SP500 LDN TRADING UPDATE 9/12/25

SP500 LDN TRADING UPDATE 9/12/25

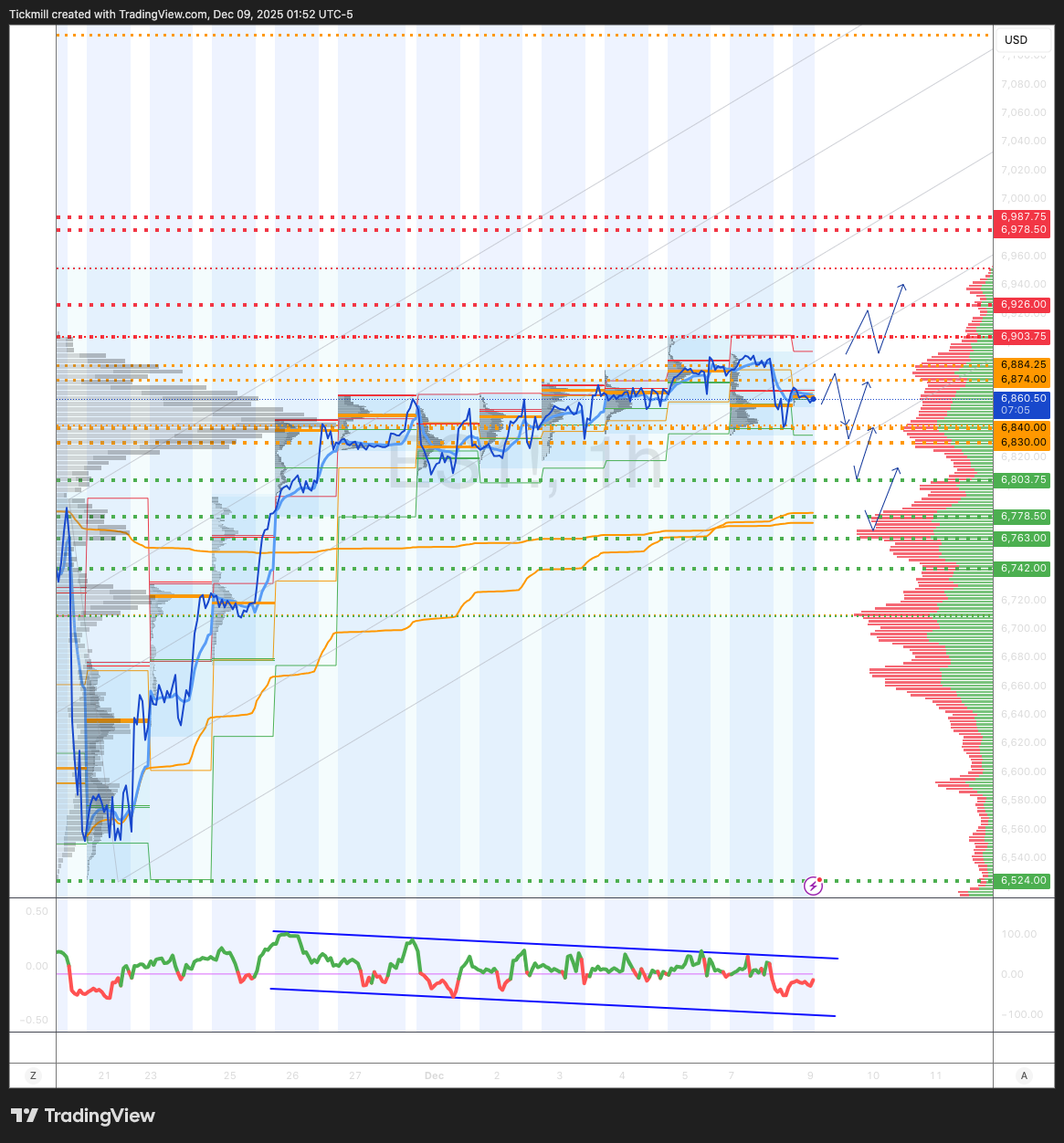

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

WEEKLY BULL BEAR ZONE 6830/40

WEEKLY RANGE RES 6978 SUP 6778

DEC EOM STRADDLE 6631/7067

DEC QOPEX STRADDLE 7025/6303

WEEKLY VWAP BEARISH 6747

MONTHLY VWAP BULLISH 6761

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6812

MONTHLY STRUCTURE – BALANCE - 6952/6539

The SPX aggregate gamma flip point is 6780, whereas we are currently at a relative peak around 6950. This indicates that dealers are typically backing the price and will be applying brakes as it fluctuates up and down

DAILY STRUCTURE – BALANCE - 6905/6820

DAILY VWAP BEARISH 6865

DAILY BULL BEAR ZONE 6874/84

DAILY RANGE RES 6926 SUP 6803

2 SIGMA RES 6987 SUP 6742

VIX BULL BEAR ZONE 18.66

PUT/CALL RATIO 1.06 ⇩

TRADES & TARGETS

SHORT ON ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE SUP

LONG ON ACCEPTANCE ABOVE DAILY BULL BEAR ZONE TRAGET DAILY RANGE RES

LONG ON TEST/REJECT DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW

Market slightly lower to start the day (SPX -30bps, NDX -25bps) after an initial positive open. Trading activity remains subdued as investors await Wednesday's FOMC decision, with a 95% probability of a 25 bp rate cut already priced in. Market participants largely anticipate a ‘hawkish cut,’ with attention focused on the dot plot and press conference commentary for future guidance.

Select market segments are outperforming today, with R2K up +26bps, outpacing both SPX and NDX. The GS Non-Profitable Tech index (GSXUNPTC) is up +85bps, and high-beta momentum shorts are +32bps. Retail-related themes are also performing well, with the Bitcoin-sensitive GSCBBTC1 +185bps, Quantum Computing +125bps, and the Memes Basket (GSXUMEME) +7bps.

