Summer Lack of Volatility Fuels Demand for Risk

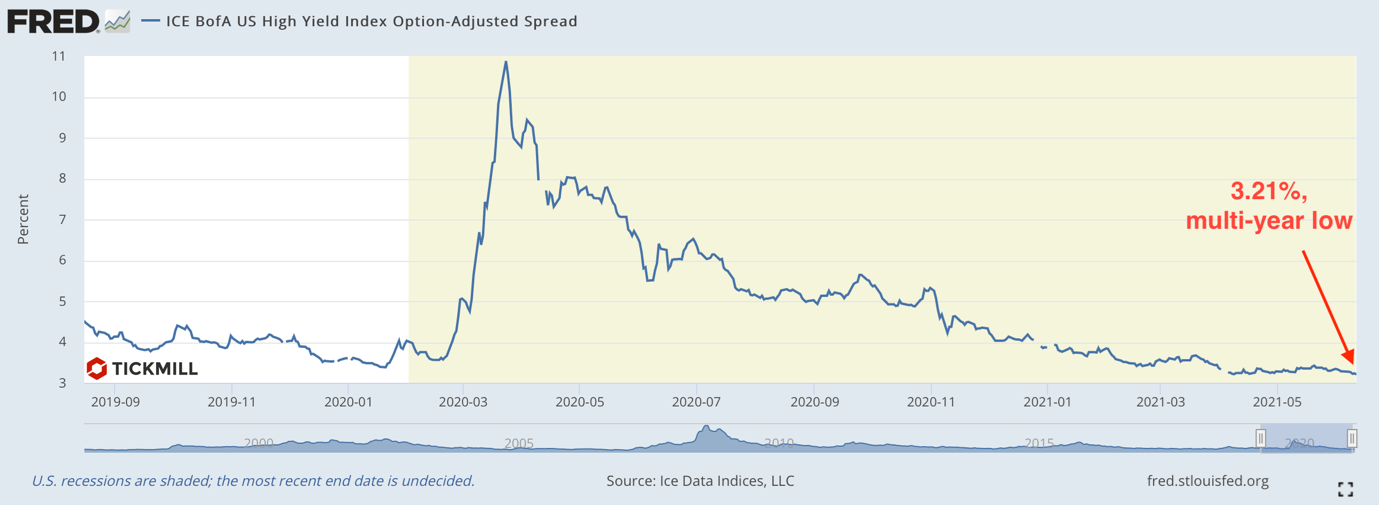

The day of the Fed meeting nears and financial markets prefer to remain in a wait and see position. Low volatility becomes even lower, which is noticeable by intraday fluctuations of major currency pairs. The dollar index seems to have found equilibrium around 90.50 points, while stocks and oil are trading around Tuesday's opening. Nevertheless, demand for risk strengthened. This can be seen from the sharp sell-off in gold on Monday, weakening of the Japanese yen, which are traditionally considered safe-heavens, and further tightening of the spread between investment-grade and junk bond yields:

After the weak uptrend in May, the spread began to shrink again and now stands at multi-year low of 3.21%. As the spread narrows, investors' preference for high-yield risky bonds over safe, lower-yield bonds, grows.

After a short pause, the ruble went on the offensive in accordance with the idea described earlier. USDRUB is trading below 72 rubles per dollar.

Despite the established lull, there are potential sources of volatility today. Chief among them is the US retail sales report. A 0.8% monthly decrease in sales is expected due slowing growth in car sales, as well as due to the fact that the share of expenses for services, travel, etc., which is not included in retail sales, are gradually recovering. That is, the decline may more reflect shifts inside spending. Therefore, if expectations are not met, it’s unlikely to cause a strong negative market reaction. However, a positive surprise in retail sales is likely to spur the corrective rally of USD as the market is clearly biased to expect the Fed to announce plans to start discussing reduction in the asset purchase program tomorrow, and the good data will be an additional argument for that.

It is also worth paying attention to the data on industrial production and PPI in the US, which are unlikely to cause immediate market reaction, but will be useful to clarify the overall picture of the US economic recovery.

The British government has postponed the date of complete lifting of restrictions, which significantly weakened the pound. GBPUSD dived below 1.41 and feels noticeably weaker than the rest of the G10 currencies. Nevertheless, the reaction is more like an emotional sell-off, as even with the current constraints, the economy is recovering faster than expected. Data on jobless claims for May, which were released today, showed that the number of unemployed is falling faster than expected. The pressure on the pound as a result of the news is likely to be limited in time and GBPUSD will probably be able to move to growth after the Fed meeting.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.