Stocks Retreat After the Fed is Likely Temporary and Here is Why

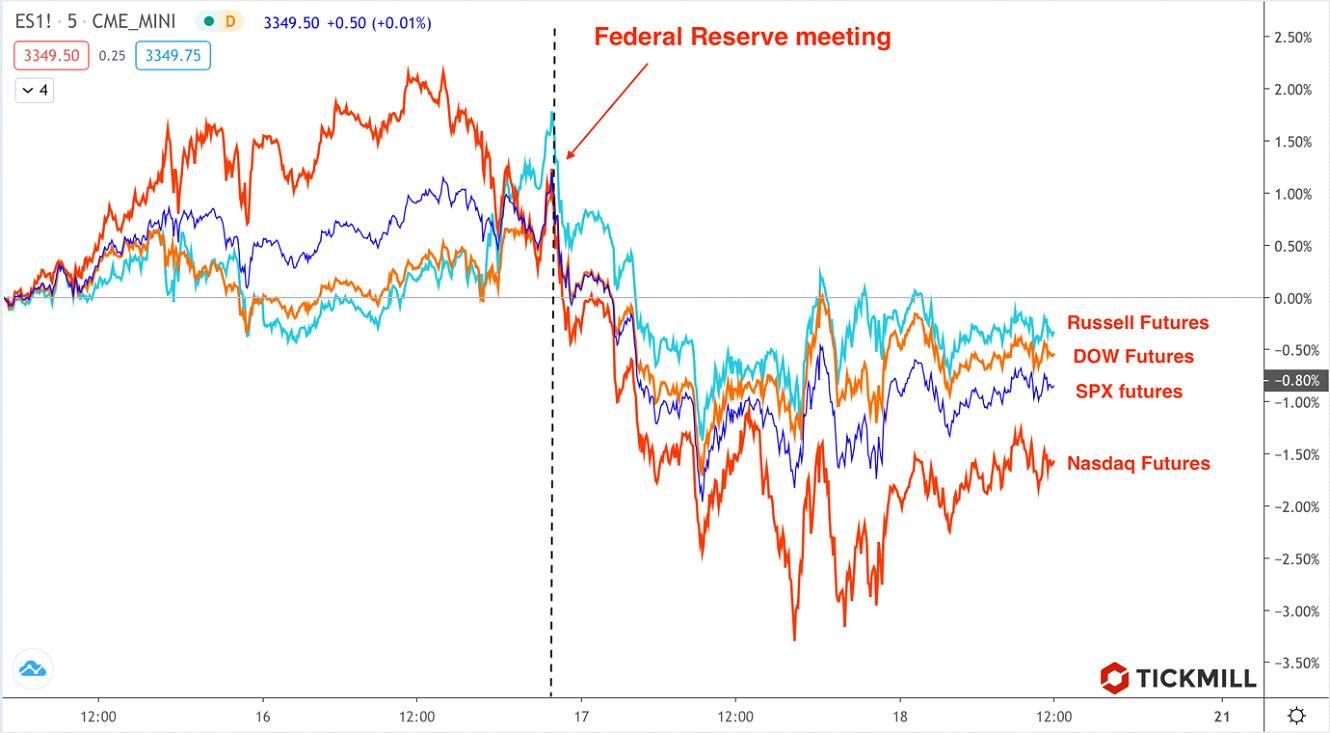

US futures appear to be freezing with indecision as chances are slimming to obtain bullish catalysts from the US eco data or the Fed policy. The US central bank was pretty transparent at signaling that although the interest rate is expected to stay near zero until the end of 2023, there is enough liquidity in the banking sector and credit market spreads are tight enough, so the bar for deeper monetary stimulus is high. Basically, this was the change in expectations which induced decline in equities. NASDAQ declined more actively than others after the Fed meeting:

However, the frustration, in my opinion, should be short-term. In the long term, the update from the Fed (zero rates extended to 2023) should contribute to the development of a trend that was before the meeting - rising appeal of stocks relative to bonds (risk assets vs. safe assets). “Lower for longer” Fed message basically implies it will take longer for bondholders to reap returns.

