Seasonal Trends Suggest Short-term USD Longs are at Risk

USstock indices rebounded yesterday for no apparent reason, gaining 1.9% byaverage. Tech sector led gains, closing the session in positive territory by2.4%. In the absence of fundamental information, the rebound could be wellexplained by the technical analysis: on Monday, the market's fall stopped atthe 50-DMA, forming a pinbar typical for the test of such levels. The bearishbreakthrough failed, which could be a signal that bullish sentiment continuesto dominate:

Investorsare trying to ignore the risk that a massive US spending package may meetresistance from individual Democrats and the path to the Congress approval willnot be as smooth as expected.

Inthe absence of negative news reports, the stock market is likely to remain inconsolidation mode near the recent highs (4600-4700 range) in lateDecember-January. The main risk for this scenario is possible pandemic shocks,which, for example, are already undermining growth forecasts for the Britisheconomy due to the alarming dynamics of the spread of the new Omicron strain.If there is news about new restrictions, a correction in the market cannot beavoided.

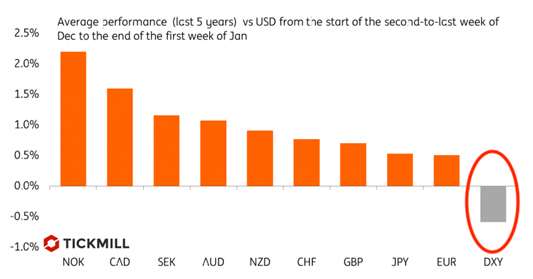

Asfor the foreign exchange market, there is a risk that seasonal weakness may startto play out in the dollar: over the past 5 years, the average dollar returnsfor the period two weeks before the New Year and the first week of January hasbeen negative:

Thisis usually attributed to the fact that US companies transfer money offshore atthe end of the year for tax reasons. Nevertheless, a long-term short on thedollar does not seem like a very attractive idea, given that after the lastcentral bank meetings, the difference in the expected pace of stimulusreduction between the Fed and, for example, the ECB has only grown. Theemphasis in expectations regarding the Fed's policy is shifting to the date ofthe first rate hike, and if the market begins to price in the first hike inMarch 2022, the dollar may receive solid support. In addition, the risk of new socialrestrictions in the Eurozone is higher, which, of course, negatively affectslocal assets and determines the potential for the euro to decline against thedollar.

TheFed has signaled that it is seriously monitoring inflation, so market attentionto US inflation reports is likely to remain elevated for a while. One of thefirst reports that will clarify the forecast for the first Fed rate hike willbe tomorrow's report on US inflation - the dynamics of personal consumerspending (PCE). The acceleration of the indicator will probably not gounnoticed and will cause a short-term positive reaction of the dollar.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.