Opposition in OPEC+, Fed’s Powell Speech: Key Events to Watch this Week

EURUSD resumed its movement towards 1.20 on Monday in line with our expectations outlined last week, however buyers are in no hurry to break through the level. Greenback index remains in a mild downtrend and there are no prerequisites for a significant pullback in December. A breakdown of the 1.20 level in EURUSD in the first half of this week will depend on whether OPEC + decides to extend current output cuts. Then the pair will likely pay attention to the macro updates from the US (ADP, NFP, PMI indices) and remarks of the head of the Fed Powell and Treasury Secretary Mnuchin, which are going to speak in the Senate this week.

The minutes of the Fed's November meeting showed that the question of additional monetary easing in December remains open. Powell's rhetoric this week is expected to shed light on the Central Bank's December action. Risks are biased towards the announcement of additional easing (most likely increase in Treasury purchases), which is a factor of pressure on the USD.

The minutes of the ECB meeting and the comments of the chief economist of the Central Bank Lane last week indicated that the Central Bank is reluctant to cut deposit rate or increase QE (due to low efficiency and high costs) and is likely to resort to soft and targeted measures. Expectations of strong monetary easing, which were priced in the euro, are being gradually priced out, removing one of the burdens from EUR.

Oil opened lower as an “insider fact” leaked to the market ahead of the upcoming meeting that some participants rebelled over the extension of the current production restrictions. The opposition was Kazakhstan and the UAE - the participants, which, fortunately, make up an insignificant share of production in OPEC +. Chances are high that key players, such as Russia and Saudi Arabia, will be able to convince those who disagree to change their stance, or agree to take on part of the obligations (as was the case with Mexico at the last meeting). Moreover, the story with the opposition is a good reason to correct downward. As a result, oil may still jump up on removal of purely “formal” uncertainty, but medium-term prospects are not clear.

China's manufacturing PMI rose, indicating that economic activity in the sector was picking up in the controversial month of November, which at least maintains state of relax in key equity markets. The index rose from 51.4 to 52.1 points, beating expectations.

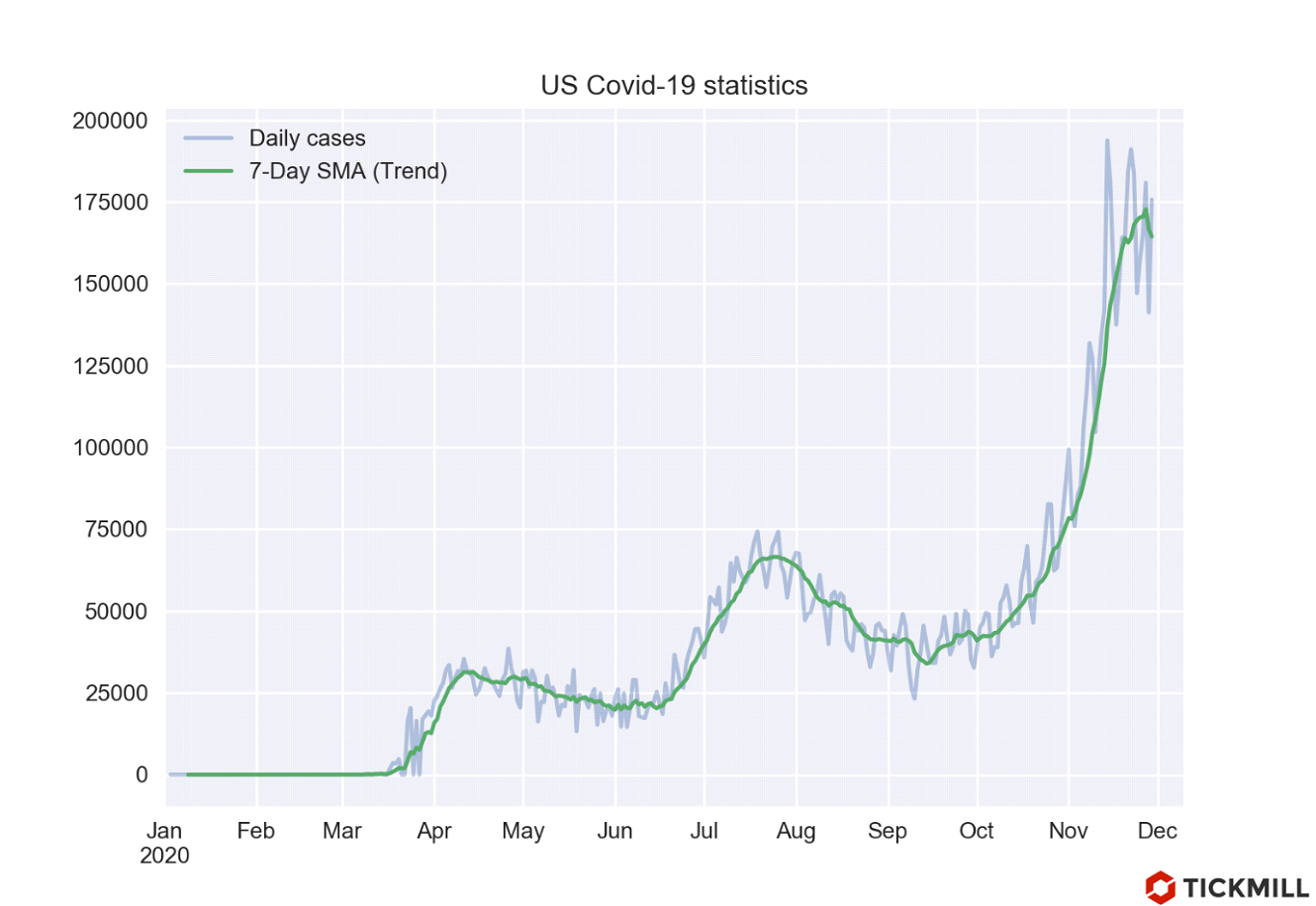

This week, the focus may be on measures to contain Covid-19 in the United States. The United States let Thanksgiving Day pass without tight restrictions, which could trigger a new leg of rise in daily cases after levelling off at the end of the month:

The dollar index is expected to test 91.50 in the first half of the week, with the highest pressure exerted by the European currency.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.