Optimism Boosts the Euro and Pound Amid Surprising UK Jobs Data

The euro and British pound surged on Tuesday following the release of UK labor market statistics, which revealed an unexpected increase in employment in both the services and manufacturing sectors. Contrary to the consensus estimate of a 198,000-job reduction in August, employment rose by 54,000, a positive revision of the previous figure. Additionally, September saw a 7.9% growth in wages in the UK, surpassing the forecasted 7.4%, marking a significant surprise. It is worth noting that wage growth is often a precursor to heightened consumer inflation due to increased consumer demand and household optimism, as well as firms’ decisions to pass cost increases onto prices, further driving inflation. These data releases have increased the likelihood of a hawkish stance by the Bank of England in December. Together with improved prospects for the EU, the data have supported the rise of the euro and pound against the dollar:

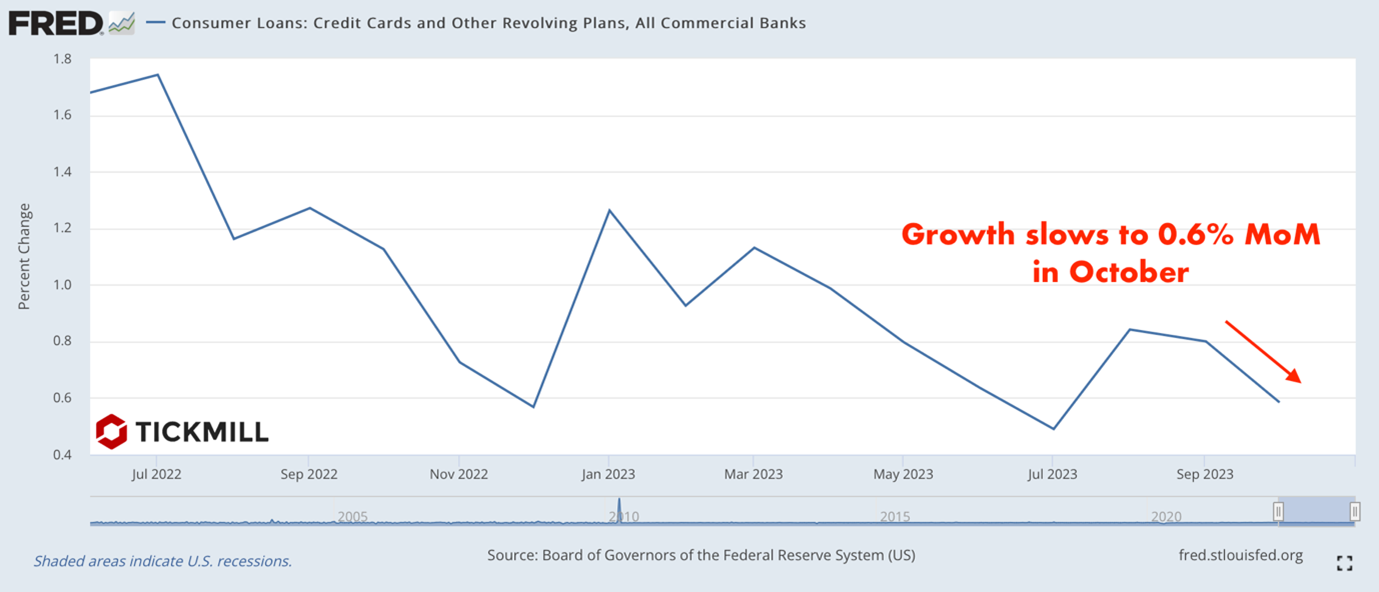

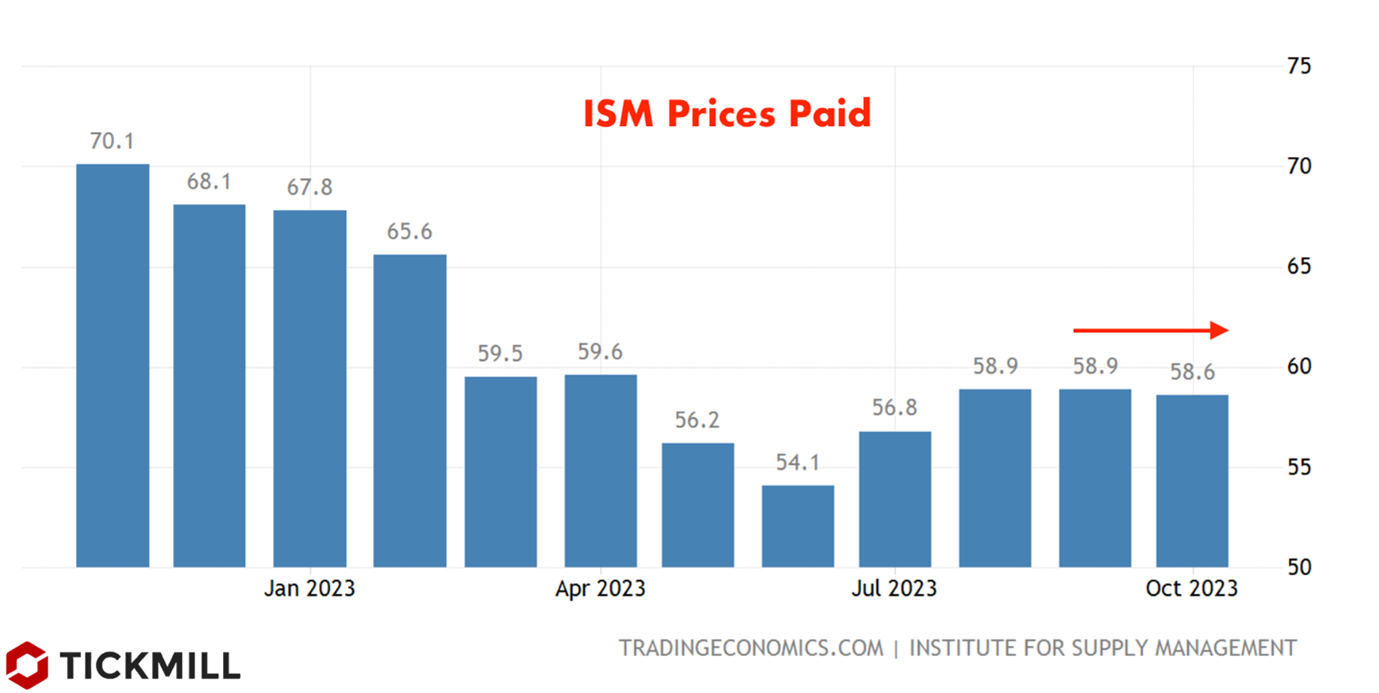

However, optimism remains tempered due to uncertainty surrounding the upcoming release of the US Consumer Price Index (CPI) for October, which could offset the positive UK employment data if US inflation shows signs of acceleration. Nevertheless, this scenario seems unlikely, as gasoline prices in the US decreased in October, credit card expenditures slowed, and car sales declined. Indirect indicators of moderating inflationary pressures have led to relatively moderate expectations for headline inflation at 3.3% (down from 3.7% in September) and core inflation at 4.1% (unchanged from September):

The monthly pace of consumer credit growth in the US provides a counterargument to these data

Considering these factors, any deviation of today’s actual readings from the consensus forecast is expected to be minor. However, as previously emphasized, the market will closely scrutinize the details of the report, particularly service sector inflation and the "Shelter Inflation" component. These factors currently influence the underlying trend of inflation, as highlighted by the Federal Reserve.

European investors were also buoyed by the ZEW report on Germany and the EU. The economic sentiment index exceeded expectations, registering 9.8 points against a forecast of 5, entering positive territory for the first time since April. Similarly, the index for the entire EU surpassed expectations, reaching 13.8 points compared to the forecasted 6.1.

