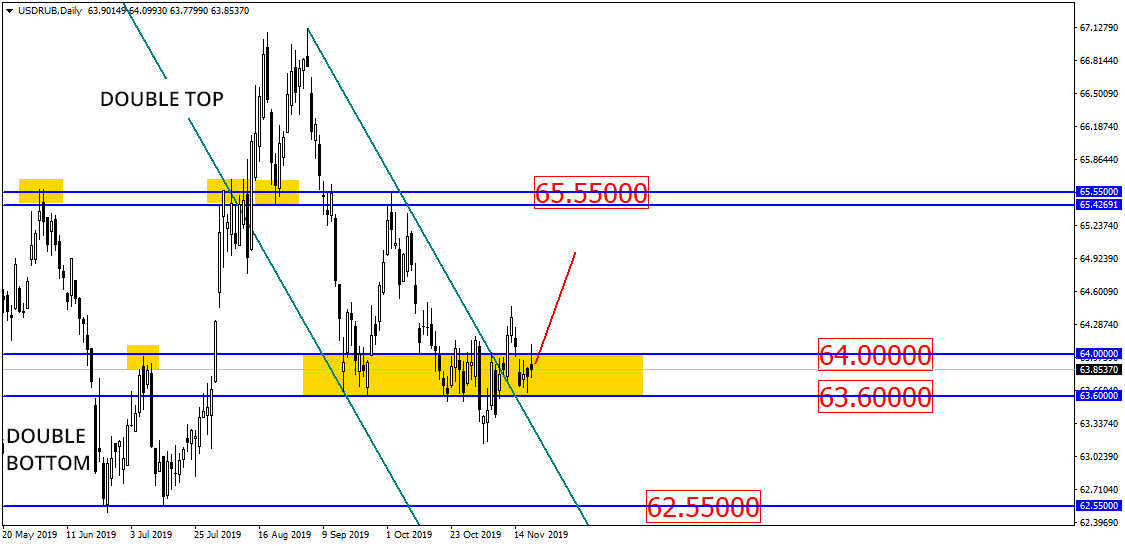

Russian Ruble Targets the Level of 65.00

Good day!

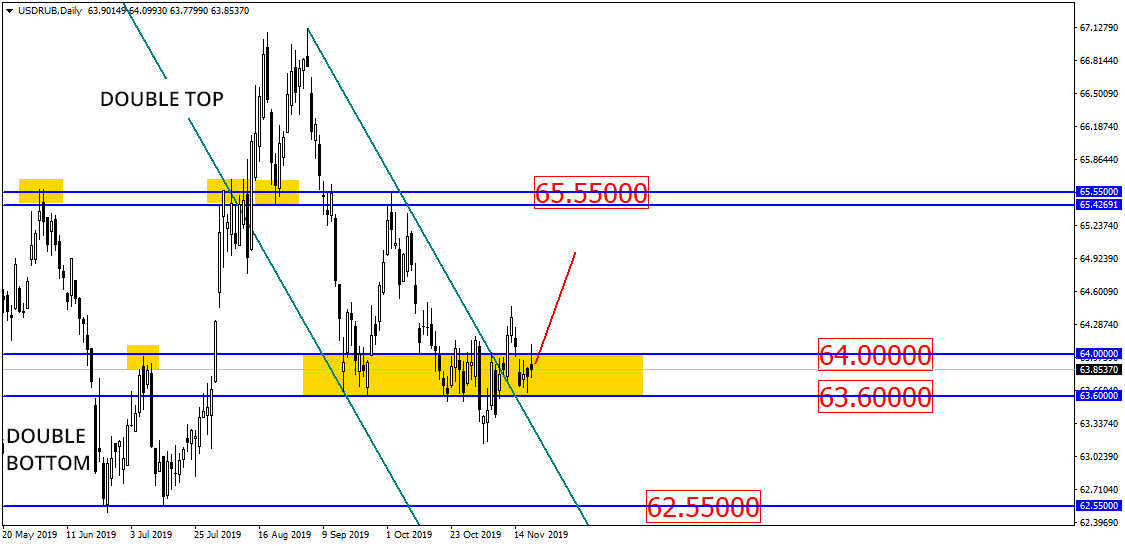

Russian ruble got stuck between the levels 63.60 and 64.00, forming the pattern much resembling inverse head and shoulders. So far, we assume that the currency pair may target the level of 65 as it is currently testing the level of 63.60 where the bearish trap was formed at.

