The Dollar Will Likely Extend Gains Next Week. Here is Why.

The unexpected decision of the Bank of England to go against the market consensus and leave interested rate unchanged not only led to Pound collapse, but has also undermined the belief of market participants that Central Banks of leading economies are caving in to rising inflation. Nevertheless, the Fed signaled that it starts to gradually unwind asset purchases and made it clear that the pace of tightening can be adjusted to reflect macroeconomic and financial conditions. It means that there is a way for incoming data for October and November to affect Fed policy stance so market response to the NFP release today shouldn’t be underestimated.

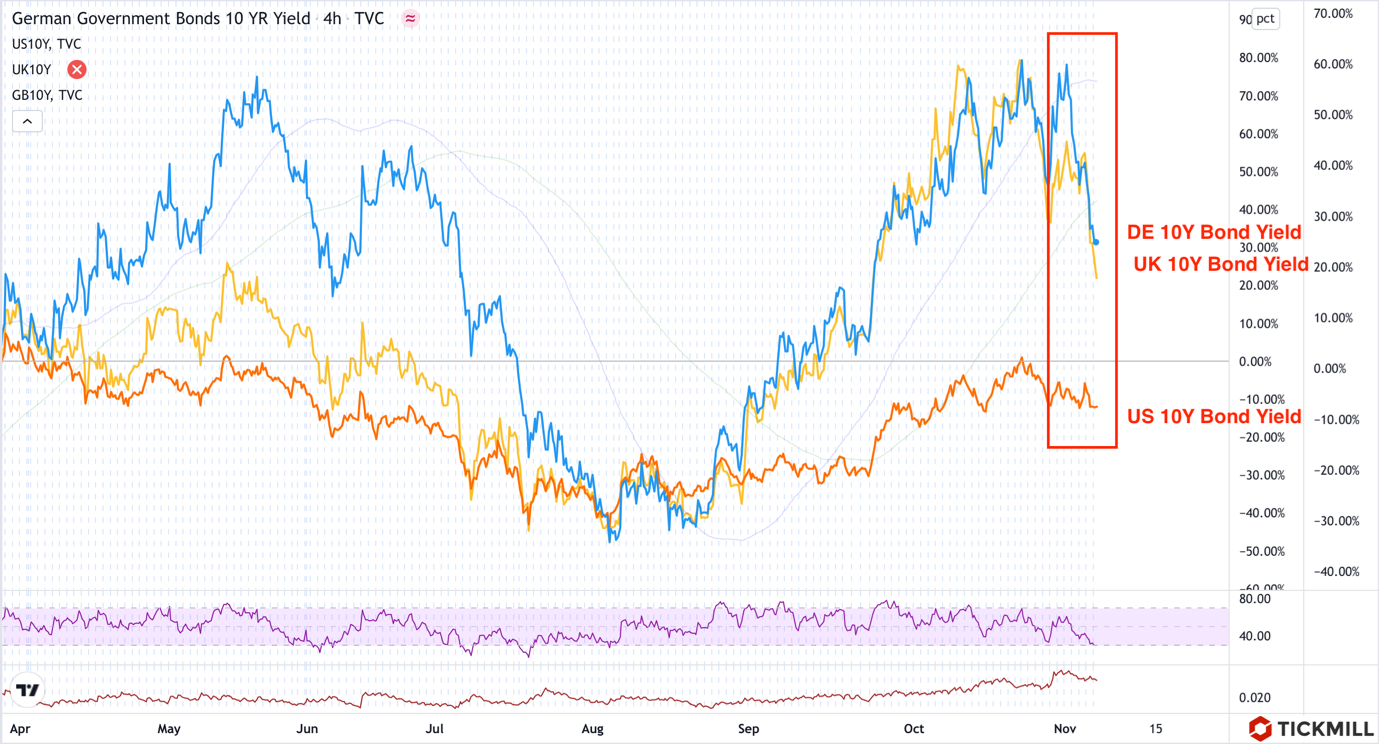

The dollar saw dovish reaction after the Fed meeting although it didn’t last long as already on Thursday the US currency resumed rally. One of the key drivers of this move was the BoE with its bearish surprise, which unexpectedly made the Fed a leader in credit tightening among the leading economies. Recall that inflation, retail sales data, PMI indices as well as relatively hawkish BoE pre-meeting rhetoric (compared to other Central Banks) cemented beliefs that the BoE will hike interest rates in November, which, however, didn’t materialize. The bearish shift of the UK central bank also caused pullback in expectations of rate hikes from less hawkish central banks, including the Bank of Japan and the ECB. This can be seen from dovish repricing of yields of long-dated UK and German Bunds, while the yield of 10-Year US T-Notes remained relatively stable in the same period:

Dovish repricing of sovereign bonds outside of the US helped the US Dollar to quickly pare decline.

