SP500 LDN TRADING UPDATE 3/12/25

SP500 LDN TRADING UPDATE 3/12/25

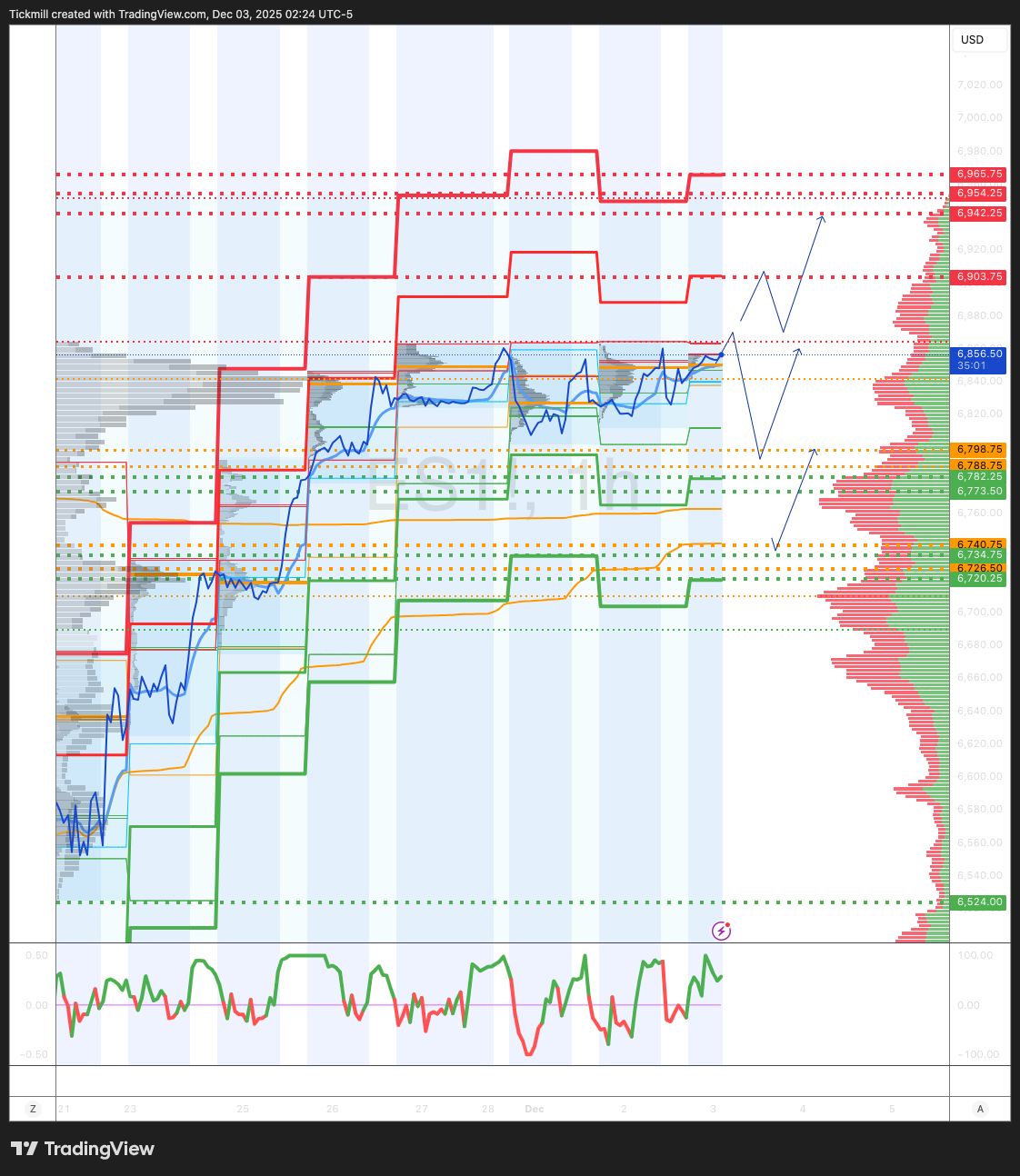

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6740/26

WEEKLY RANGE RES 6943 SUP 6773

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 7025/6303

WEEKLY VWAP BULLISH 6726

MONTHLY VWAP BULLISH 6758

WEEKLY STRUCTURE – BALANCE - 6892/6539

MONTHLY STRUCTURE – BALANCE - 6952/6539

The SPX aggregate gamma flip point is at 6720, whereas we're currently close to the relative peak around 6850. This indicates that dealers typically support the price and will act to stabilise it as it fluctuates upward and downward.

