StarWars Pin-Bars

Much to Learn You Still Have... Let Our Pin-Bars Guide Help You Feel the Force.

Contents:

- Introduction

- The Power of the Pin Bar

- Pin Bars at Key Fibonacci Levels

- Pin Bars with Support & Resistance

- Pin Bars with Trend Lines

- Reverse Pin Bar

- Conclusion

"In a dark place we find ourselves, and a little more knowledge lights out way." - Yoda

Introduction

The costumes might not be as fancy, and Harrison Ford has yet to make an appearance, but the battle between bulls and bears is just as real and exciting as the battle between the Jedi knights and the Stormtroopers.

In this battle, it’s important to be equipped with the knowledge needed to succeed. While the Jedi had Yoda to dispense wisdom and prepare them for battle, you luckily have Tickmill. With that in mind, in this article, we’re going to take a look at 4 pin bar setups that you can use right away to start battling the markets and claiming pips.

Read on young Skywalker.

The Power of the Pin Bar

The Jedi had their lightsabres to do battle with and similarly, we have our trusty pin bar to help us defeat the forces of evil in the market. Here’s a quick breakdown for those of you unfamiliar with pin bars. By the way, if you already have the scoop on them, feel free to jump ahead!

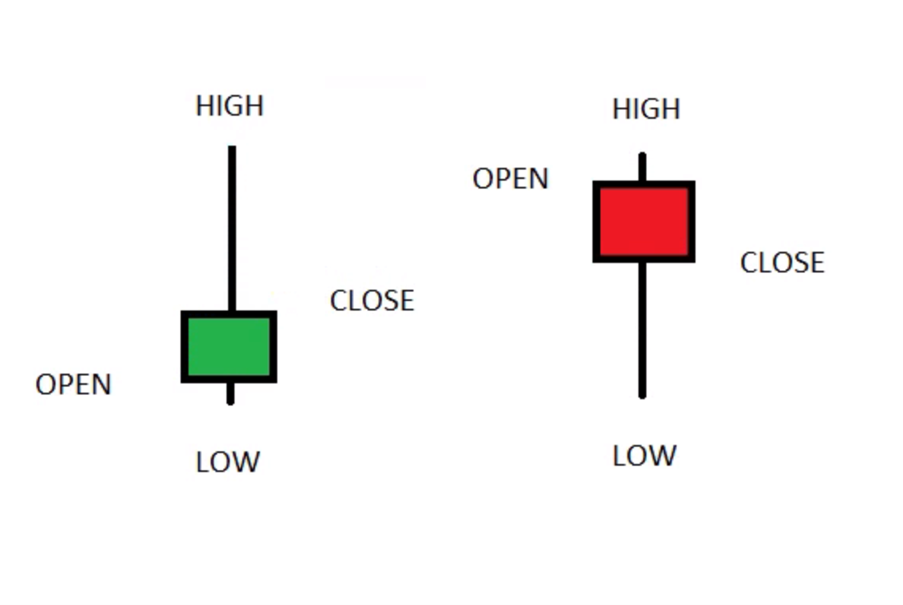

So, a pin bar is a candlestick with a long tail and a short body, which I guess looks a little like a lightsabre... Kind of.

The candle also represents a snippet of time in the market. Essentially, the candle tells us there has been a shift in market sentiment.

With a bearish pin bar (shown on the left), the long tail and small body at the bottom tells us that buyers were in control initially, driving price higher, before sellers overpowered them, driving price lower to close at the bottom of the candle. This shift in sentiment tells us that a reversal lower is likely coming.

In the same way, with a bullish pin bar (shown on right) we know that sellers were in control initially, driving price lower, before buyers overpowered them and drove price higher to close in the top of the candle. This shift in sentiment tells us that a reversal higher is likely coming.

So, now you’ve been armed with the lightsabre. Sorry, pin bar! Let’s take a look at the 4 Pin Bar setups you need to know about.

1 – Pin Bars at Key Fibonacci Levels

The Fibonacci retracement tool is a fantastic technical tool that all traders should be using. The tool helps us measure any move in price and automatically plots key retracement points on our chart based on the Fibonacci sequence principles. These retracement points often serve as key price pivots and can be a powerful way of finding an entry during the correction in a trending market.

Now, although the Fibonacci retracement tool is a fantastic tool for helping us find potential trade locations, the issue is that we still don’t know at which level to trade. Price might blow through the level or it might reverse, so if we just try and trade every level, we’re unlikely to come off too well. This is where the pin bar comes in handy!

