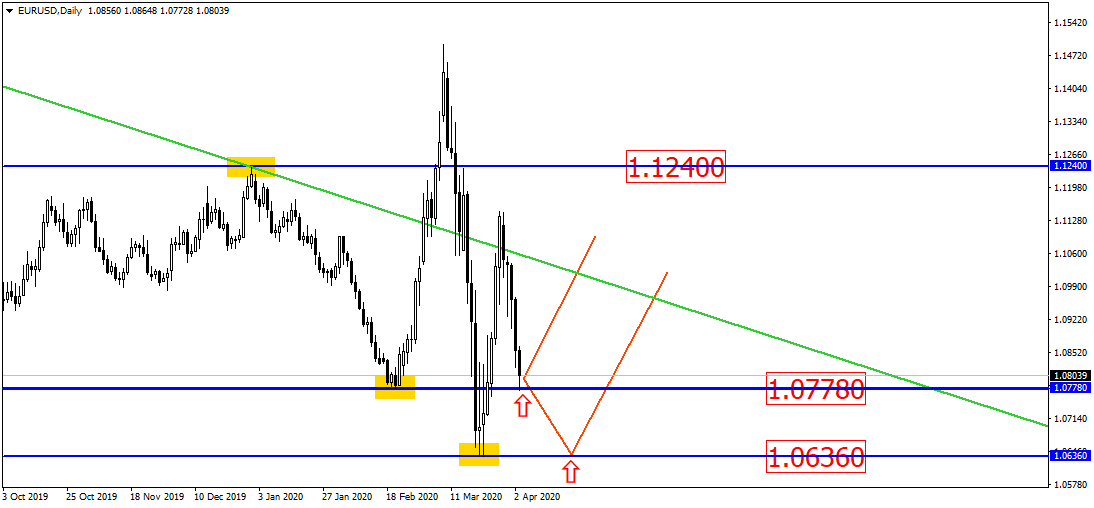

The EUR/USD currency pair was very volatile last week and has been for a while now. On Friday the asset’s price reached the 1.0778 level which could support the downtrend. The asset can also pull from the 1.0636 supporting level, located slightly below the current prices. Now, it’s also wise to rely on the candlestick formations which can provide additional indications regarding the asset’s future:

The data provided by COT CFTC show that Euro could become stronger in the mid-term, as large operators keep decreasing their short positions and expanding the long ones. Large operators also prefer to rather go long than stay short. Therefore, the data could indirectly signify the potential growth of Euro prices:

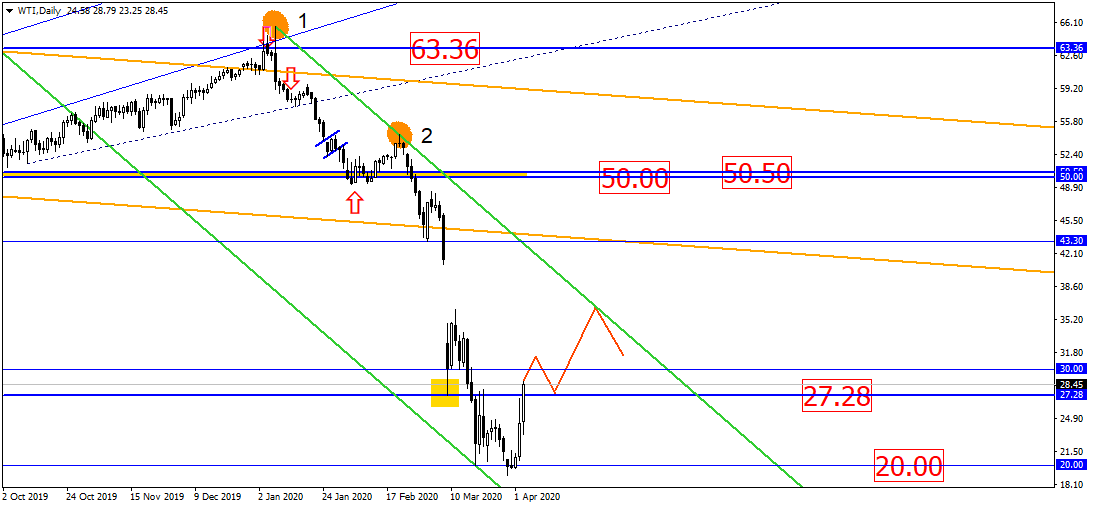

After Trump’s interesting tweets and intentions to hold the video conference with OPEC+ to stabilize oil prices, oil managed to pull from the psychological level of 20. The asset is currently targeting the downtrend. It seems that asset’s price has finally reached critical levels and all the other countries decided to take necessary measures to stop this from happening. It’s probably due to the fact that oil-exporting countries are losing a lot of money due to the ongoing economic crisis and epidemic, and they really need them here and now. The situation has worsened in a matter of weeks. We just can’t help but wonder how many millions of oil barrels the oil producers are going to cut from the output. Let’s just wait and see what happens next:

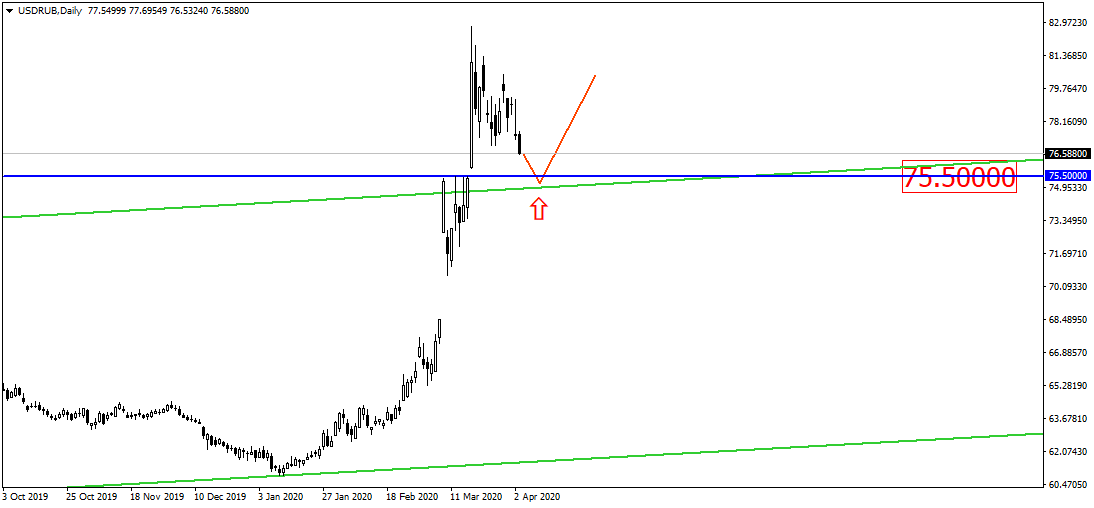

The USD/RUB currency pair pulled from the 75.50 level which it’s targeting right now. The video meeting of the OPEC+ countries is coming up and Russia is looking forward to discussion with the US representative at that time. Therefore, it could be prudent to follow the candlestick formations next to the 75.50 level as the asset might even break this level down against positive signals from OPEC:

Let us remind you that this material is provided for informative purposes only and cannot be considered as a direct go ahead to implement transactions in the financial markets. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.