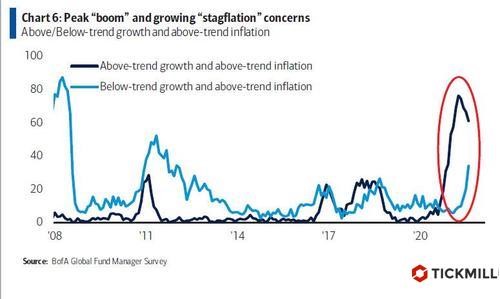

Stagflation may Soon Become the Biggest Worry for Financial Markets

Worries about so-called stagflation - a combination of lowgrowth and high inflation - continue to mount among asset managers, the latestBofA report shows. In the last survey, the share of respondents who believethat both inflation and economic growth will be above the long-term trend forsome time has decreased, but the share of managers who believe that the globaleconomy will face a combination of high inflation and weak growth rates rose:

In financial markets, these fears are mainly reflected by the flight from longer maturity bonds, which are more sensitive to changes in inflation rates. If, until recently, the United States stood out among the leading economies with this trend, which incidentally supported the dollar, then the rate of sell-off has recently increased as well in the sovereign debt markets of the Eurozone, Great Britain, Switzerland, Japan and other countries with low interest rates.

The source of inflation remains the slow adjustment of supply, coupled with fiscally stimulated demand, as evidenced by the decline in delivery times index and the jump in the indexes of input prices and new orders in the global PMI:

Signs of bond sell-offs extended this week, and the upcoming meetings of the Bank of Canada, the ECB and the Bank of Japan will be viewed in the context of central banks' responses to inflation challenges. Rate hikes are not on the agenda, however, central banks' expectations regarding persistence of inflation and its forecast for the next year are likely to cause volatility in EUR, JPY, CAD.

The ECB seems to be reluctant to make or communicate about any possible tweaks in policy in the near-term. As chief economist Lane recently stated, despite rising price pressures, service sector price increases and wage growth remain weak, so raising rates could simply disrupt economic growth. Christine Lagarde has about the same opinion. Despite this, the bond market prices in one 10bp rate hike by the end of 2022. If the ECB insists on a cautious approach, these expectations are subject to correction, which will have a negative impact on the euro.

At its meeting on Wednesday, the Bank of Canada may announce a new cut in the quantitative easing program. The September employment dynamics allowed the latter to reach the pre-crisis level. The forecast for further cuts in stimulus by the central bank will have an impact on the CAD, however, given the monthly weakening of inflation in August and September, the central bank may prefer to refrain from hawkish comments. The net effect for CAD can also be negative with the following technical scenario for the USDCAD pair:

In turn, the Bank of Japan is even further away from theinflation target. In September, it hit only 0.2% YoY and is far from the 2%target. Therefore, the Bank of Japan has the least incentive to do anything in thepolicy. Considering the technical picture of USDJPY, it can be noted that thecorrection, after reaching the maximums since 2018 (level 114.50), may come toan end, as the price approached the lower border of the trend channel, fromwhere support is expected:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.