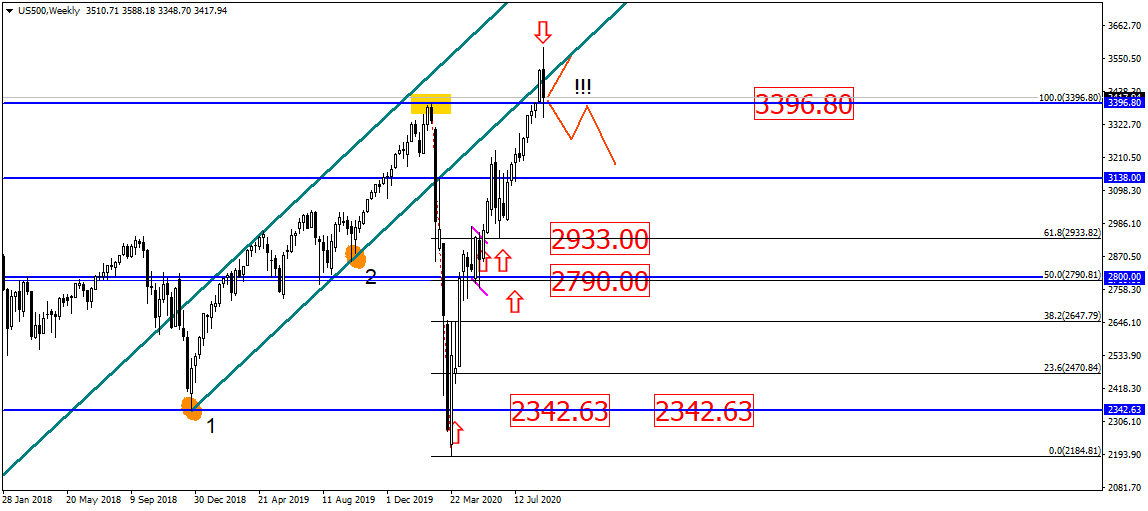

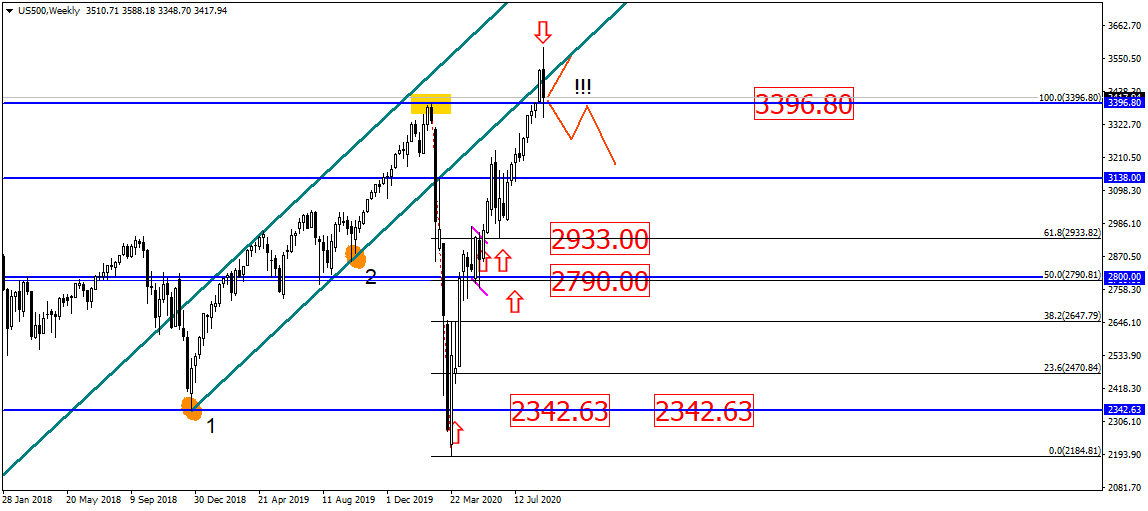

S&P500 Falls: What’s Next?

Good day,

In the end of last week, the S&P500 index has slipped into a correction just to pull back from the broken trend and close behind it, almost forming a bearish engulfing. However, the asset’s closing price exceeded the past broken historical maximum of 3396.80. Hence, now the asset can potentially get support from the broken top. So, we should wait and see what happens next.

