The Dollar Still has Chances to Rise this Week

The week began with a broad greenback retreat, but with varying intensity, from weak to moderate. Industrial output and retail sales in China slowed less than expected, dampening risk aversion somewhat on fears of a slowdown in the Chinese economy.

Despite the weak dollar at the beginning of the week, there is potential for strengthening, especially in light of the Fed's as yet unclear reaction to the strong positive inflation shock in October. There is a risk that the Fed may respond by accelerating the pace of the QE rollback or bringing the rate hike closer. Among the reports for the United States, it is worth paying attention to October retail sales and industrial output.

The Fed's speech calendar this week includes Williams, Evans, Bostic and Clarida. Investors are waiting for their reaction to the controversial inflation report, which may well lead to a rise in the US currency, as inflation becomes more difficult to deny.

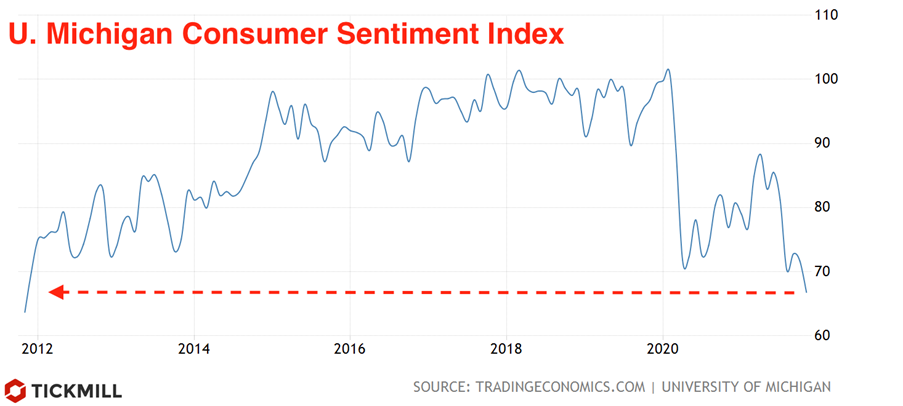

The cost of living in the United States is growing rapidly, so consumer confidence is showing an increasingly depressing trend. The consumer confidence index from W. Michigan fell to 66.8 points, data showed on Friday. This is the minimum since 2011:

However, the relationship between consumer sentiment and spending has been weak over the past few years, and the fall in the index primarily reflects concerns about inflation.

The details of the report showed that only 36% of the surveyed households believe that income will grow faster than inflation over the next 5 years. This share has been steadily declining over the past few months. Most of them felt that now was not the time for high-value purchases such as a home, car, and real estate.

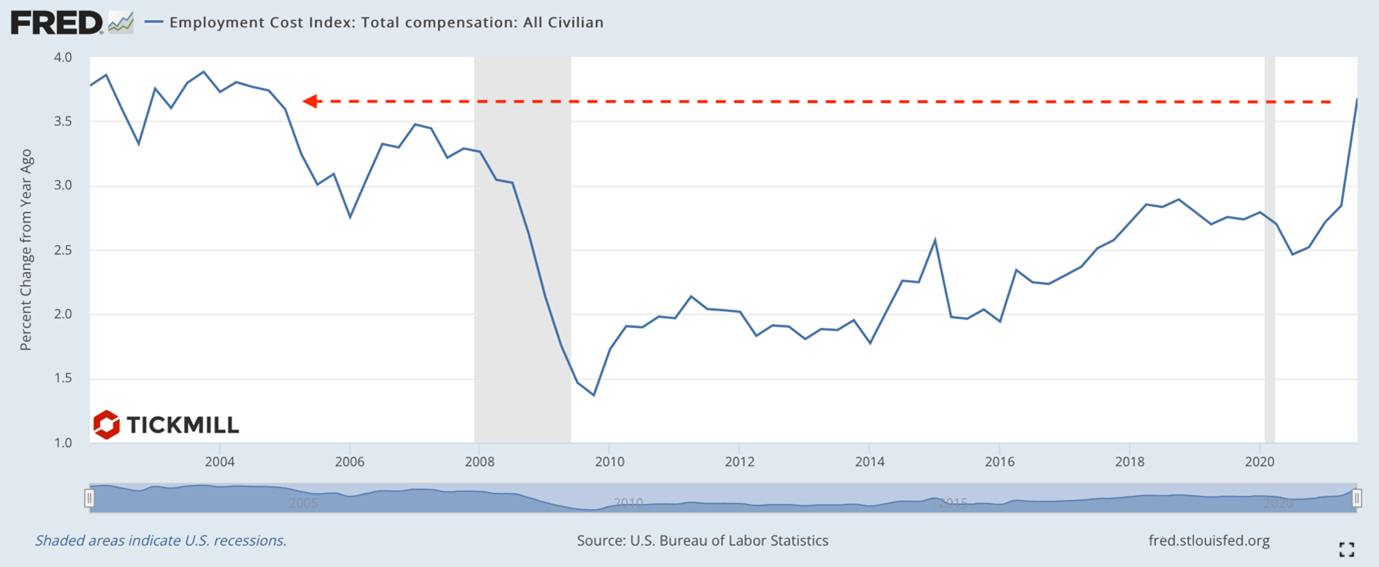

With regard to the JOLTS report on the US labor market, it showed that the share of layoffs rose to 3.4% of the workforce in the private sector, while in the hospitality and entertainment sector it was 6.4%, 4.4% in retail and 3.6% in trade and the sector of passenger transportation. In fact, this is further evidence that companies have to fight for workers by raising wages. This trend is reflected in the Labor Cost Index - which rose to a multi-year high in the third quarter:

At the same time, the NFIB in its latest report pointed to a record number of companies that are going to raise salaries in the coming months.

The number of job openings remains very high at 10.4 million and based on the job growth we saw in October, it will take 20 months to fill these vacancies. Particular attention should be paid to labor “reserves” - if the level of labor force participation continues to recover as slowly as now, the pressure on wages will persist, and therefore the risks of inflation will also remain high.

The third quarter of the Japanese economy was very disappointing, which leaves no chance at all that the Bank of Japan will switch to hawkish rhetoric. GDP contracted by 3% in the third quarter, with a forecast of -0.8%, and investments in fixed assets also suffered a lot, declining by 3.8% (forecast -0.6%). It is clear that firms are reluctant to increase production volumes, or they cannot do so due to shortages of components, supply chain disruptions, high prices for raw materials and labor, etc. USDJPY reacted mildly positively to the data, as with such data it is increasingly difficult for the Bank of Japan to move to lower monetary stimulus level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.