Russian Ruble: Falls and Jumps

Good day!

Last week Russian ruble broke the level 63.50 and dropped till the support level of 62.50. A fine hammer has also formed at this level. So far, we assume that the Russian ruble could jump when the market opens:

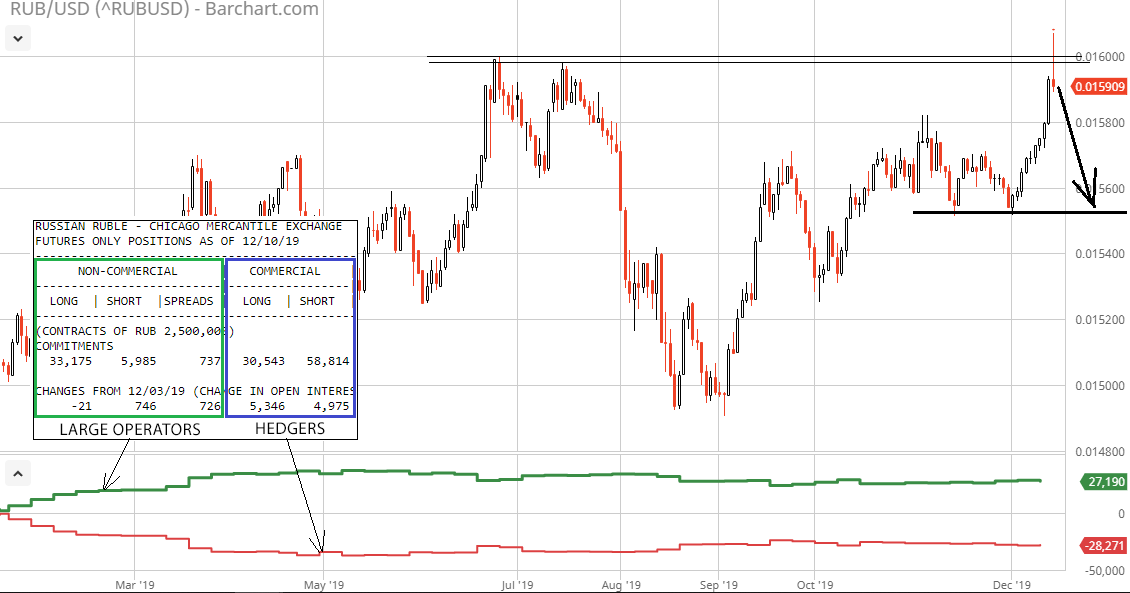

Last reports by COT CFTC show that once large operators have brought the USD/RUB currency pair down, they decided to expand short positions on Russian ruble. So far, it looks like a mere correction rather than a full reversal:

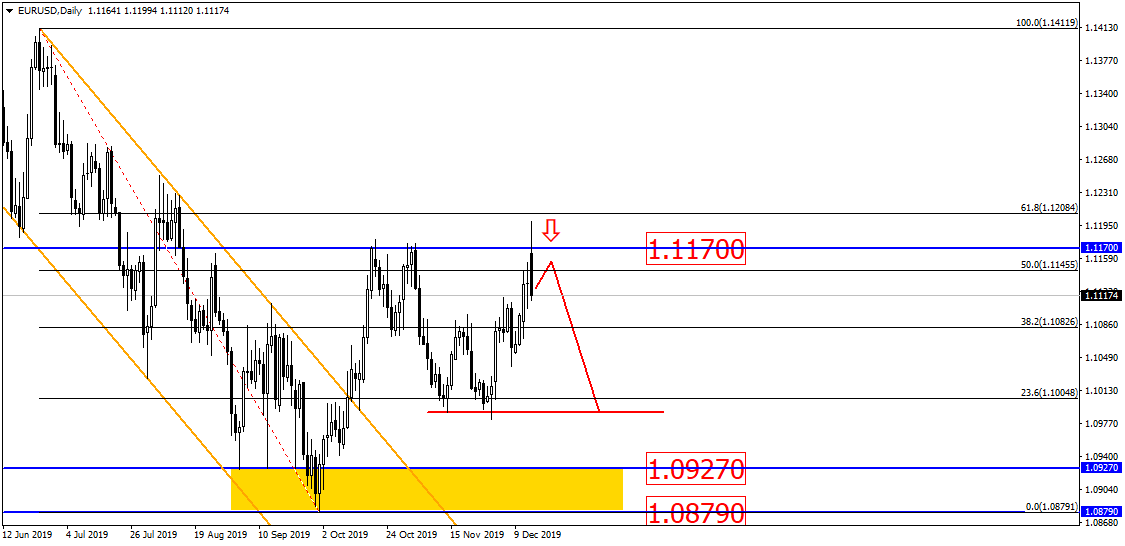

The European currency pulled from the resistance level of 1.1170 and absorbed the previously formed long-legged candle with a long black candle. This is a sign that EUR/USD could drop anytime soon:

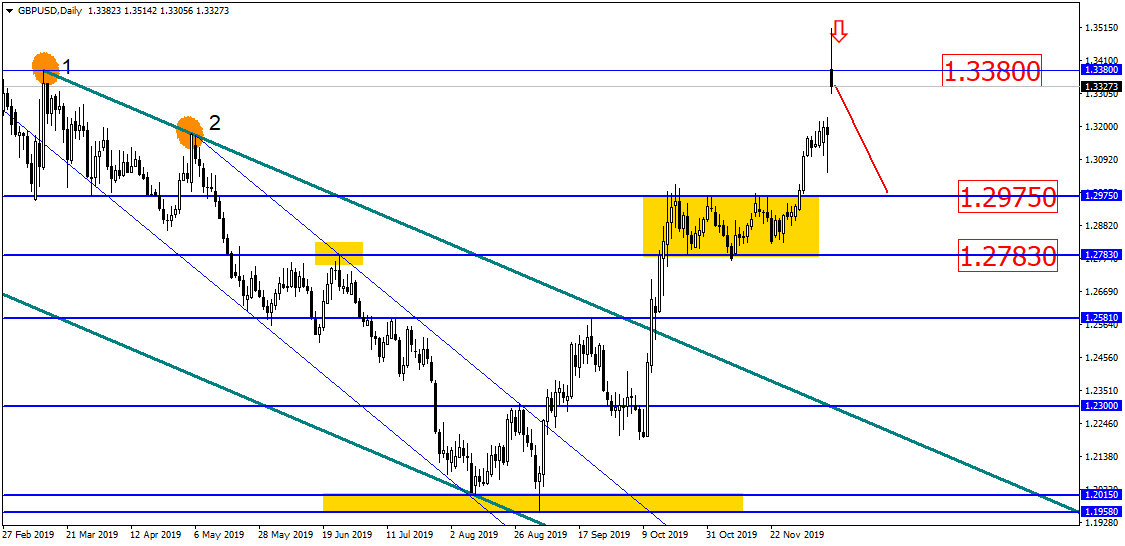

British pound has touched a very strong resistance level of 1.3380 and pulled back down, forming a shooting star. This is a very strong signal that signifies the correction of GBP/USD with the level of 1.2975 being a potential target:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.