Stalemate in Fiscal Talks, Growing Slack in eco Data put a dent in Equities Rally

US equities were unable to develop positive start of Thursday session and bulls ceded ground to sellers later. There may be growing conviction in the market that US lawmakers (both the Fed and Congress) will not be able to enact monetary or fiscal support before the US presidential elections. This is a negative scenario for equity markets which reinforces the case for consolidation.

Yesterday I wrote that the GOP wanted to adopt skinny fiscal package - in the amount of only $300 billion. The vote on it was scheduled for Thursday. The vote failed and it looks like that the talks headed for a dead end.

A break below 3300 points in SPX early in the session today may set persistent corrective tone for risky assets extending for the rest of the session. However, rising US index futures indicate that breaking support won’t be an easy task.

In the economic calendar, the focus is on the US CPI release for August. Core inflation is expected at 1.6%, and the market will be more sensitive to negative deviations from the forecast than positive ones. Market response to accelerating inflation is limited by the Fed's new "patient" inflationary stance (FAIT). Slowing inflation in the US is critical for sentiment, since nothing can be opposed to it yet due to the stalemate in fiscal negotiations. Yesterday's PPI release which beat estimates indicates that inflation pressure could rise in the prices of consumer goods as well.

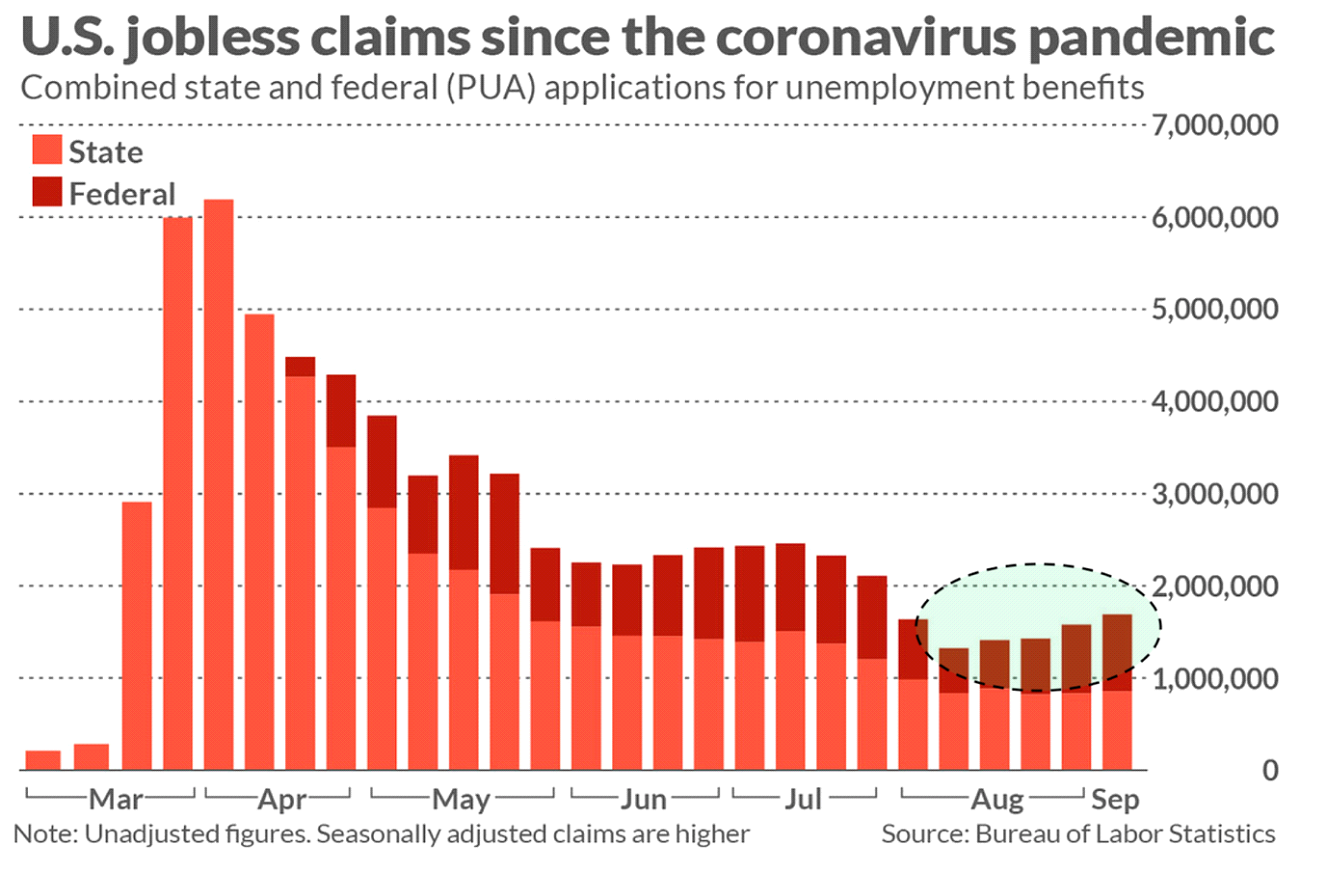

The report on unemployment claims in the US released on Thursday was a blow to market optimism. The number of unemployed increased for the fourth consecutive week. This is a subtle signal that slack in economic activity is growing in the US.

Key points from the September ECB meeting

Earlier in this week I wrote that the chance for the resumption of EURUSD rally is high, since the ECB cannot stop the growth of the Euro with any specific measures. This statement can be strengthened by considering key meeting takeaways:

- The ECB's response to the Fed's new inflation targeting concept is in the works, so the euro could not get anything out of it;

- Inflation forecasts for 2020, 2021 are unexpectedly revised upwards - the ECB's bias to ease policy becomes lower;

- The ECB is closely monitoring the exchange rate of the euro and believes that the expensive euro slows inflation. However, targeting of Euro exchange rate is not included in monetary policy objectives. This is the verbal intervention that we talked about, and which did not make an impression on the euro. The base scenario for EURUSD, despite the growing chances of the dollar bullish pullback in the next two weeks, is continue rally towards 1.25 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.