The FOMC Minutes Could be a Nothingburger as the Bar for Surprise is High

The US equities have finally succumbed to the hawkish interest rate narrative that was gathering momentum in the market since the start of the February. The recent stream of fundamental data updates, officials’ statements, warnings from market experts about Fed tightening extending into the second half of 2023 seem to have reached critical mass, which caused the first serious bearish equity market correction in several weeks. Major US equity indexes erased about 2 percent; SPX ended the trading session below 4,000 points on Tuesday. Interestingly, the dollar index remains "glued" to the 104-point area, although it usually benefits from any significant downside move in the stock market. This may indicate that the dollar demand as a safe haven is currently quite low, which suggests recession fears in 2023 are somewhat subdued. The key bearish catalyst remains the rising discount rate (opportunity cost for stocks). This rate is rising along with Treasury yields, which even approached the peak levels of 2022 on certain maturities:

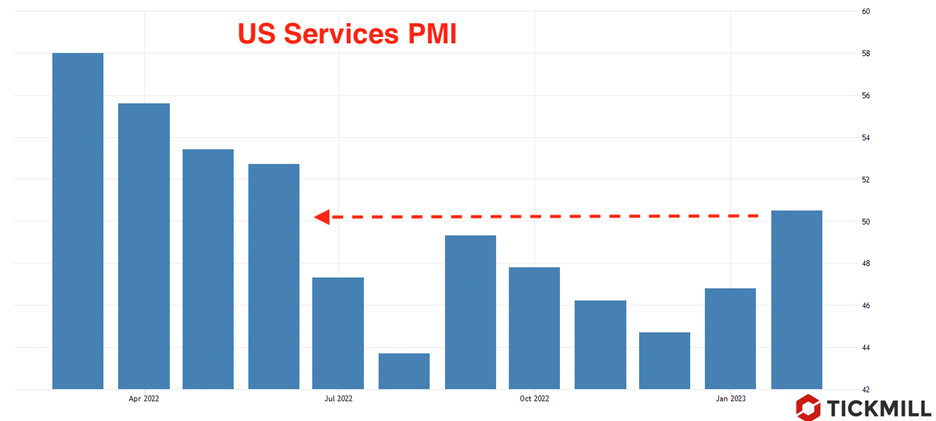

It may sound a bit paradoxical, but yesterday's market correction was exacerbated by the very optimistic PMI prints in manufacturing and services US sectors from the S&P Global. The reports joined a series of positive data points on the US economy, which started from the February NFP report. The index of activity in the services sector unexpectedly got into the growth zone, having increased to 50.5 points in February (forecast 47.2 points). The indicator value above 50 points has been observed for the first time since June 2022, until February the situation with activity in the sector steadily worsened from month to month, as can be seen from the indicator readings below 50 points:

Although activity in the manufacturing sector continued to deteriorate, it did so at a slower pace - PMI in February inched up to 47.8 points against 46.9 points forecast.

Today the markets will analyze the minutes of the last FOMC meeting with great interest. The Feb. 1 meeting was held before the release of strong employment and inflation numbers and, most importantly, before a hawkish revision of the Fed's expectations. Since the Fed's terminal rate is already estimated at 5.50%, the minutes will be able to influence market expectations if it indicates that at least a few Fed officials were in favor of raising the rate by 50 bp. in February. This would be a strong argument to wait for such a rate hike in March and would probably improve dollar position a little bit. However, after the recent wave of hawkish rhetoric from several representatives of the FOMC, the bar is set quite high, so most likely the release of the protocol will not be a significant event for the markets.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.