Powell Speech, Upcoming Stimulus Talks in Congress Should Provide Additional Support for Stocks

Orderly sell-off in sovereign debt markets, which flared into massive dump last week, has slowed down on Monday, but is far from over. The 10-year Treasury yield bounced off from a local high of 1.55%, however resumed advance on Monday. It looks like the bond markets entered into a state of short-term equilibrium, but the balance of forces is fragile. The Fed types gave a dry commentary on the rout last week, leaving a lot of understatement. This week there will be a number of speeches by the Fed officials, it is expected that their detailed comments on the rally of risk-free rates will become the main catalyst for movement in risk assets.

Unlike the Fed, the European Central Bank did not stand aside and came forward with “open mouth operations”, hinting at flexibility of the current main program of asset purchases - PEPP. The RBA supported Australian government debt market with concrete actions, boosting bond purchases to enhance control over long-term rates. Considering that world central banks often act in sync, there is a chance that the Fed will also hint at the opportunity, for example, to change composition of monthly QE purchases (by increasing purchases of longer-maturity bonds), which should bring peace to the Treasuries.

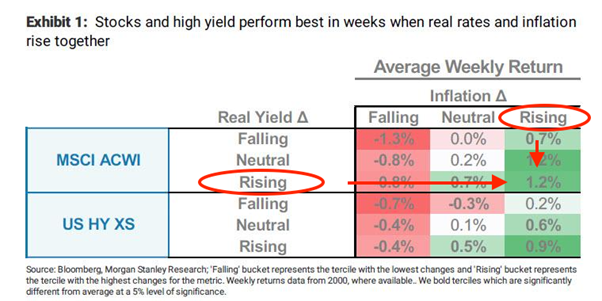

Nevertheless, since both inflation expectations and real rate rise in the US, with the exception of negative shocks due to high volatility, this combination should have a bullish impact on world stock markets. At least this is what history suggests:

Macroeconomic news on the US last Friday had in overall a positive tone – consumption expenditures growth (the main inflation gauge of the Fed) accelerated to 1.5% (1.4% forecast), consumer sentiment from Michigan beat forecast. As for the economic calendar this week, the focus is solely on the US labor market data - ADP report, employment component of the ISM service sector activity index. and Non-Farm Payrolls report for February.

Congress is rushing to approve new fiscal stimulus. Biden proposal were approved in the House on Saturday. None of the Republicans voted in favor, but their votes are not needed. Past stimulus measures had bipartisan support, but this time we see a complete split between the parties. It should be borne in mind that the main programs of extended social protection will expire on March 14, i.e., this date is probably an unofficial deadline for the approval of new stimulus. The highlight of the proposal is stimulus checks of $ 1,400 per person (whose income is below $75K per year). A good portion of this money, like last time, will likely flow into the stock market. Expectations of an impending positive retail investment shock are also pushing stock indices higher, or at least preventing them from correcting much.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.