Large operators keep buying all the other assets except of Russian ruble. We should wait and see what happens next and so do they:

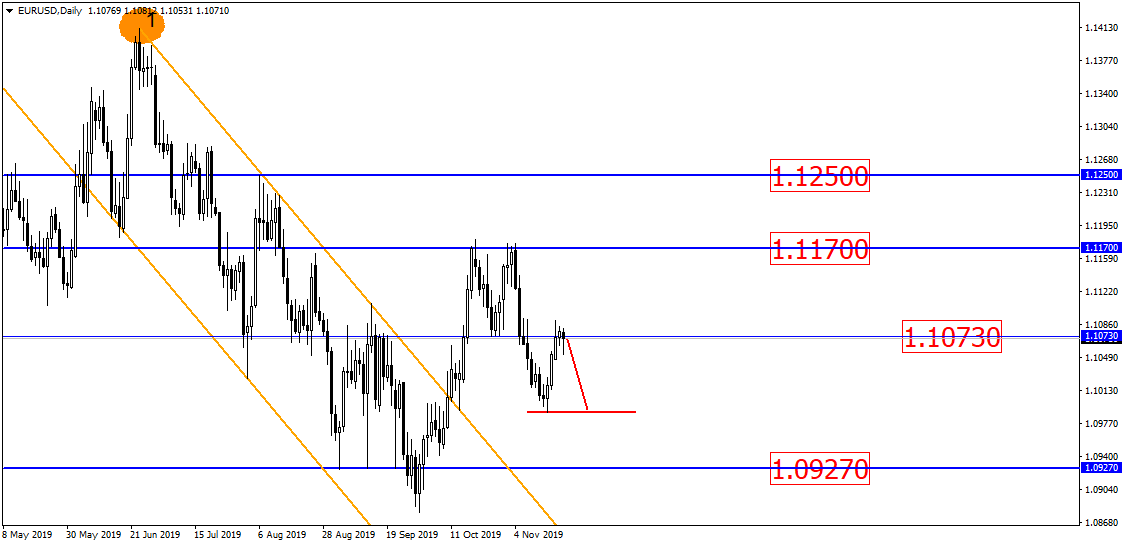

The price of EUR/USD is staying at the level of 1.1073. Should asset’s price stay below the trendline, single currency might nicely drop:

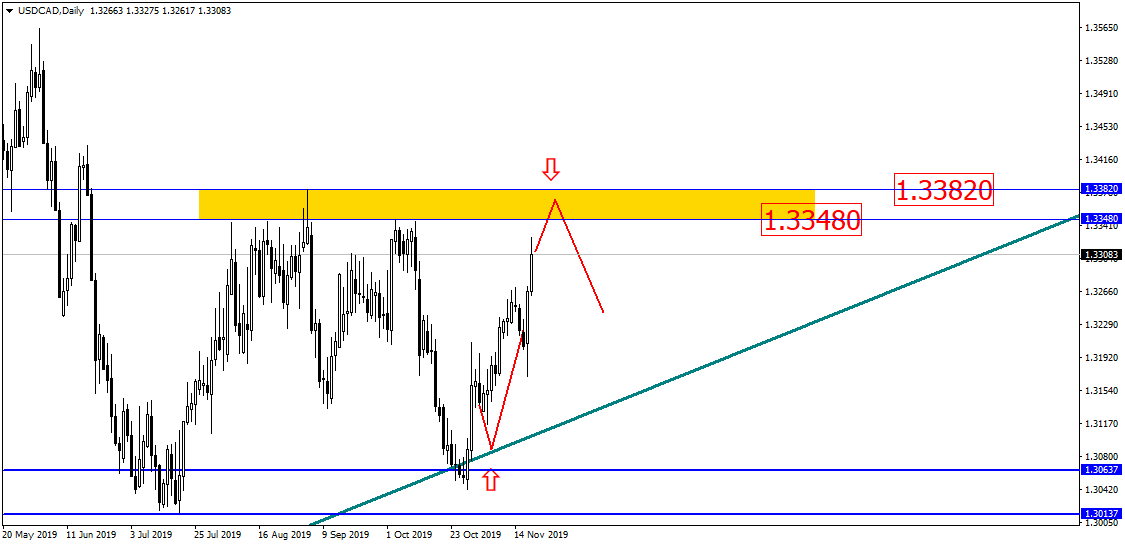

The price of USD/CAD approached a very strong resistance zone formed between the levels 1.3348 and 1.3382. The asset is likely to pull from the support levels even in case of correction:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 71% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work andwhether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.