DAILY STRUCTURE – BALANCE - 6863/6795

DAILY VWAP BULLISH 6834

DAILY BULL BEAR ZONE 6798/88

DAILY RANGE RES 6900 SUP 6765

2 SIGMA RES 6957 SUP 6729

VIX BULL BEAR ZONE 22.2

PUT/CALL RATIO 1.12

TRADES & TARGETS

LONG ON ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

SHORT ON TEST/REJECT DAILY RANGE RES TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEWS - AI BOUNCEBACK

S&P closed +25bps at 6,829 with a Market on Close (MOC) of $700mm to BUY. NDX gained +84bps to finish at 25,556, while R2K slipped -17bps to 2,465. The Dow added +39bps, closing at 47,474. Total US equity trading volume reached 15.4 billion shares, below the year-to-date daily average of 17.47 billion shares. The VIX dropped -3.77% to 16.59, WTI Crude climbed +116bps to $58.64, and the US 10YR yield remained unchanged at 4.09%. Gold fell -51bps to $4,211, the DXY declined -6bps to 99.36, and Bitcoin surged +560bps to $91,305k.

Trading volumes and activity levels remain subdued, continuing the week's trend of suppressed engagement. Markets ended in the green, supported by stabilization in crypto and broader momentum. Volume and liquidity dynamics are under close watch as we approach the final 20 trading sessions of the year. Market volumes today were down -16% versus the 20-day average, though top-of-book liquidity has shown improvement from last week’s lows. Macro products continue to dominate activity, with ETFs accounting for 32% of tape versus the YTD average of 28%.

12-month winners, retail favorites, and AI-themed stocks led the screens, despite some midday volatility in NVDA, which dropped 3% off its highs. The AI narrative remains a key driver of volatility, with disruption headlines like AMZN’s Trainum3 and OpenAI's "code red" causing price dispersion. The NDX has now rallied in 6 of the past 7 sessions, reflecting growing confidence in a more diversified market rally. Notably, R2K Tech has outperformed NDX and AI Longs by ~6 points over the past 10 days.

Retail strength continues to stand out, with a 1-week rally of +10%, outpacing the broader market by 600bps. Consumer specialists remain optimistic heading into 2026, though macro and generalist investors are more cautious about adopting a long-term consumer thesis. Key questions from investors center on the sustainability of this rally and strategies to capitalize on it.

Reminder: Tomorrow marks Day 1 of the GS Industrials and Materials Conference. Top 10 most requested companies include ETN, CARR, NVT, PPG, GE, MLM, LII, HON, AMRZ, and MMM. Relevant links: Conference Website, Full GIR Preview, Desk Preview, Agenda.

Flows: Activity levels on the floor were rated a 3 out of 10. Buy/sell skews were flat, with LOs finishing as small net sellers and HFs as small net buyers. LOs net sold Info Tech while buying pockets of Financials and Communication Services. HFs also net sold Tech but bought Macro products and Industrials.

Derivatives: It was another quiet day on the desk, with the S&P experiencing repeated 40+ bps intraday moves. Volatility compressed further during today’s rally, following a similar trend during yesterday’s sell-off. Dealers appear max long gamma on rallies and shorter on sell-offs, suggesting potential for outsized moves if the market exits its current gamma pocket. Skew in the front was lightly offered, with no significant moves elsewhere. Tomorrow's straddle closed at $33, implying a 0.93% move through the end of the week. Notably, a large put roll occurred: SPX Dec-Mar 6700 Put Spread traded at 6,840, with the customer paying 122 for 8,000x (buying 7mm vega, net selling 300mm gamma).

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!