Price Component may be the Key Thing to Watch in Today’s ISM Report

Today, market participants’ focus is on the ISM's US non-manufacturing activity index. Services account for more than 70% of US employment, so activity in this sector is more closely correlated with US economic growth rates. There is still uncertainty as to whether the Fed will back away from its January communication (which implied policy should soon reach a “plateau”) or chalk up the January strength in the data to a temporary deviation from the downtrend, and the ISM report today is likely to provide better insight into the situation.

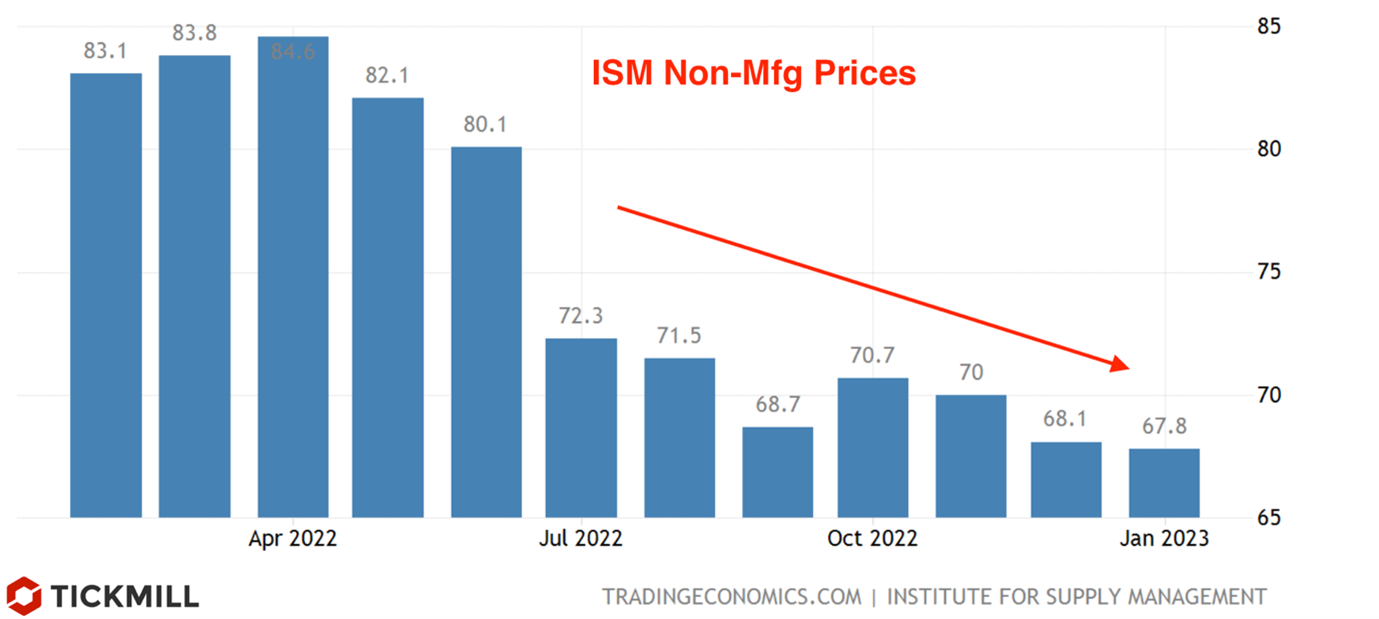

Before today's data comes out, it's worth remembering that the unexpected drop to 49.2 (i.e., into contraction territory) in the December report was a trigger for reassessment of expectations of the Fed's interest rate policy towards a more dovish stance and dollar weakening. The sharp rise to 55.2 in the January report (almost back to November levels) provided a serious argument against recessionary assumptions, and combined with the strong employment data, led to expectations of higher interest rates from the Fed and a strengthening of the dollar. The overall consensus regarding today's figure is for a slight decline from 55.2 to 54.5 points. Wednesday's manufacturing PMI showed that surprises could be hidden in the data about prices (the prices paid subindex jumped more than 5 points, breaking into positive territory), so market participants may be paying close attention to the "Non-Manufacturing Prices" component. Last month it was at a fairly high level of 67.8 points.

Today, several FOMC speakers are also set to appear following the release of the ISM report and next week we can expect some "heavy artillery" in the form of Powell's testimony to Congress.

In the eurozone, the re-pricing of the expected terminal rate of the ECB has also been the most intense in the last few weeks. After the rather hawkish ECB meeting minutes published on Wednesday, ECB's Pierre Wunsch spoke about a peak rate of 4.0%. The OIS curve now fully incorporates a 4.0% deposit rate by October and no further rate cuts until as far as 2024. Latest inflation data from the EU countries suggests that inflationary pressures are building up and for ECB to contain the excessive weakening of the euro, they will have to keep rates at a decent level. Despite the significant increase in US yields, the 2-year EUR-USD swap spread has started to contract again and currently stands at -133 bps after touching -150 bps last week, resulting in the EURUSD consolidating in the range of 1.05-1.065 despite heavy pressure from US yields.

Today's Eurozone calendar has the final PMI data for February and PPI data for January, but the US services ISM data is probably going to be the only release to pay attention to for EUR/USD today.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.