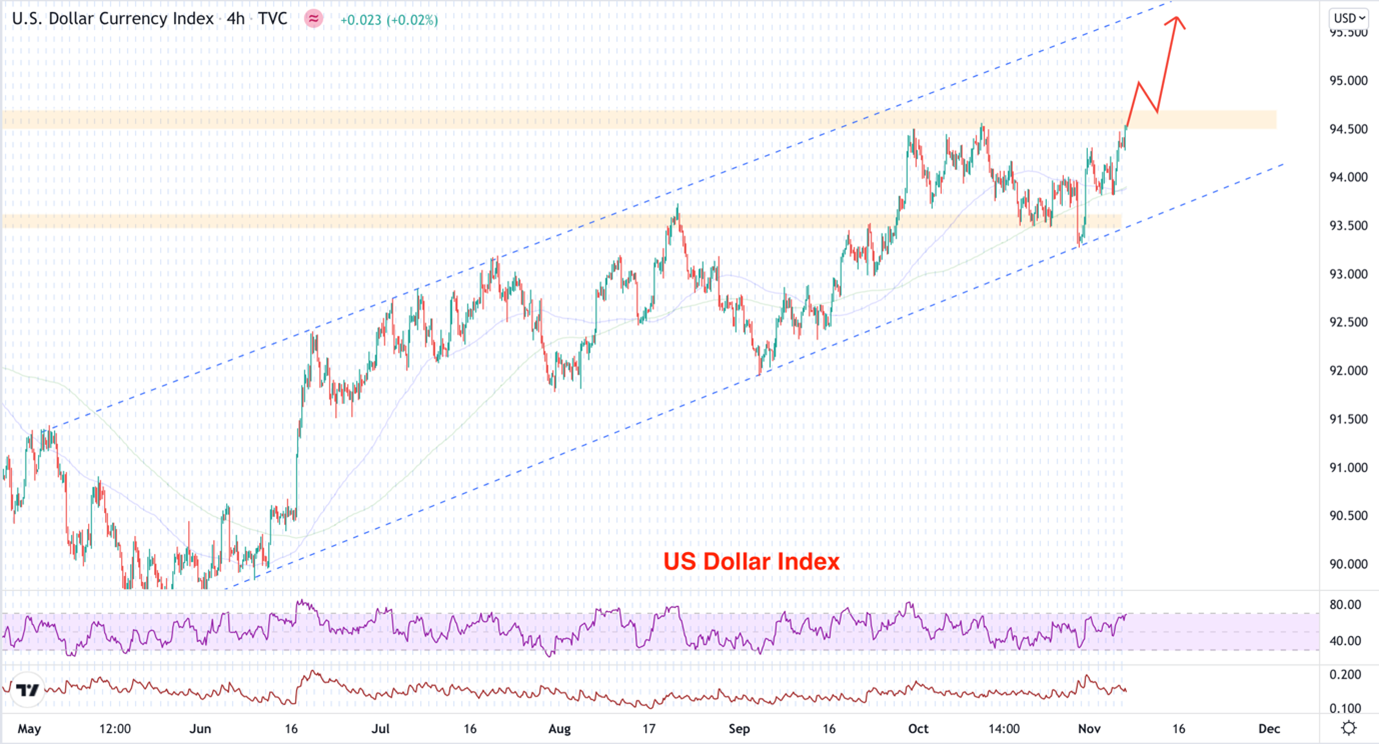

On the technical side, the dollar index is making the third attempt to test the September 2020 high (94.50 level). A breakout above the level may lead to extension of the really towards 95.00 round resistance level, and then, after a bearish pullback, target the upper bound of the current ascending channel (95.50 mark):

The October NFP report could be a potential catalyst for the move. The gain in jobs is expected at 450K, but the risks are skewed towards a higher reading, since the resumption of full-time attendance at schools most likely allowed parents to go to work. Particular focus will be on wages, which growth in annual terms may approach 5%. It is the rise in wages that is now considered by central bank officials as one of the main factors of persistent inflation (to which it is necessary to respond by changing monetary policy). Strong growth in wages is likely to trigger speculation that the pace of QT may be increased, which will strengthen the position of the dollar.

It is also worth recalling that the last two releases, the dollar reacted poorly to the negative surprise from Payrolls, so the risks for the dollar may be asymmetrically biased towards growth after today's release.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.