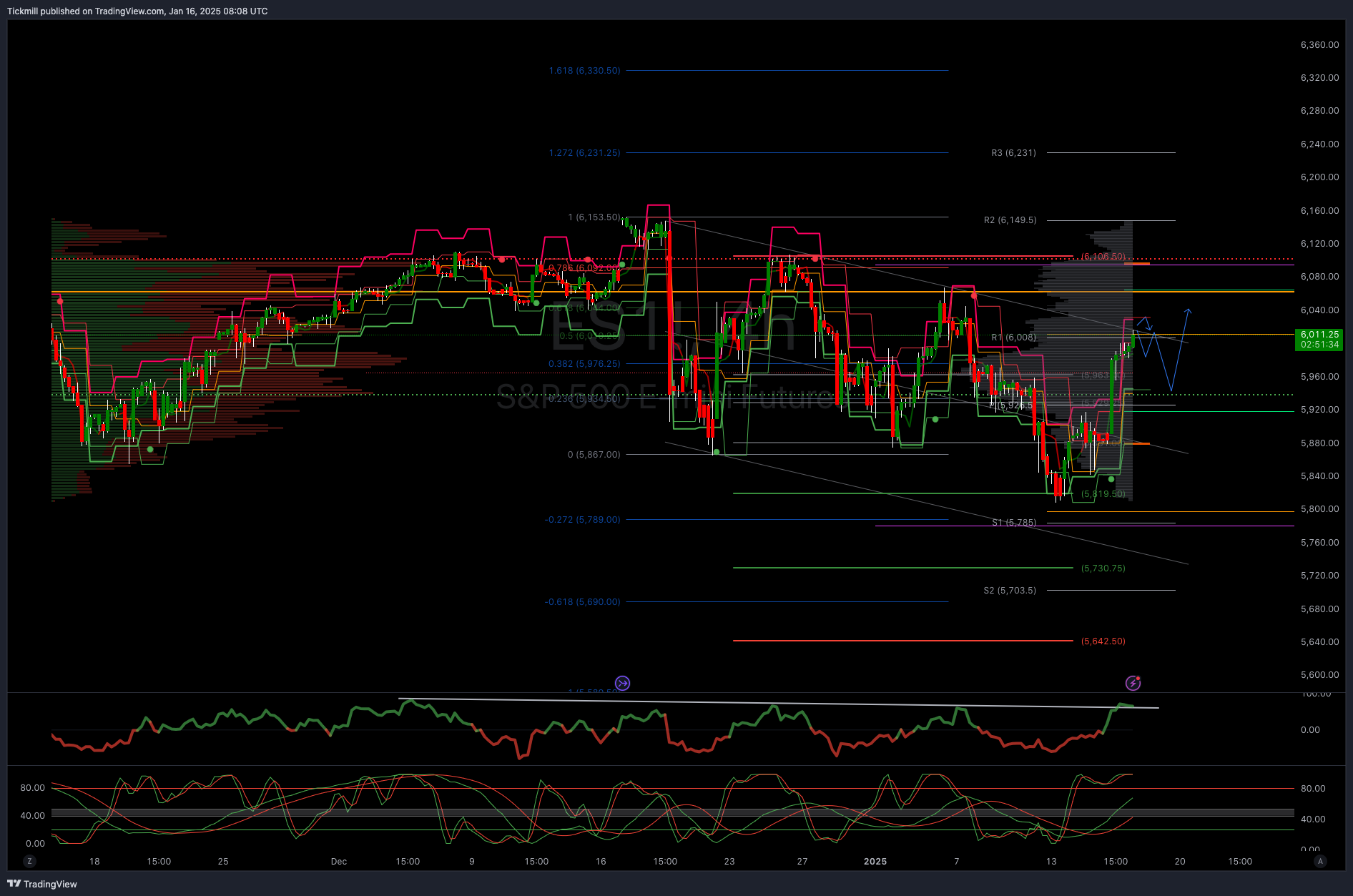

SP500 LDN TRADING UPDATE 16/01/25

#SP500 LDN TRADING UPDATE 16/01/25

WEEKLY BULL BEAR ZONE 5905/15

WEEKLY RANGE RES 5983 SUP 5745

DAILY BULL BEAR ZONE 5980/90

DAILY RANGE RES 6030 RANGE SUP 5946

TODAY'S TRADE LEVELS & TARGETS

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

LONG ON TEST/REJECT OF DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON ACCEPTANCE BELOW DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

