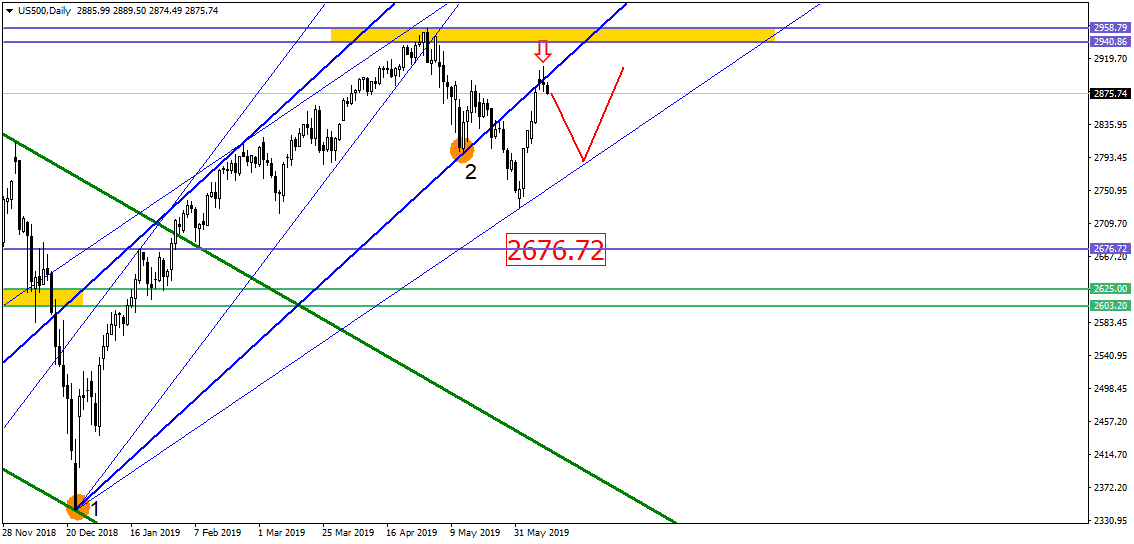

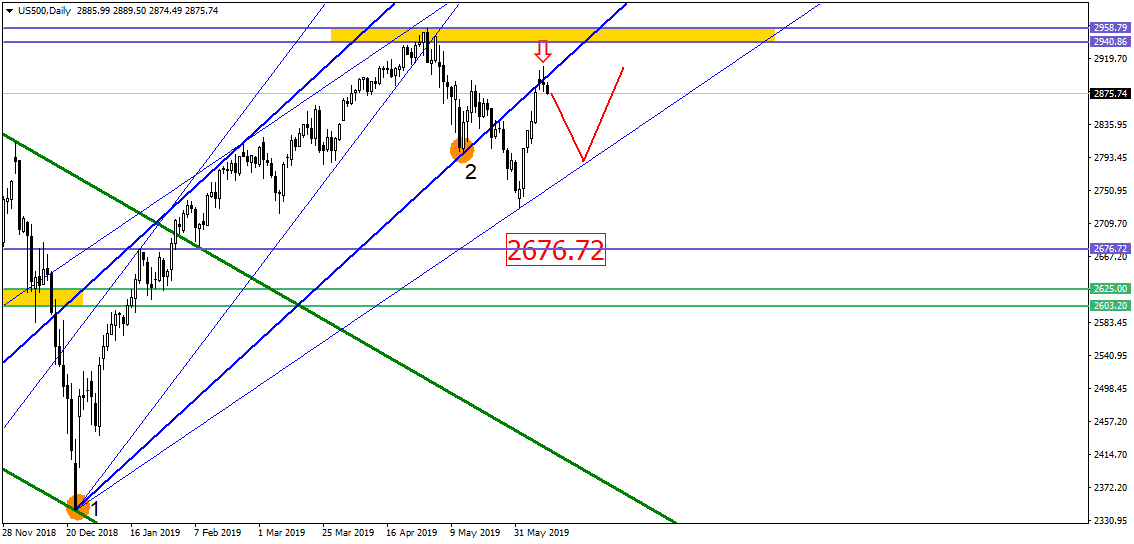

Could the S&P500 potentially fall?!

Good day!

