Pressure on USD Rises Ahead of Possible Dovish Fed Move

The CFTC data showed that net long speculative positioning on EURUSD rose last week, which suggests the shift in sentiment on the pair is under way after a protracted squeeze of long positions. Historically, the euro net long position is within one sigma, i.e., far from extreme levels and there is still room for bulls to ramp up pressure. Speaking of the short term, there was no rush of buyers after the test of 1.21 on Monday. The major move is most likely set for Wednesday when the Fed will clarify the course of US monetary policy. Once again, the main question is when to expect the unwinding of the current pace of QE purchases. Long-dated Treasury yields advanced on Monday, signaling the return of inflation concerns as well as worries about the possible Fed meeting outcome where the regulator hints that a reduction in credit stimulus could begin in the less distant future.

The European currency is also drawing strength from progress on the fiscal front. Positive news on the European recovery fund (large-scale fiscal stimulus) triggered some sell-off in European bonds, due to reassessment of inflation expectations. The yield on 10-year German bonds is again moving towards the local high of this year (-0.217%), while the sell-off appears to be stronger than in long-dated Treasuries:

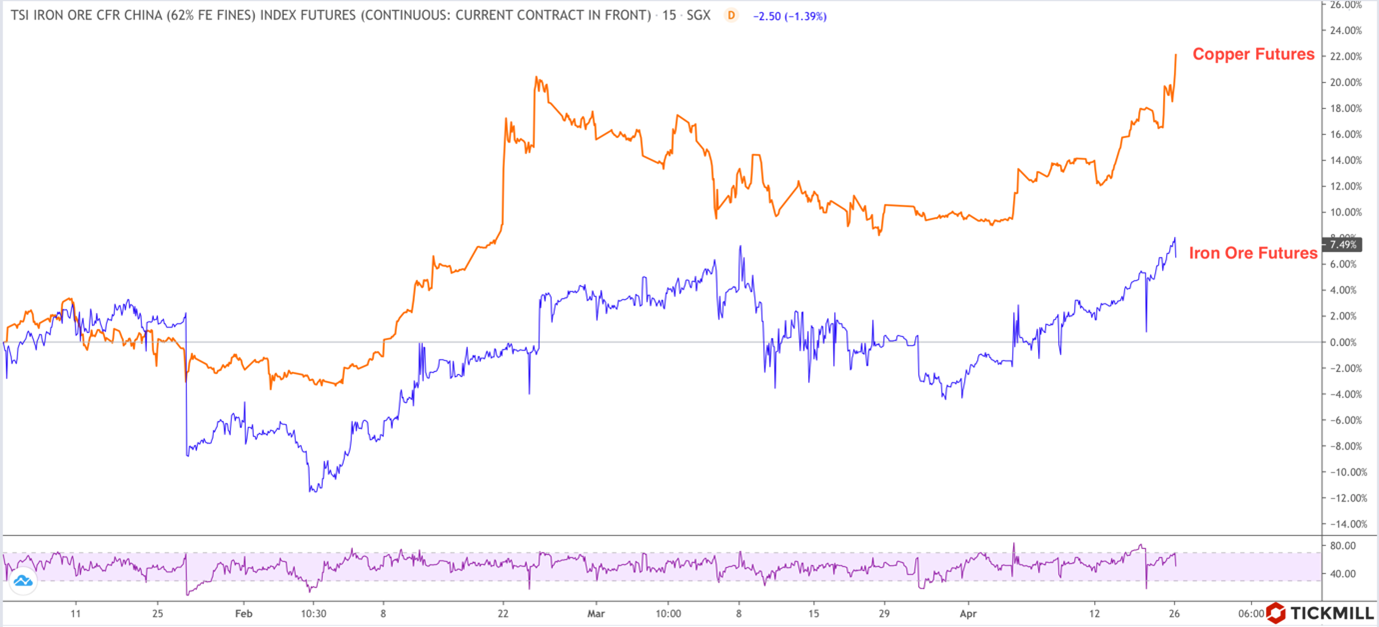

The dollar index is moderately correcting downwards, having touched the lowest level since the beginning of March (90.65). Despite the coronavirus crisis in one of the largest emerging economies (India), expectations for a global recovery persist, as evidenced by the positive dynamics of industrial metal prices. Iron ore and copper have resumed their uptrend since early April, reflecting expectations that demand will continue to rise:

The theme of recovery this week may be supported by the data on the US economy, in particular GDP, orders for durable goods and claims for unemployment benefits. Output growth in the US economy for the first quarter is expected to be an impressive 6.1%. Given the benign environment, better-than-expected data updates should fuel risk appetite. If the Fed gives a signal that it will tolerate overheating of the economy, there will be even less sense to stick to USD positions till the next meeting.

Joe Biden's first speech to Congress will also take place this week, in which he can provide more details on tax reform. For risk assets, the details are likely to be negative, so US indices are likely to decline ahead of the speech.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.