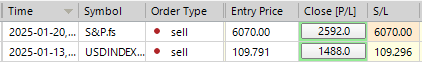

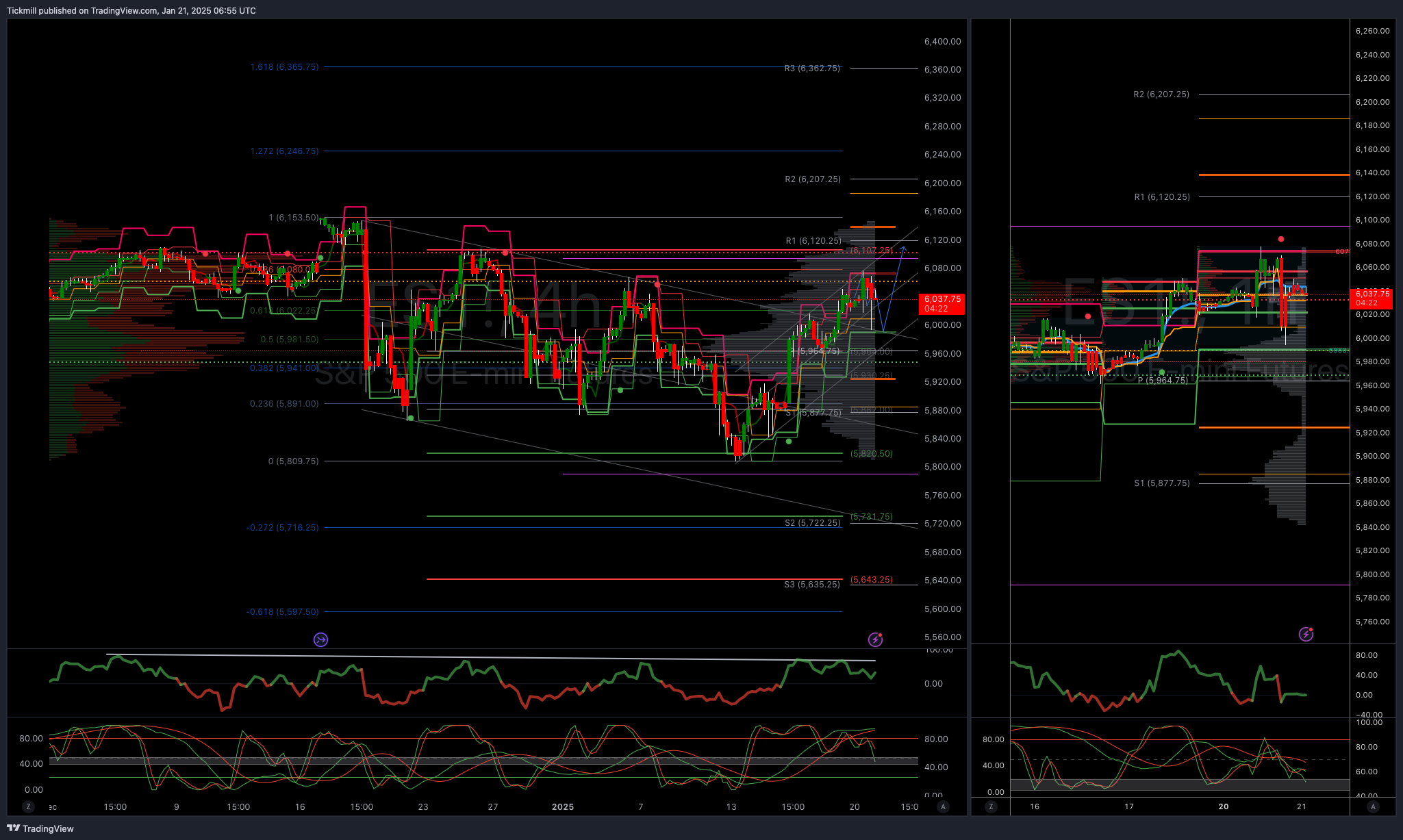

SP500 LDN TRADING UPDATE 21/01/25

SP500 LDN TRADING UPDATE 21/01/25

WEEKLY BULL BEAR ZONE 6070/80

WEEKLY RANGE RES 6119 SUP 5945

DAILY BULL BEAR ZONE 5995/85

DAILY RANGE RES 6074 RANGE SUP 5990

TODAY'S TRADE LEVELS & TARGETS

LONG ON ACCEPTANCE ABOVE BULL BEAR ZONE TARGET WEEKLY RANGE RES TARGET

SHORT ON TEST/REJECT WEEKLY RANGE RES TARGET WEEKLY BULL BEAR ZONE

SHORT ON ACCEPTANCE BELOW DAILY RANGE SUP TARGET WEEKLY RANGE SUP

LONG ON TEST/REJECT OF WEEKLY RANGE SUP TARGET DAILY BULL BEAR ZONE

YOU CAN REVIEW WEEKLY ACTION AREAS & PRICE OBJECTIVE VIDEO HERE

GOLDMAN SACHS TRADING DESK VIEWS

We experienced a relief rally following the CPI report. Sentiment appears too low for a significant sell-off, and I'm inclined to buy into any weakness caused by tariffs early this week. Interest rates remain a challenge, and despite more favourable inflation, the underlying growth conditions, fiscal situation, and mechanical bond supply suggest that yield curves may remain steep and term premiums extended. This situation places a figurative limit on equity multiples, while the primary source of returns will need to come from cyclical earnings growth, leading to outperformance in cyclical over defensive stocks. Aside from the inauguration, this week is relatively quiet for both micro and macro events (with the exception of the BOJ), and my bias is to take advantage of weakness in industrials and financials. I see potential in emerging markets and the dollar, and the true test for the markets will arrive next week with the Mega Cap earnings reports—can we maintain our position in light of a stronger dollar, capital expenditure demands, and slower earnings growth?

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!