The rates of American stock index S&P500 pulled back from the broken uptrend and slowly reversed down, targeting one more uptrend located below. All in all, the index has the potential to drop:

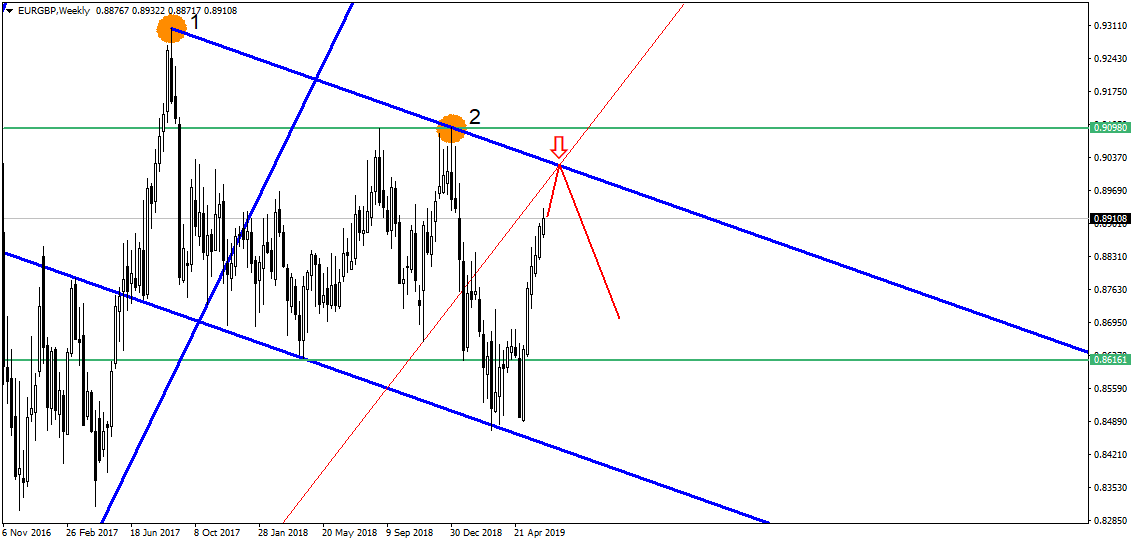

The cross rate of EUR/GBP is approaching a very strong weekly downtrend; therefore this currency pair could potentially pull back down from the downtrend. Let’s observe the candlestick formations happening next to the downtrend to see the developments soon:

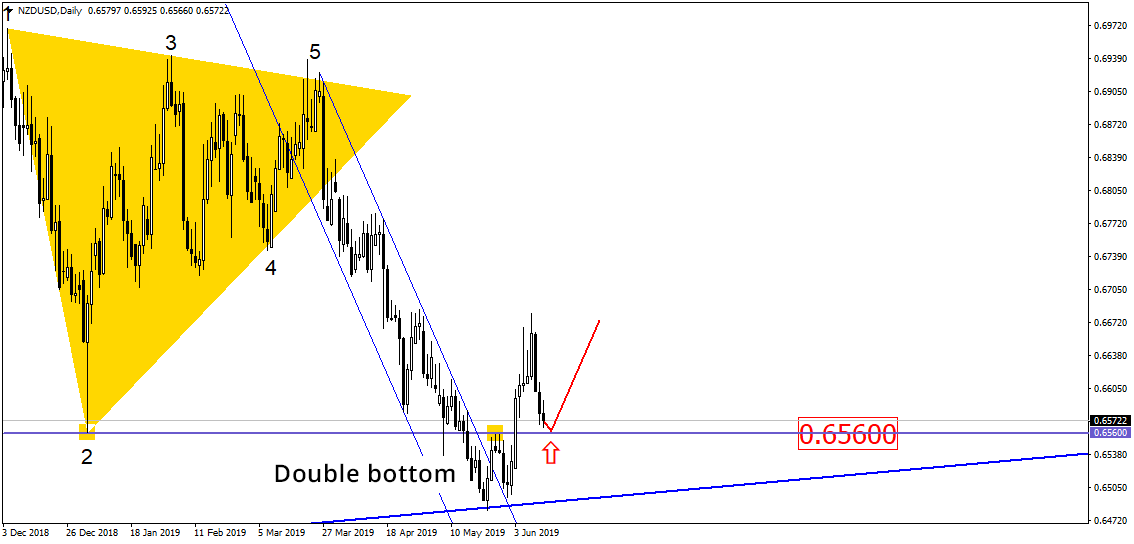

The New Zealand currency nicely worked through the broken local downtrend. Now, the asset’s rate reached back to the broken neckline of double bottom, that is, the 0.6560 level. It’s noteworthy that the double bottom is touching the weekly uptrend and could strongly support the kiwi. In general, the currency pair could potentially jump from the 0.6560 level:

Let us remind you that this material is provided for informative purposes only and cannot be considered as a direct go ahead to implement transactions in the financial markets. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.