Signals of a Hotter US Inflation Pile Up, Causing Deeper Rout from Fixed Income

Yields on 10-year bonds hit over 4% for the first time since November last year, after the ISM data came out on Wednesday. The key takeaway from the report was the signal of a sharp shift in the price pressures in the sector, with the index jumping from 44.5 to 51.3 (forecast was 45.1). The aggregate index still showed the sector was on a weakening trajectory at 47.7.

US stocks retreated to a new defensive line closer to 3900 points, reflecting a higher discount rate due to the rise in Treasury bond yields. The sell-off gave support to the US dollar, with the DXY index edging closer to 105 points.

Fed top manager Neil Kashkari, who is mostly known for his tendency to lean towards a soft, stimulative monetary policy, caused a surprise yesterday with his comments about the March FOMC meeting. He said he's ready to consider a rate hike of 25, even 50 basis points because, in his opinion, the potential damage from over-tightening is lower than the damage from an insufficiently restrictive policy and inflation remains goal number one. He also added that wage growth in the economy is indicating an overheating and isn't in line with the inflation goal. The comments of the traditional Fed dove about the need for tight measures added fuel to the fire sending interest rate futures lower so the chances of the Fed terminal rate range (where the tightening will end) being at 5.50-5.75% at the end of the year increased even more. On Wednesday, the chances for this outcome were up to 28.1% compared to 12.4% a week before.

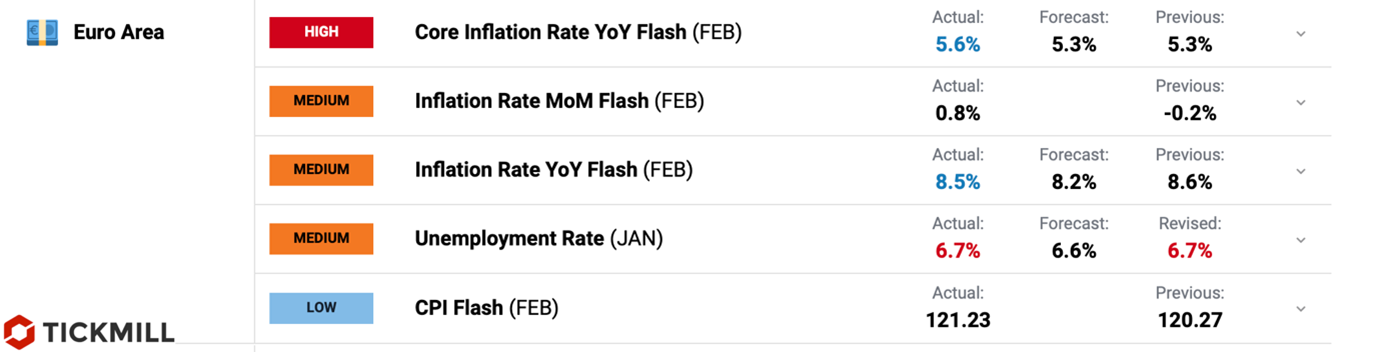

Data from consumer prices in the EU pointed to a possible re-acceleration of inflation in European countries. On Thursday, data from the bloc showed that the core inflation rate had accelerated from 5.3% to 5.6%, while a forecast of 5.3% was expected:

The ECB swaps market and sovereign debt market are pricing in at least 50bp hikes at the upcoming meeting and currently ruling out a rate cut on the ECB deposit facility this year.

Tomorrow we are expecting the ISM report on the US non-manufacturing sector. Judging by the "hint" from the manufacturing PMI, the price component will be in focus. Last month it came in at 67.8 points, higher readings in February may trigger a sell-off in Treasuries, meaning a new rise in yields, which in turn is predictably going to weigh on risk assets.

Based on the analysis above, the short-term risks of the US dollar are skewed up, high-beta and commodity currencies are at risk of further depreciation. For example, within the current bearish channel of AUDUSD, a test of 0.6650, the minimum level since the beginning of the year, is expected:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.