Key macro data updates

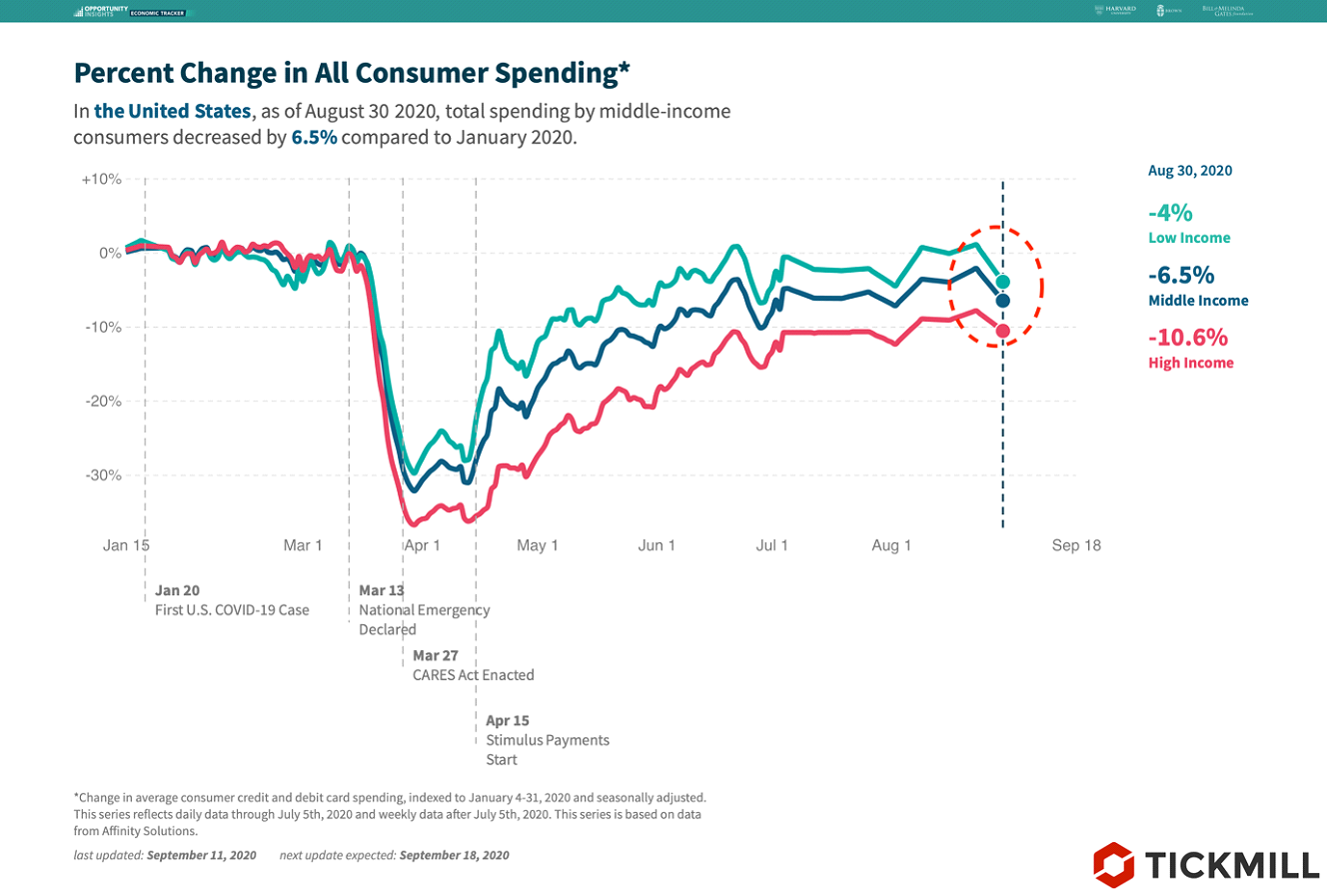

US retail sales for August was a shot of harsh reality into somewhat carefree markets. Broad sales fell short of the forecast, control group MoM sales growth was negative. Downward revision of July reading also hurt sentiments. Recall that retail sales account for about half of consumer outlays in the United States, which means that retail sales are a good proxy of economic growth, so the market should be receptive to them.

Total consumer spending started to decline in the last week of August and remains on average 6.5% below January 2020:

Total consumer spending started to decline in the last week of August and remains on average 6.5% below January 2020:

Общие потребительские расходы перешли в снижение на последней неделе августа и остаются в среднем на 6.5% ниже января 2020:

Finding optimism to rally further becomes more and more difficult.

Initial claims for unemployment benefits were slightly worse than expected, continuing claims were better than expected. Revised readings for prior week often deviate from initial estimates, so we look at 4-week average. It continued to move in a positive direction (from 973K to 912K). Still no bearish hint from the labor market side.

The case in favor of interim market consolidation, which I proposed last week, in my opinion, is strengthening. Considering the SPX, a break below is likely on increasing general uncertainty in the V-shaped rebound story, which is supported by a clear technical figure - an ascending triangle:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.