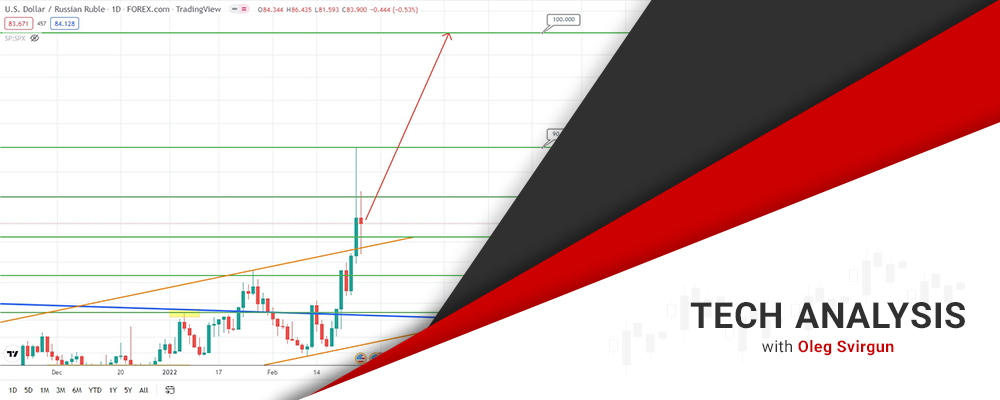

Russian Ruble Hits Record Low Against Invasion of Ukraine!

Last Thursday the USD/RUB tested the historical level of 90.00 against Russian invasion of Ukraine. Next, the currency pair has pulled back to the level of 83 due to intensive profit takes and treatments of losses. Remember that in this kind of situation the currency of invading country becomes less volatile in the first few days of military clashes. This happens due to the market counting on a quick blitzkrieg and minimal financial losses during the conduct of military operation. This is what the Russian ruble is currently going through.

However, the market made a mistake. Inadditiontothe Russianbanks being expelled from SWIFTandthe airspacesbeing closed for Russian aircrafts, theRussianFederationisaboutto have averyserious conflictwithunpleasant consequencesfor years to come.What comes to the market, every day of the current conflict will cost a great deal to the invading country and, most certainly, will not strengthen the national currency.

So, let’s wait and see how the USD/RUB is going to trade on Monday with a huge gap up. The Russian ruble might even hit the level of 100 or higher. Economic impact of tension with Russia will escalate as any cumulative effect delayed in time.

Gold might drop till the broken weekly downtrend to pull back and jump till the level of about 1840. Then this asset might target the level of 1920.00.

American stock index S&P500 has pulled from the level of 4260 and jumped. It might face a very strong resistance at the level of 4550 and drop again.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.