The Fed is About to Unwind Stimulus, but is the US Economy Ready for it?

Risk assets came under serious pressure at the beginning ofthe week, although the first signs of a sell-off appeared as early as lastFriday. S&P 500 futures were down 1% on Monday, the first support line canbe expected in the 4300-4320 area after a 50-day MA test:

The flight from risk was more pronounced in European equities where major indices erased more than 2%. Hong Kong's Hang Seng fell more than 3% on Monday as China's Evergrande and its huge $300bn debt continue to fuel risk aversion not only in offshore China, but is also beginning to echo in overseas asset markets.

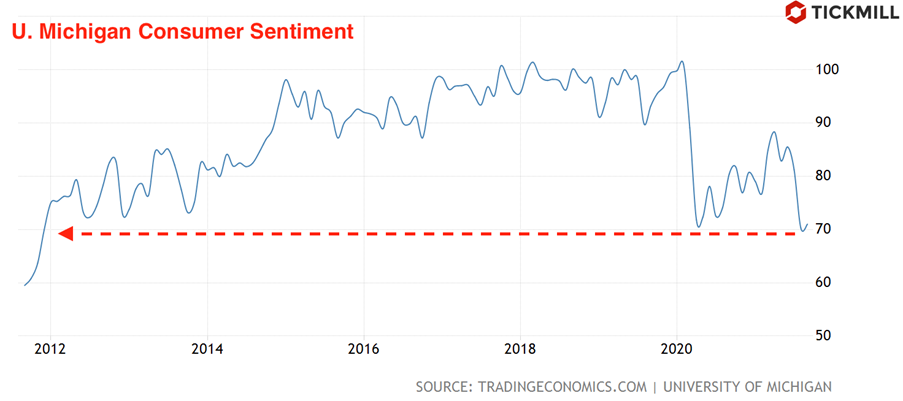

At the heart of risk aversion are investors’ doubts that the Fed picked the right time to signal that it moves to unwinding stimulus. This week the FOMC meeting is due at which the policymakers are expected to clarify the central bank position on QE tapering and interest rate outlook (aka dot plot). The likely shift in monetary policy may come at the time of slowdown in hiring pace and falling consumer expectations. Recall that employment gains in August was three times lower than projections, and consumer expectations, according to the report of U. Michigan, failed to rebound in September after falling to 70 points in August. The index of consumer expectations ticked higher just by 0.7 points, i.e., it remained for the second month in a row at the lowest level in almost 10 years:

At the same time, it was a little strange to see retail sales rebounding by 0.7% August, but let’s make it clear that the survey data of U. Michigan consists primarily of leading indicators, therefore, retail sales may catch up with the decline in consumer expectations in the next months.

And if expectations regarding the start of QE tapering are more or less priced in (respective announcement in November or December), changes in dot plot are far less certain. A number of FOMC members have already signaled that first rate hike could be done in 2022, if we see more peers joining their camp and the median of expectations shifts to 4Q of 2022, then the pressure on risk assets is likely to increase significantly. In addition, we cannot rule out medium-term strengthening of greenback against this background, since the US will pull ahead in comparison with other economies in terms of expected growth of bond yields.

Also, this week there will be meetings of a number of other central banks - England, Japan and Switzerland. The big uncertainty for the pound is that the Bank of England has given a signal that it is ready to raise rates earlier, but the data on the economy over the past month, in particular retail sales, began to deteriorate. Therefore, the Central Bank will have to choose a more cautious position, and the scale of disappointment for the Cable will depend on how much the pain the Bank is ready to deliver to the market.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.