Resilient US Inflation Presents Growing Dilemma for the Fed

The latest report from the US Bureau of Labor Statistics (BLS) revealed a slight softening in inflationary pressures in the United States, with the Consumer Price Index (CPI) showing a year-on-year increase of 3.1% in January, down from 3.4% in December. However, this figure surpassed market expectations, which had anticipated a lower reading of 2.9%. The Core CPI, which excludes volatile food and energy prices, remained resilient, matching December's increase at 3.9% and surpassing analysts' estimates of 3.7%.

On a monthly basis, both the CPI and the Core CPI rose, albeit moderately, by 0.3% and 0.4%, respectively. This modest increase suggests a continued but tempered upward pressure on prices.

The immediate market reaction was a strengthening of the US Dollar (USD) against its rivals, as evidenced by the US Dollar Index climbing 0.45% to 104.60. This rally was underpinned by the data exceeding market expectations and affirming the resilience of the US economy against inflationary pressures.

The BLS also announced revisions to previous CPI data, lowering December's CPI increase to 0.2% from 0.3%, while leaving the Core CPI unrevised at 0.3%. November's CPI increase was revised higher to 0.2% from 0.1%, with October's growth remaining unchanged. These revisions were attributed to adjustments in seasonal factors, indicating the importance of considering the broader economic context beyond monthly fluctuations.

In parallel, the global oil market experienced a surge, with prices rising more than 6% in January due to concerns over a potential supply shock stemming from the ongoing crisis in the Red Sea. However, the Manheim Used Vehicle Index remained unchanged during the same period, suggesting stability in a key sector of consumer spending.

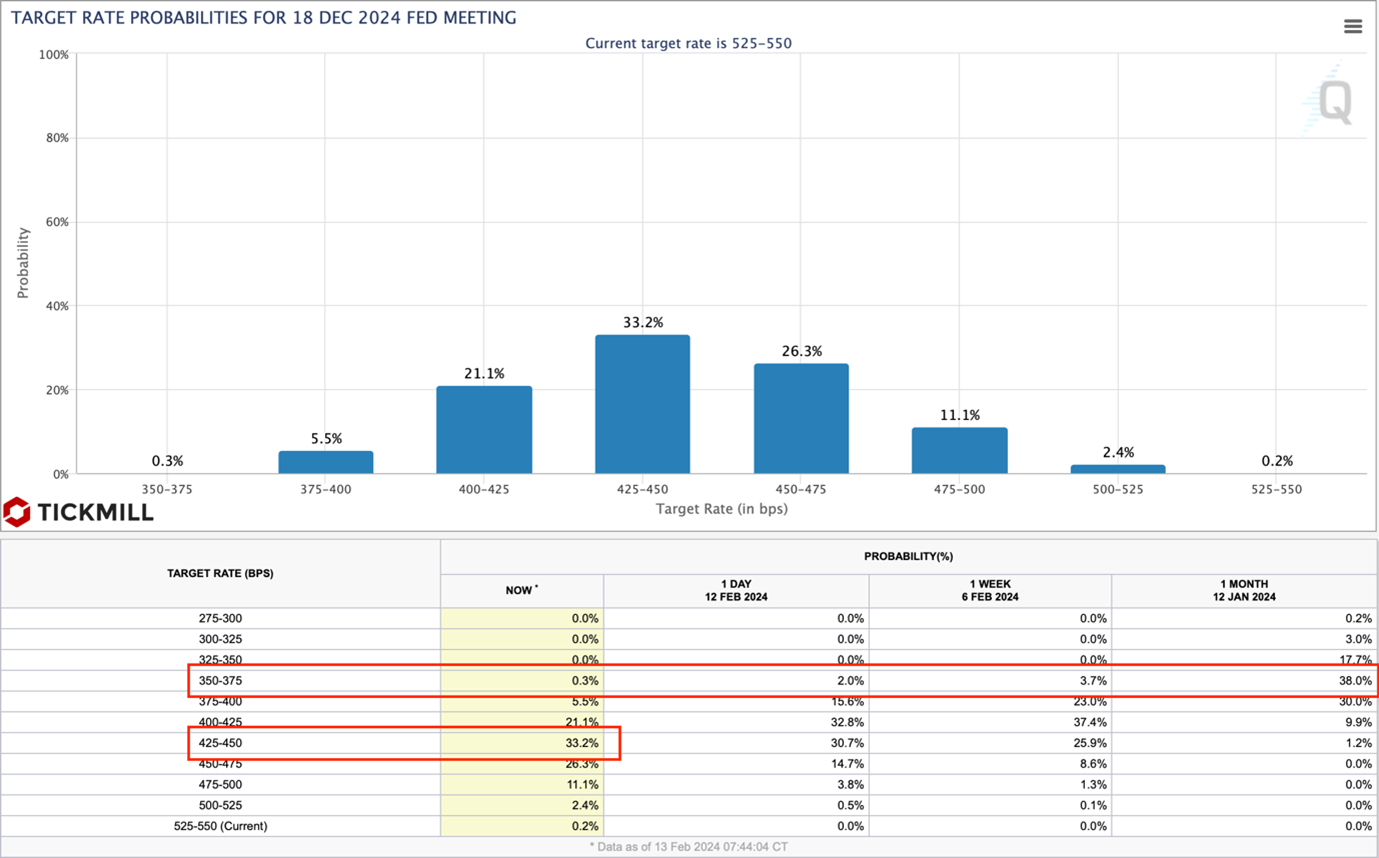

Market sentiment regarding Federal Reserve (Fed) policy underwent a notable shift following robust labor market data for January. This has led to a reassessment of the timing of the Fed's policy pivot, with markets refraining from pricing in a rate cut in March. The release of January's CPI data further solidified these expectations, with federal funds rate futures now indicating expectations of less than 100 basis points (bp) cumulative easing from the Fed this year, down from 175 bp just a month ago:

Looking ahead, the possibility of a rate reduction in May hinges on the trajectory of upcoming Core CPI data for March and April. A significant downward surprise in these figures could prompt a reconsideration of rate cut expectations, potentially leading to a downturn in US Treasury Bond yields and weighing on the US Dollar. Conversely, a stronger-than-forecast increase in Core CPI could bolster the USD in the short term, highlighting the sensitivity of currency markets to inflation dynamics and central bank policy expectations.

The key takeaway from the January CPI report underscores the enduring presence of inflationary pressures in the US, urging the Federal Reserve to tread with increased caution when considering policy adjustments. Against the backdrop of a nuanced economic environment, it is evident that market participants will maintain a vigilant watch over forthcoming data releases and Federal Reserve communications, seeking insights into future policy trajectories and their potential ramifications for currency markets.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.