The Fed may Hike Interest Rates two Times Next Year to Tame Inflation

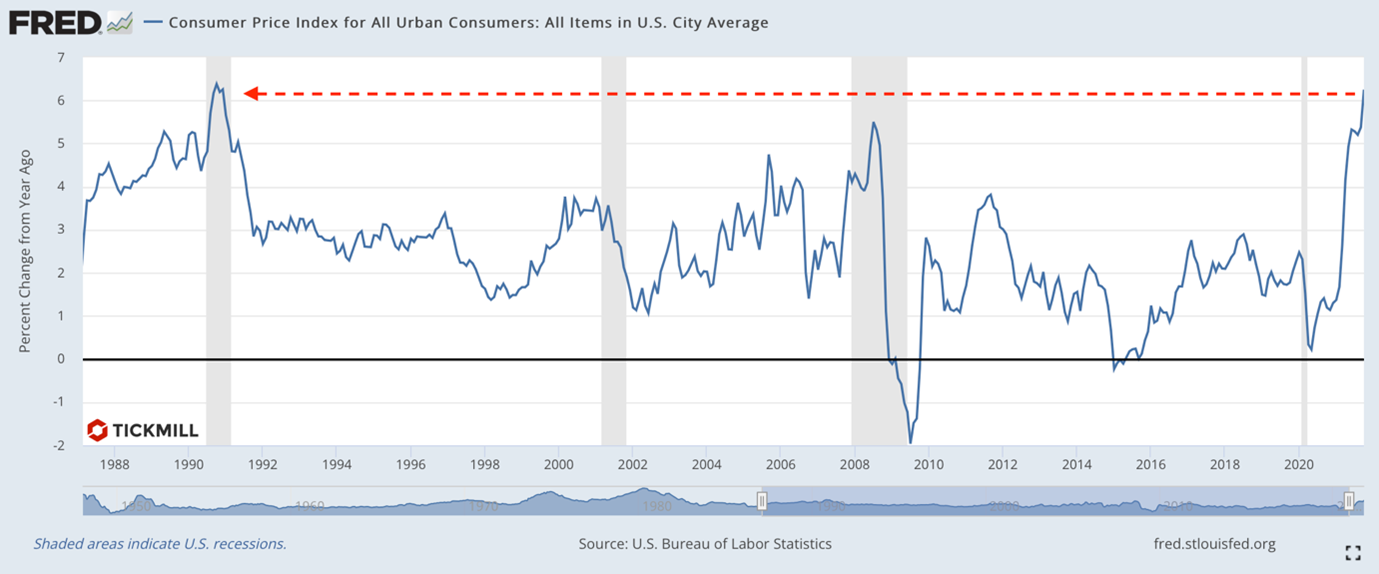

The US economy continues to expand at a solid pace and it is increasingly difficult for the Fed to dismiss the accompanying price pressures, which in less than a year reached their highest level since the early 90s:

Events are changing so fast that less than half a year has passed from the Fed’s intention to continue QE at full speed in 2022 to the possibility of unwinding the asset purchase program already in February! It is clear that the Fed needs higher rates as quickly as possible so that during the next crisis there will be a tool to boost activity. Now speculation is intensifying in the market that the dot plot at the upcoming meeting will already point to 2 rate hikes next year. This, by the way, is felt well in the foreign exchange market, the dollar index is gradually moving up.

In November, the Fed announced that it was beginning to cut its $120 billion/month supply of liquidity to the banking sector. In November, the volume of asset purchases fell by $15 billion, then by another $15 billion in December. Maintaining this pace of contraction, the Fed will complete QE in May next year, however, an important caveat was made that the pace of decreasing asset purchases could increase if economic forecasts change. And the forecasts have really changed. Households, firms, government and even regional Fed officials are sounding the alarm as inflation is approaching 7%, so in a previous speech, Powell hinted that policy normalization could happen faster.

Despite the spread of the omicron strain, proposals to accelerate the QE cut are unlikely to meet with resistance, as inflation leaves no choice, so at the upcoming meeting we will probably hear that the Fed is increasing the rate of reduction in asset purchases to $30 billion per month in January and another $30 billion dollars in February. Thus, by early March, the Fed may complete QE, while the volume of assets on the balance sheet will be about 9 trillion dollars, which is twice the level before the pandemic.

The balance of risks for the dollar after the Fed meeting is shifted towards further rally. A potential weakening in US growth forecasts will be offset by a shorter cycle of reductions in the QE program and a hint of a second rate hike in the dot plot next year. It was dot plot that acted as the main driver of dollar growth in June and September of this year.

The biggest gains in the dollar are likely to be against low-yielding currencies such as the yen and the Euro. In December, EURUSD was trading in the range of 1.18-1.1380 and the Fed meeting could be a catalyst for a decline and a potential breakthrough of 1.10 for the pair. Although investors can listen to the ECB before finally considering selling. USDJPY may target the 115 level again.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.