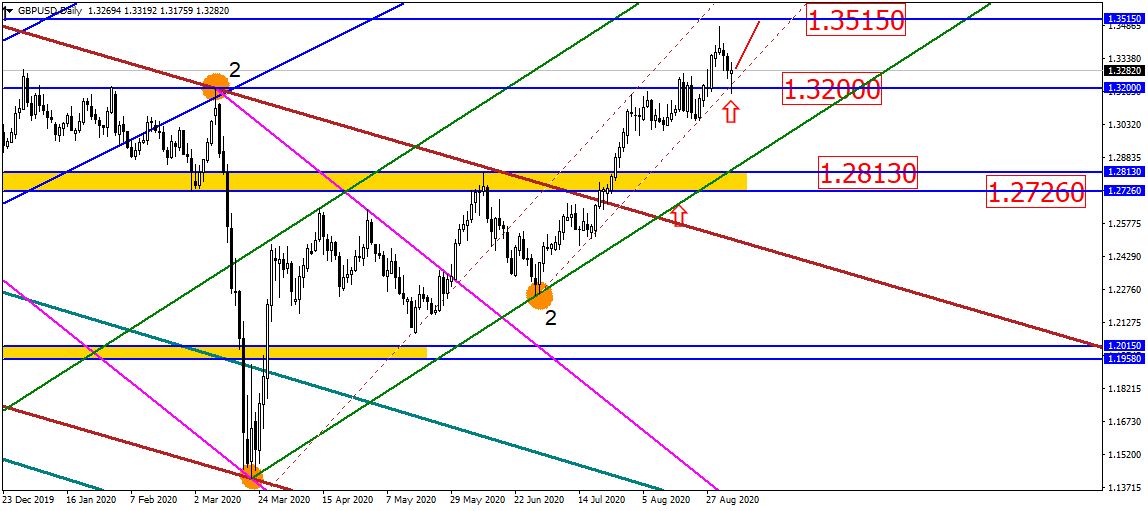

Last Friday, the GBP/USD pair has closed with a hammer that has pulled from the level of 1.3200. The asset might potentially jump, targeting the level of 1.3515.

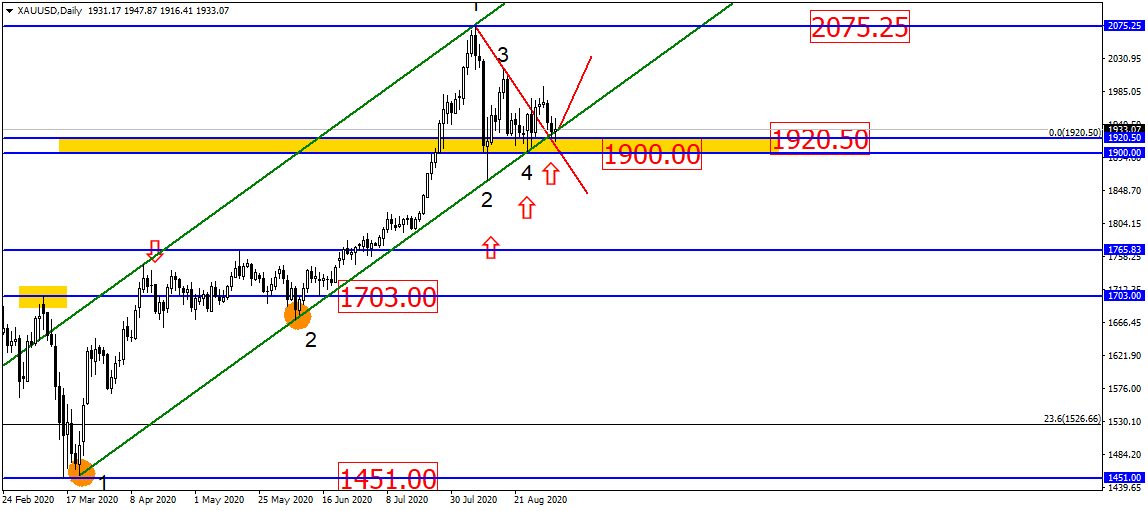

The price of gold keeps testing the supporting zone at the psychological level of 1900.00. Last Friday, the asset has closed with a doji candle. This means that gold might jump anytime soon. So far gold is testing the support and the upper broken side of triangle. Hence, it would be wise to keep an eye on metal prices.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.