Strong Job Growth and Low Unemployment Shift Expectations for CPI Upside

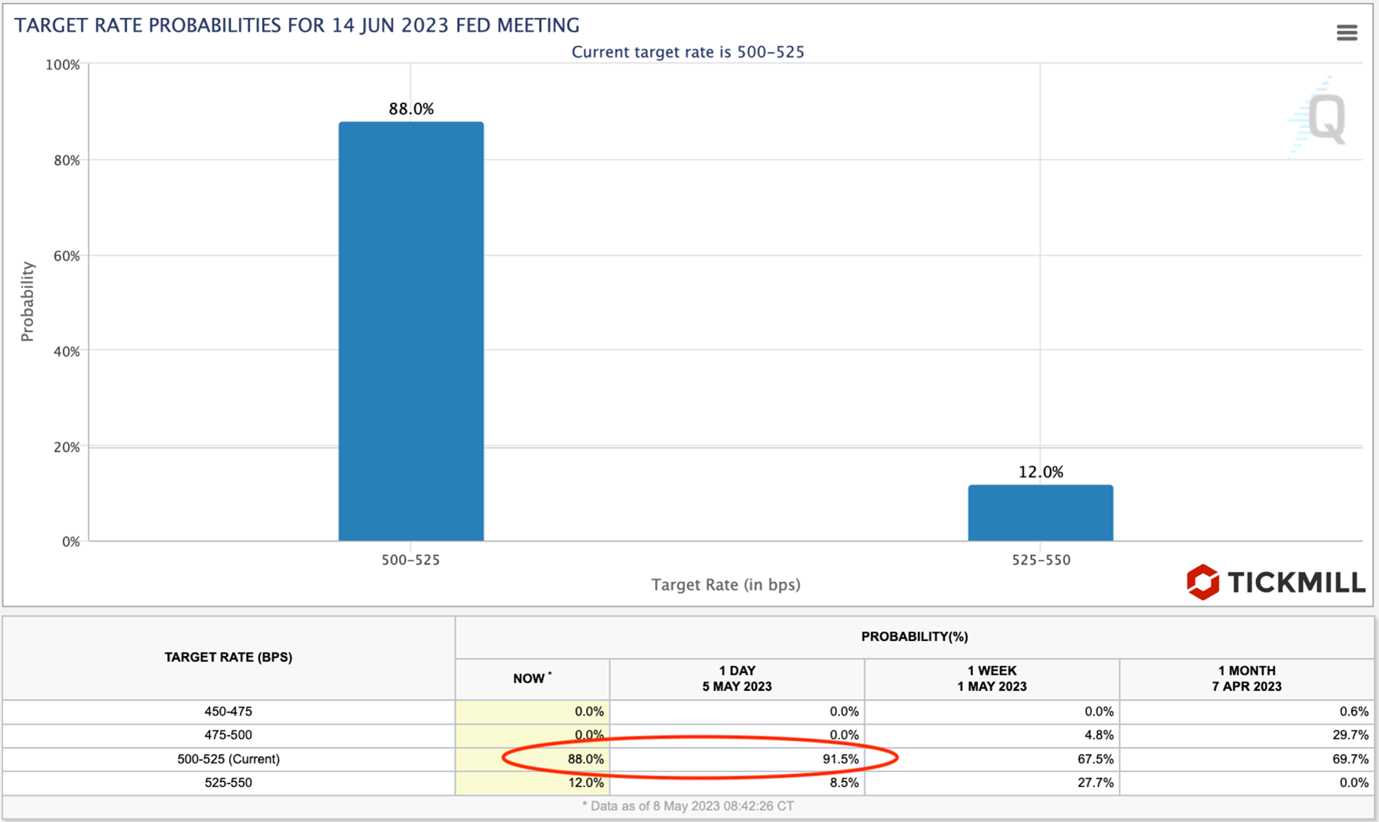

US equities wrapped up last week on a positive note, with key indexes gaining an average of 1.9%. The unemployment report pleased the hawks: job growth in the US economy surpassed expectations by over 70K (+253K), wages saw a 0.5% increase (forecasted at 0.3%), and the unemployment rate hit a new low (3.4%). The only negative aspect was the downward revision of job growth for the previous two months by a significant 149K. Wage growth and unemployment dynamics have once again brought attention to inflation risks in the economy, indicating a potential underestimation of expected inflation. However, market rates reacted modestly, with a 6 basis point increase in the 10-year Treasury and a 10 basis point increase in the 2-year Treasury. The chances of another 25 basis point rate hike at the next meeting have risen from 8.5% to 12%:

Clearly, the Federal Reserve sounded quite convincing in its intention to pause in June, and only extraordinary improvements in the data could prompt a change in communication from the central bank. Hence, the assessed chances are low.

The US dollar index rebounded by 0.3% after the release, but subsequently lost its advantage and on Monday is once again hovering around the 101 level:

Another important report from last Friday was the increase in consumer credit in the US. The figures are positive once again, with a growth of +26.5 billion (forecasted at 16.5 billion). The data indicates strong consumer demand in March, which was also evident in the first quarter GDP data, where the component of consumer demand stood out.

On Friday, there was also a speech by a representative of the Federal Reserve, Bullard. According to his baseline scenario, the US economy can expect slow growth and declining inflation, but not a recession. He also stated that despite the interest rate being above 5%, inflation in the economy is still high, suggesting that rate hikes may continue.

This week, the main focus will be on the US CPI for April (scheduled for release on Wednesday) and the University of Michigan Consumer Sentiment Index (release on Friday). Considering the strong NFP for April in terms of unemployment and inflation, the risks for CPI lean towards exceeding expectations, meaning that core inflation could be above 5.5%. A retest of the lower boundary of the uptrend channel for EURUSD is expected, with a challenge to support at 1.0950, as shown in the chart below:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.