TO REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO CLCIK HERE

GOLDMAN SACHS TRADING DESK VIEWS

S&P closed up +183bps at 5949 with a MOC of $3.8bn to sell. NDX rose +231bps to 21237, R2K increased +199bps to 2263, and Dow gained +165bps to 43221. A total of 14.29bn shares were traded across all US equity exchanges, compared to a year-to-date daily average of 16bn shares. VIX decreased by 1384bps to 16.12, Crude oil rose +383bps to 80.46, the US 10-year yield was at 4.65%, gold increased +69bps to 2695, DXY fell by 19bps to 109.07, and Bitcoin rose +346bps to 99789.

There was a risk-on sentiment today as the market reacted to a softer CPI report (core rose +23bps unrounded vs +30bps expected, and the YoY rate fell to 3.24%) alongside strong earnings in Financials (NII beats across the board and expenses were in line, leading to better NII into operational leverage). The tone on buybacks at Citigroup and JPMorgan was particularly positive. There was also some relief in rates with the US 10YR yield dropping 14bps to 4.65%. Market breadth improved with over 369 names rising today. A reminder that PB indicates an overly short positioning.

As we entered this week, the pace of net leverage reduction over the past month was the fastest since mid-2022. US single stock shorts have increased for 12 consecutive weeks (22 of the last 24). We have not seen a significant short unwind since last July, with the most shorted stocks up +380bps and TMT shorts up +750bps.

Some components contributing to core PCE data fell sharply this month, likely due to larger-than-usual holiday sales. Our economists now estimate that Core PCE inflation rose by only 0.15% month-over-month in December. Tomorrow, we will be monitoring US Retail Sales, Trump confirmation hearings, US import/export data, and earnings reports before the market opens (BAC, FHN, INFY, MS, MTB, PNC, TSMC, UNH, USB).

Our floor activity was rated a 7 on a scale of 1-10 in terms of overall activity levels. Overall executed flow finished +430bps compared to a -34bps 30-day average. LOs ended as net buyers by +$2bn, driven by demand in macro products, financials, and discretionary sectors. Hedge funds were net sellers overall by -$1.5bn, with broad supply spread across every sector for the second consecutive session.

BUYBACK update:

2024 ended as the second highest year for authorizations at $1.26T.

We anticipate 2024 executions to be the second most active at approximately $1.00T.

Looking ahead, we project 2025 to be the most active buyback year on record, expected to finish up +15% at $1.45T in authorizations and $1.16T in executions.

We are currently in our estimated S&P 500 blackout period until 1/24; after this date, we expect around 45% of the S&P 500 to enter their open period.

Leading up to this morning's CPI, the market was anticipating a 1.10% move, the highest for an inflation print since March 2023. We easily realized this and saw volatility and skew decrease throughout the day, as UX1 underperformed the spot move by nearly a volatility point. In terms of flows, we observed short-dated call buying in SPY and demand for VIX calls as some clients took advantage of the pullback in volatility to add positions. TLT call volumes surged, with 865k contracts traded today, marking the second highest volume ever. This was primarily seen on the desk as monetization of existing upside. Heading into today, dealers were short approximately $700m of SPX gamma, and our model indicates positioning remains short/flat on any rallies. With the main macro event of the week behind us, the SPX straddle to Friday’s close is now only 0.90%.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!