M&A headlines remain prominent: Paramount has offered $30 per share in cash for Warner Bros. Discovery (WBD), surpassing Netflix’s recent $27.75 cash-and-stock bid. Additionally, IBM announced plans to acquire data infrastructure company Confluent (CFLT) for ~$11 billion or $31 per share in cash, representing a ~50% premium to the stock's early October trading levels, prior to reports of acquisition interest.

Liquidity conditions are improving despite lighter activity overall. Market volumes are up 4% versus the 5DMA but remain down 6% compared to the 20DMA. ETF activity is normalizing at 27% of tape versus a 29% average. Top-of-book liquidity is also improving, now at $11.7 million, up 35% from the 20DMA.

Our buybacks desk remains highly active as we approach the final open trading window of the year, which closes on December 19. Last week’s buyback volumes were 1.8x 2024 YTD ADTV and 2.0x 2023 YTD ADTV, with activity concentrated in financials, tech, and consumer discretionary sectors. Although some tapering is expected in the next two weeks due to corporate blackout periods ahead of Q4 earnings, desk activity remains relatively robust compared to prior years.

Flows Update:

- Overall activity levels are moderate, rated 3 out of 10, with the floor tilting 1% better to buy.

- Long-only investors (LOs) are skewed towards selling, with supply concentrated in communication services and information technology, while demand is stronger in energy and financials.

- Hedge funds (HFs) are 1.7% better to buy, with demand led by information technology and consumer discretionary, offset by supply in communication services.

Stocks with significant exposure to middle-income consumers are expected to outperform in the coming months. These companies present an attractive opportunity due to their discounted valuations and anticipated revenue growth in early 2026. Exhibit 12 highlights 39 Consumer Discretionary stocks identified by our equity analysts, including 9 Restaurants, 19 Discretionary Retail firms, and 11 Leisure & Hospitality companies.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!