RBA Keeps Rate On Hold But Cuts Growth Forecasts

Rates Remain At Record Lows

At its August meeting, held overnight, the RBA bucked expectations for further easing by keeping rates on hold, at record lows of 1%. Following reductions at both the June and July meetings, the market had anticipated a pause. However, traders are still looking for further cuts this year, with current pricing for a September cut at 50% and a rate cut fully priced in by November.

Growth Forecasts Cut

Expectations for further RBA easing remain intact given the subdued tone of the meeting statement. Governor Lowe explained that although the unemployment rate is expected to decline further over the coming years, "Wage growth remains subdued and there is little upward pressure at present, with strong labour demand being met by more supply.”

Lowe added that "Caps on wages growth are also affecting public-sector pay outcomes across the country.” Despite the forecasts for a pick up in employment, the central bank cut its GDP forecasts, now projecting growth to hit 2.5% this year but still maintains that momentum will pick up into 2020.

In terms of the bank’s broader outlook, Lowe refrained from directly commenting on the rising tensions between the US and China. However, Lowe did reiterate the bank’s view that elevated uncertainty is weighing on investment, saying "The risks to the global economy remain tilted to the downside."

Persistent Downside Risks

Commenting further on the bank’s broader outlook, Lowe said "The persistent downside risks to the global economy combined with subdued inflation have led a number of central banks to reduce interest rates this year and further monetary easing is widely expected.

"Long-term government bond yields have declined further and are at record lows in many countries, including Australia. Borrowing rates for both businesses and households are also at historically low levels. The Australian dollar is at its lowest level of recent times."

Former Australian PM Criticises RBA

Opinions over the RBA’s handling of the country’s economic issues have been mixed. Former Australian PM John Howard told reporters that he was “not sure that these interest rate cuts have been the right thing to do… I think we’ve cut interest rates probably far enough already, perhaps too far.”

Howard added “But I don’t think my advice will be taken. A number of reasons why we came through the GFC so well is that our interest rates were higher when we entered the GFC and the central bank had room to move.”

The former PM continued, saying “If you cut them too far you get rid of all the petrol in the tank. If something unexpected comes along you don’t have the same room for manoeuvre. It’s a point of view, and I’m not claiming any special expertise, but I think we’ve gone quite far enough and perhaps too far.”

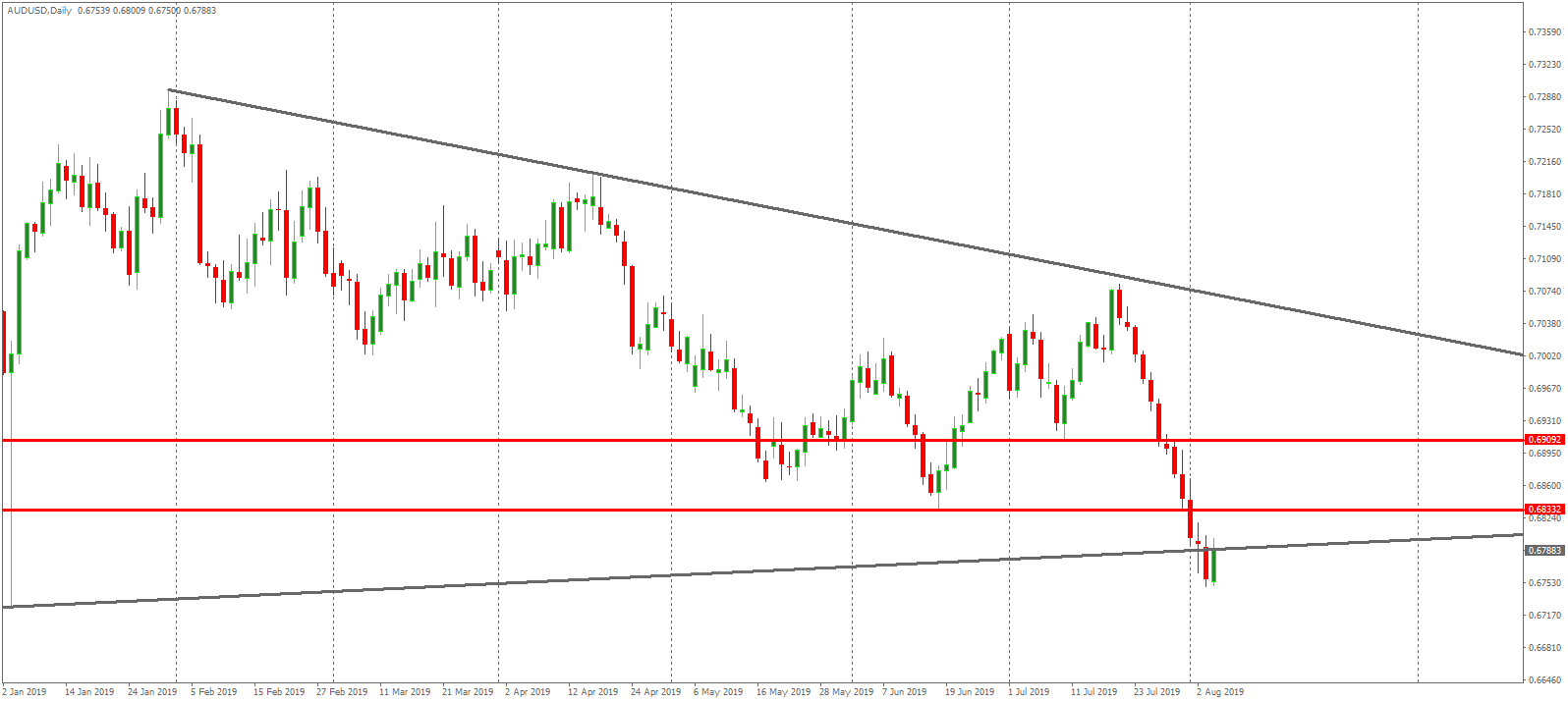

Technical Perspective

The sell off in AUDUSD over recent weeks has seen price collapsing down through the long term bullish trend line from 1998 lows. However, price has rebounded today on the back of the RBA meeting and is currently retesting the trend line from below. Bulls will need to quickly see price back above the trend line and back above the .6833 level to alleviate the near term bearish bias. However, the tone remains heavy and further losses are expected.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.