"Difficult to see. Always in motion is the future." - Yoda

Knowing what the pin bar tells us about a shift in market sentiment and the likelihood of a reversal occurring, it makes sense that if we wait to identify a pin bar at a key Fibonacci level, we stand a much better chance of having a successful strategic move at that level, right? Yes, young Skywalker, now you are learning!

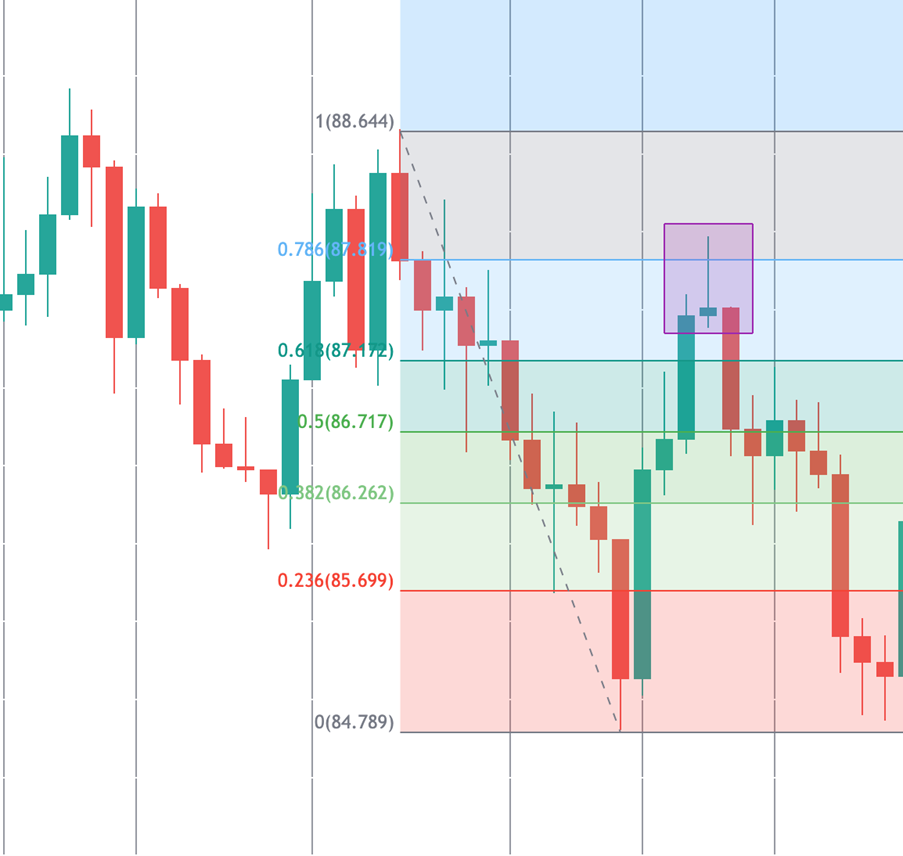

Ok, so, in the image above you can see a great example of how we use this setup and the type of results it can yield. Price has sold off from the second peak in this bearish trend and broken down to make a new low. Price then starts to retrace higher. As it does so, we use our Fibonacci tool, measuring from the peak to the trough of the downswing, to give us our retracement points.

You can see that price blows through each level until it hits the 78.6% level and, that’s where we get our bearish pin bar – our lightsabre! So, knowing what we know about pin bars (that a big shift in sentiment has occurred), we can go ahead and sell as price breaks below the pin, capturing the reversal. Even Yoda would be impressed with this trade!

2 - Pin Bars with Support & Resistance

Now you’ve seen what the pin bar can do, you’re no doubt excited for the next setup. So, this time around we are going to be using our trusty pin bar in conjunction with support and resistance levels. Support and resistance levels are at the very heart of technical analysis and among the foundation of any good technical trader’s toolkit.

Support and resistance levels are horizontal lines that traders plot on our charts marking highs and lows to identify support and resistance in the market. Support levels are marked by joining swing lows and show us where there has been strong buying interest in the market. So, we can anticipate that if price tests the level again, buyers will take price higher.

Similarly, resistance levels are marked by joining swing highs and show us where there has been strong selling interest in the market. So, we can anticipate that if price tests the level again, sellers will take price lower.

"Your path you must decide." - Yoda

Now, some traders will mark their support and resistance levels and simply take a trade each time price hits the level. However, this is a very risky way to trade and these levels can often catch traders out with volatility as order flow changes. A much more strategic way to trade is to wait for some price action confirmation, and what better way to do this than to use our pin bar! If we use our support and resistance levels to highlight a potential trade area and then wait for a pin bar to form, we know we have a much higher chance of being right with our trade.

