The Big Surprise in US Retail Sales is a Negative Event for the USD

The minutes of the Fed meeting brought relief to equity investors as the US Central Bank made it clear that it acknowledges the fact that inflation is accelerating, but is not going to suppress it by easing QE, what could harm risk assets. Before the release of the Minutes factor of risk for stock markets was the uncertainty associated with what the Fed thinks about clear signs of inflation in the US both in the financial market (in the form of an increase in inflation premium in bonds) and in certain consumption segments like housing market where prices have been rising with the fastest pace in 30 years. The Fed discounted substantial inflation pressure in house prices, signaling that it does not see overheating in the market.

The US retail sales report for January came as a big surprise for investors, as it indicated growth of the key component of consumer spending by 5.3% against the forecast of 1.1%. Earlier, I wrote that consensus about the retail sales reading tends to underestimate growth, since in early January, American households received stimulus checks from the government, the stimulating effect of which was difficult to calculate. Gold fell on the report, while the dollar rose.

The Fed's stance in monetary policy implies that it isn’t going to tamper growth of long-maturity bond yields. It means that the outflows from Treasury market may continue to fuel demand for the US currency. However, strong growth in retail sales is a clear signal that the world's largest economy is growing well, which means that the theme of yield hunting remains valid. This has negative implications for the USD.

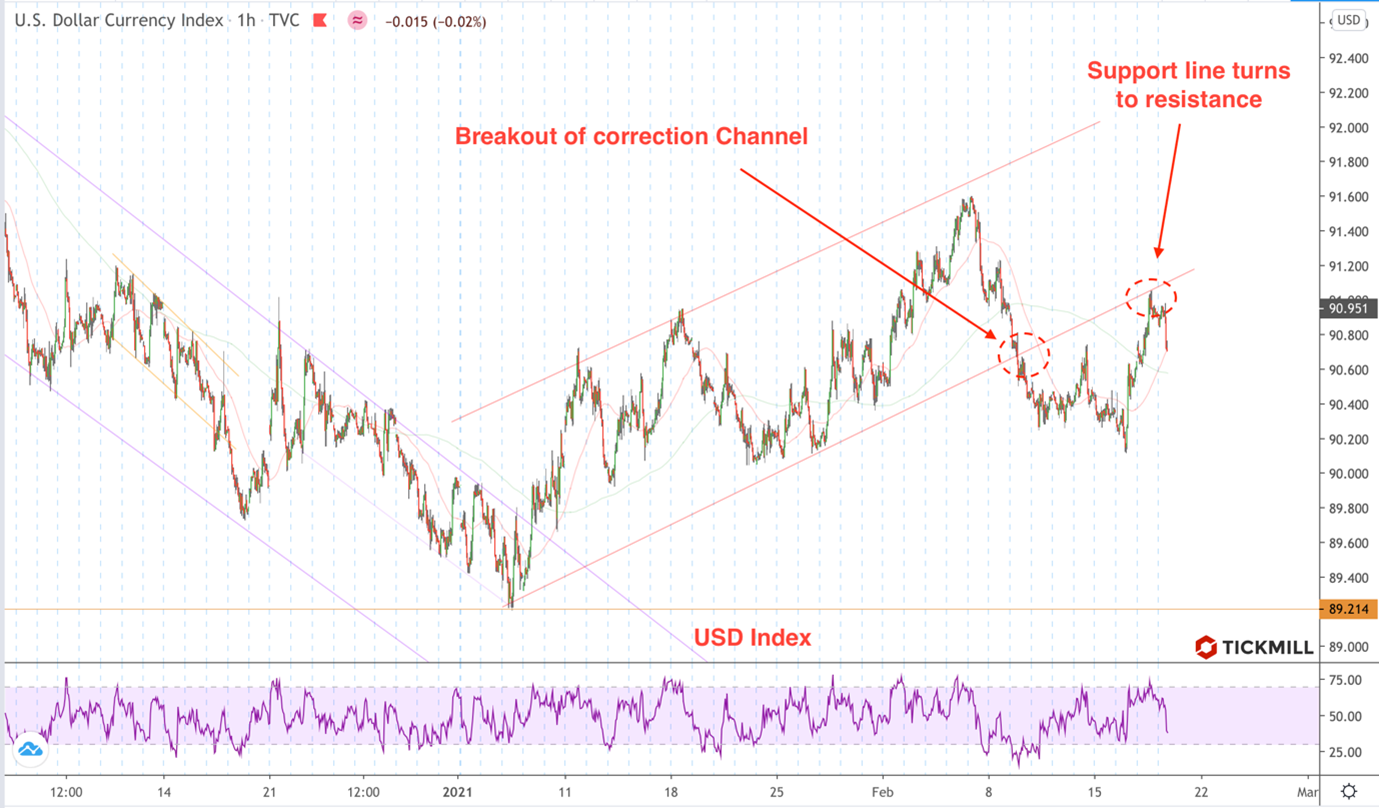

The technical picture for USD is as following:

After rising to 1.30%, the yield on the 10-year Treasuries show signs of stabilization. Stock index futures in the US are trading in moderately negative area, so all in all the demand or USD today gradually weakens. EURUSD is likely to consolidate in the 1.20-1.21 channel with a probable test of the 1.21 level. Lack of progress on vaccination pace in Europe is the main obstacle to appreciation of the European currency. As soon as the situation in this direction starts to improve, the European currency should be able to resume strengthening against the USD.

Regarding GBPUSD, we also see a moderate correction after flirting with vicinities of 1.40 level. The forecast for the British economy is being consistently revised, in addition, the Brexit risks are in the past. Therefore, the Pound is returning to its fundamental value and the test of the 1.40 level, in my opinion, is only a matter of time.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 75% and 65% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.