Selling Risks Persist for EURUSD as Key Bearish Targets are Yet to be Met

The EUR/USD pair isn't catching a break, heading south for the second day straight and hovering around 1.0790 during the European session on Thursday. The mighty US Dollar is gaining traction against the Euro, riding high on the words of Federal Reserve Chair Jerome Powell, who slammed the door on a rate cut in the upcoming March meeting. Powell's skepticism that the committee will be ready to slash rates by March is also giving a boost to US Treasury yields. However, the Euro attempts to make a comeback attempt following the release of mixed Eurozone inflation data.

In the technical realm of EUR/USD, the setup signals that the selling pressure might stick around until the price hits the support area near December 2023's lowest point at 1.0740. Brace for a potential rebound from there, pushing the price towards the upper boundary of the current bearish channel:

The Euro faced challenges after softer preliminary CPI data from Germany hit the wires on Wednesday. This has raised expectations of a potential interest rate cut by the ECB in June. However, ECB member Mario Centeno suggested that if inflation keeps heading in its current direction in the upcoming months, the ECB's next move might involve cutting rates, potentially marking the beginning of a cycle aimed at normalizing interest rates. ECB Vice President Luis de Guindos hinted that interest rate cuts would only be on the table when there's confidence that inflation aligns with the central bank's 2% goal.

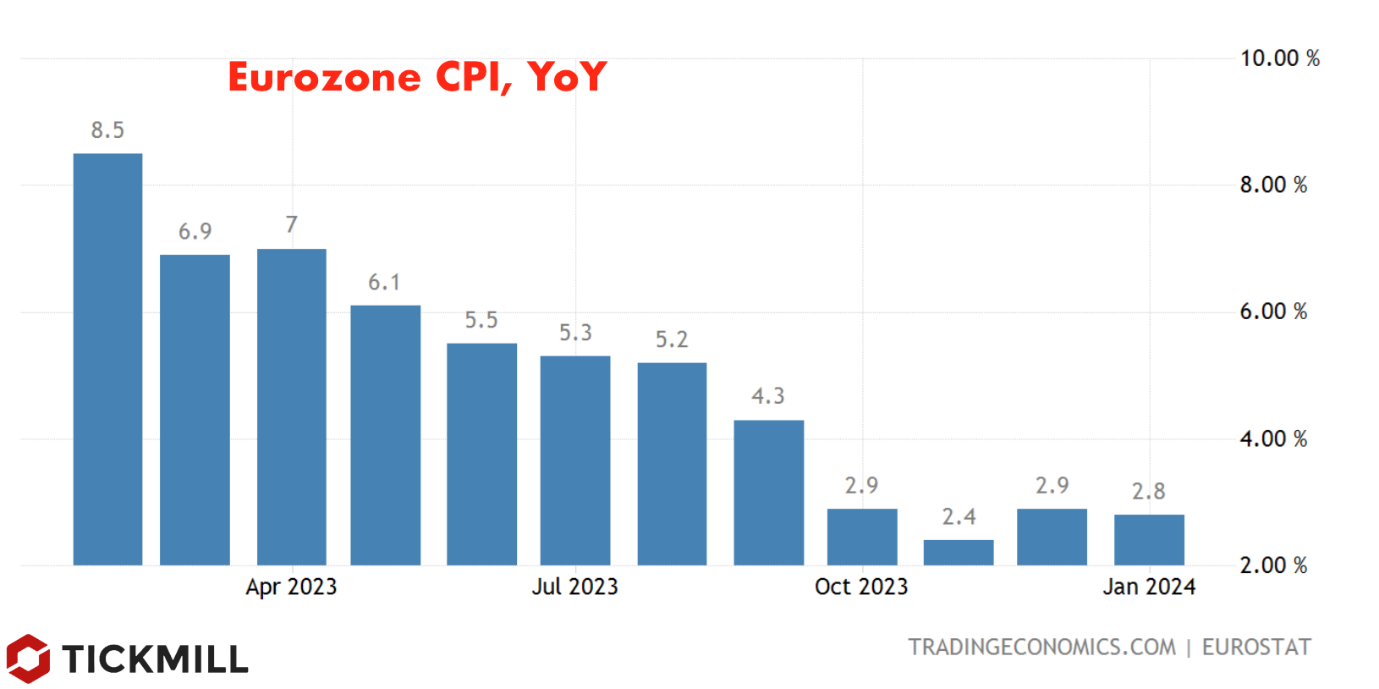

In terms of economic indicators, the Eurozone HICP showed a 3.3% increase in January, surpassing the consensus estimate of 3.2%. The annual CPI met expectations at 2.8%, in line with the previous reading of 2.9%. The month-over-month report displayed a 0.4% decline, reversing the 0.2% rise observed in December:

In Germany, the CPI for January showed a year-on-year increase of 2.9%, falling short of the anticipated 3.0% and marking a substantial drop from December’s 3.7%. Monthly consumer inflation, however, met expectations, rising to 0.2% from the previous 0.1%. The German HICP increased by 3.1%, lower than the previous figure of 3.8%.