So, in the image above you can see a great example of this method at play. We have three big swing lows on the left, all in the same region, which allow us to draw in our support zone. So, once we have our support level marked out, we know that we are looking to buy at this level if price comes back down to test it.

However, we don’t just want to buy at the level in case price just blows straight through. You can see that in the highlighted region price comes down and tests our support zone, even dipping through it slightly (bye-bye everyone who bought at the level!) before reversing sharply and closing as a bullish pin bar.

So, with our bullish pin bar in place at our marked support zone, we now have a strong case for making a trade and can take on the bears, capturing the reversal higher as price breaks out to the topside. Another fine trade young Jedi, the force is growing in you!

3 – Pin Bars with Trend Lines

Ok, we’ve looked at Fibonacci levels and we’ve looked at support and resistance, now it’s time to step up our pin bar game even higher and explore the art of trend line trading. Think of Luke Skywalker on his quest and imagine this is probably the place where the montage music starts playing. Anyway, back to trend lines.

Trend lines work much in the same way as horizontal support and resistance levels, where we are simply connecting lows and highs. However, trend lines are a little different because we’re drawing in diagonal lines to connecting rising lows, for a bullish trend line. Or lower highs, for a bearish trend line. Trend lines are therefore a great way of not just helping us understand whether the market is in a trend (and if so, in which direction?) but also a great way of finding locations to trade.

"When you look at the dark side, careful you must be. For the dark side looks back." - Yoda

So, in the same way as with our horizontal support and resistance levels, once we have identified our trend line, we are then looking to trade subsequent test of that trend line. However, because we know that just like the Dark Empire, the market can be full of tricks, we are always looking to improve our chances when taking a trade. So again, we are looking to find a bullish bar at a bullish trend line, to take a buy trade or a bearish pin bar at a bearish trend line to take a sell trade.

Ok, so, in the image above you can see that we have identified our bearish trend line by connecting the initial swing high in the series, with a secondary, lower high to give us our line. We then look to monitor price if it tests the line as we know this is a potential sell zone because the bearish trend line can act as resistance.

In the highlighted region you can see that price tests the trend line and forms a big, bearish pin bar, giving us our entry signal. So, with our bearish pin bar at the bearish trend line we can then go ahead and place a sell trade as price reverses lower from the entry candle. Another, crafty way to use our pin bar!

4 – Reverse Pin Bar

Ok young Jedi, we’ve walked through Fibonacci levels, we’ve looked at support and resistance and we’ve looked at trend lines. Your journey is almost complete. However, just like a good Jedi must become proficient in using their lightsabre with skill, a good technical trader must also develop their pin bar skills. Now, granted, we can’t do 99% of the cool tricks that Jedi Knights can do, however there is one thing we can do with a pin bar; turn it upside down.

"You can't stop the change, any more than you can stop the suns from setting." - Shmi Skywalker

So far, we have looked at the pin bar in terms of trading reversals, however it can also be incredibly useful in trading continuations. Knowing the shift in sentiment which occurs during a pin bar, one slightly more advanced way to use them is to trade reverse pin bars during breakouts.

So, looking at this image you can see that we have our resistance level marked but as price trades up to test the level it simply blows straight through. So, this would be a classic breakout trade; trading a break above a resistance level. Now in terms of how to enter such a trade, pin bar traders have a secret trick up their sleeves; the reverse pin bar.

You can see in the highlighted region that as price breaks out, what would typically be a bullish pin bar forms. However, we would usually look to trade such a pin bar at support level or a Fibonacci level or a trend line as we’ve looked at so far. However, knowing what the pin bar is telling us about a shift in sentiment, we can employ this knowledge during breakouts even though it hasn’t formed at a technical level.

Let’s think about what has actually happened during the creation of the pin bar. So, we’ve had our big break of the resistance level with two bullish candles but then during the pin bar we know that sellers were in control initially, taking price lower, before buyers overpowered them at the low and drove price higher. So, when you think of it like that, we can actually look at this pin bar as a mini correction within the trend signalling that price is going to continue higher. This is a very clever way of using these candles and can help you gain entry in fast moving breakouts which might otherwise seem difficult to gain entry to!

Conclusion

So, there you have it, young Skywalker; 4 pin bar setups to help you take on the markets whether you are looking to buy or sell. As with all technical setups, the more time you spend studying the charts and practising identifying these setups, the better you will become at trading them. So, with that in mind, once you’ve finished watching the Star Wars saga today, and start using your pin bar! Remember when trading to always use a stop loss to protect yourself against adverse market conditions and always aim for positive risk-reward with your trades. And most of all, may the force be with you!

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.