S&P 500: Sole Focus on the Odds of Democratic Sweep?

Looks like I underestimated buyers’ vigor in the US equities which posted spectacular performance on Monday, extending its winning streak. SPY (the largest ETF on the S&P 500) rose 1.64%, QQQ (the largest ETF on NASDAQ-100) jumped more than 3%. The market stubbornly ditches hopes for a pullback. However, buying from current levels is much riskier and it is probably worth waiting for a significant discount (a break below 3500 in SPX, preferably towards 3450) before considering any long positions.

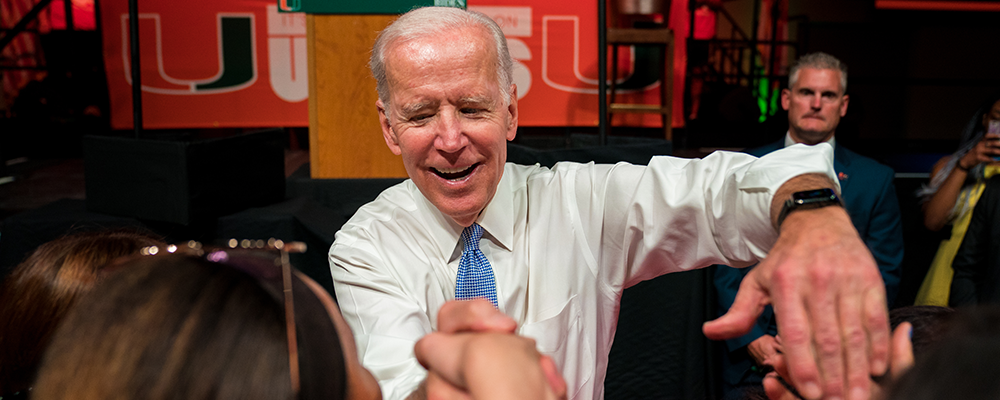

In addition to the stimulus deal story, which I tried to cover inside out, another factor of the market rally could be rising odds of the so-called Democratic sweep. With this outcome, Biden becomes president and Democrats "occupy" the Congress (get a majority in both the Senate and the House of Representatives):

Since around September 25, the likelihood of full Democratic control has jumped from 47% to 60%. Now look when SPX started to rise...

Recall that the Democrats' program includes huge government borrowing and spending spree, more friendly China policy, multilateralism, free trade, etc. In short, everything that the market loves.

Market optimism on Tuesday was supported mainly by economic data from Asia. Foreign trade data from China showed that imports grew at the fastest pace in September this year, significantly outperforming the forecast - by 13.2% YoY against expectations of 0.3%. Exports also showed good growth rate, which came slightly lower than the forecast - 9.9% YoY against the forecast of 10%.

Increase government spending (investments) accounted for a good part of import growth. Strong yuan also made positive contribution to Chinese spending power and hence demand for import products, rising by 6.5% since late May against USD.

Inflation in Germany fell in line with forecast in September (-0.2%), but the data on unemployment in the UK for July strongly disappointed the Cable. The number of employed fell by 153K in July against the forecast of -30K. GBPUSD tested the 1.30 zone after the release of the report but failed to break through it as USD momentum appears to have fizzled out. The pair quickly advanced towards 1.3050 and is expected to continue the rally.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.