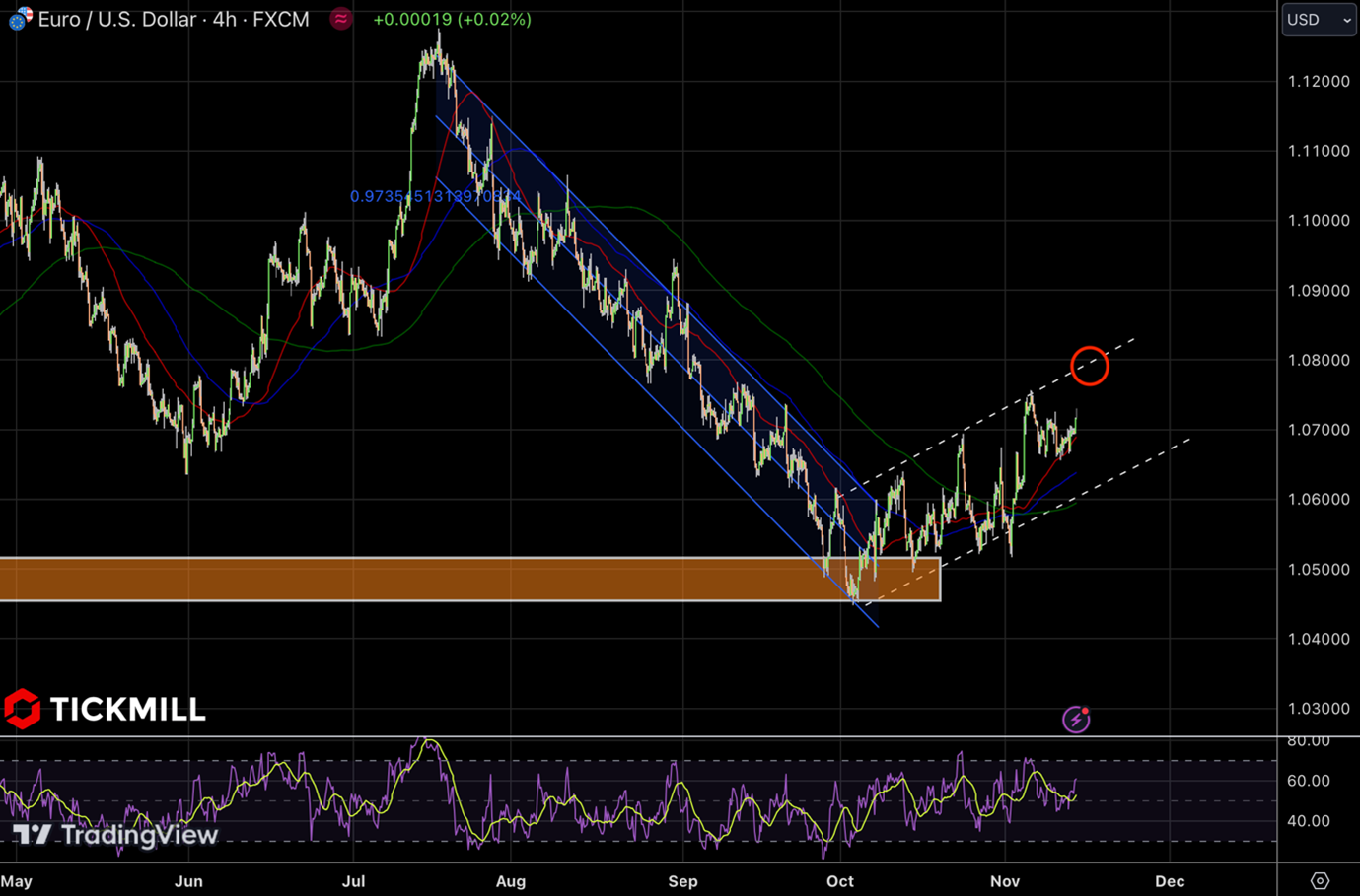

Following the recent surge towards 1.0750 in the EURUSD, we saw some pullback last week towards 1.0650, which took away some steam from excessive buying momentum. The upward trend resumed this week, with technical analysis indicating serious buyer interest in another retest of the upper channel boundary, now near 1.08:

GBPUSD is also actively forming an ascending channel, with the correction after the November surge to 1.24 apparently completing near 1.22. Overall, the technical dynamics of major dollar rivals indicate its growing weakness, thanks to improving data and the increasing likelihood of the Fed adopting a wait-and-see position amid weakening US data. It's essential to consider the historical November seasonal factor, which often works against the dollar, making the moderate inflation report today likely to be a dollar-negative event. Sellers are likely to drive movement towards higher levels for EURUSD and GBPUSD.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.