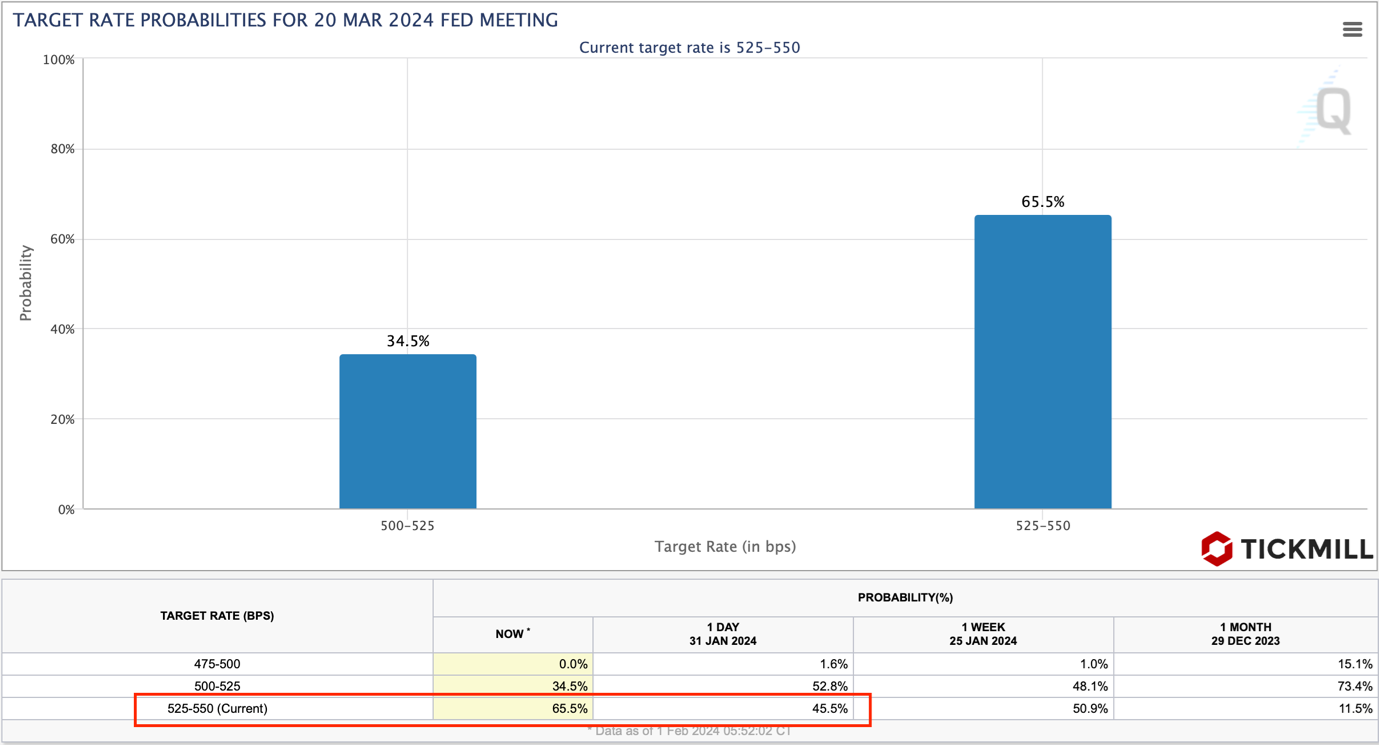

The US Dollar continues to flex its muscles amid a growing consensus that the Federal Reserve's policy-easing action might not happen until May. Fed funds futures indicate an increased likelihood that the Fed will maintain its stance in March, with odds jumping from 45.5% before the FOMC meeting to over 65% on Thursday. Furthermore, the probability of a quarter-point rate cut in May exceeds 60%:

Thursday's spotlight is expected to be on significant economic indicators such as US Initial Jobless Claims, Nonfarm Productivity, and ISM Manufacturing PMI. The recent report of a 107K job increase for January in the ADP Employment Change fell short of the expected 145K and marked a decrease from the previous reading of 158K in December.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.