The FTSE Finish Line - July 05 - 2023

The FTSE Finish Line - July 05 - 2023

FTSE Faltering As Rate Hike Risks & China Concerns Sour Sentiment

On Wednesday, British shares experienced a further decline as mining stocks retreated due to lower metal prices, and other stocks exposed to China also fell as subdued data raised concerns about slowing demand in the second-largest economy. Industrial metal miners slipped 0.7% as prices of non-ferrous metals declined, influenced by a steady dollar and weak global economic data that weighed on the demand outlook, AngloAmerican led the sector lower shedding 2.74%. Additionally, a private-sector survey revealed that China's services activity expanded at the slowest pace in five months in June.

Investors are also reacting to a warning that the Bank of England (BoE) may need to raise interest rates as high as 7% to combat inflation, which could lead to a "hard landing" for the UK economy. JPMorgan economist Allan Monks has suggested that this scenario is increasingly likely. While JPMorgan's baseline forecast is that the BoE's base rate will peak at 5.75%, there is a risk that interest rate hikes of up to 7% may be necessary if elevated wage growth continues to offset the impact of rising mortgage rates, according to Monks.

Shares of Legal & General Group Plc experienced a decline of up to 2.5% as the company's profit outlook for FY22 under the new accounting rules of IFRS 17 disappointed investors. The British insurer expects its divisional operating profit to decrease by 28%, which is worse than the previously guided range of a 20-25% decline. Legal & General attributes the larger-than-anticipated profit decline to the deferral of new business earnings and changes in assumptions. The company believes that the transition to IFRS 17 will result in a more stable and predictable profit profile. With the stock down 1.4%, its losses for this year now stand at approximately 10%. However the whipsaw action in Ocado shares continues as they sit at the bottom of the index nursing losses of 6.7%

On the positive side of the ledger, shares in Pearson PLC experienced a decent rise after UBS upgraded the educational publisher from neutral to buy, accompanied by an increased share price target of 970p, up from 930p. As a result, the firm climbed to the top of the FTSE 100 riser list, with a 2.1% increase. UBS acknowledged that Pearson shares had declined by 13% year-to-date, primarily influenced by disappointing financial year 2023 guidance and concerns regarding the impact of generative AI on its higher education business. However, the bank observed positive operating momentum in the business following Q1 results and into Q2. UBS expressed optimism about the Assessment & Qualifications (A&Q) segment, which contributes around 54% of group EBIT. The bank identified several strategic opportunities that indicate potential significant outperformance of consensus expectations for A&Q, with the potential for sustained 6% annual growth in an "upside case." UBS revised its growth forecast for the division to 5%, up from the previous 3%, surpassing the market consensus of 3-4%.

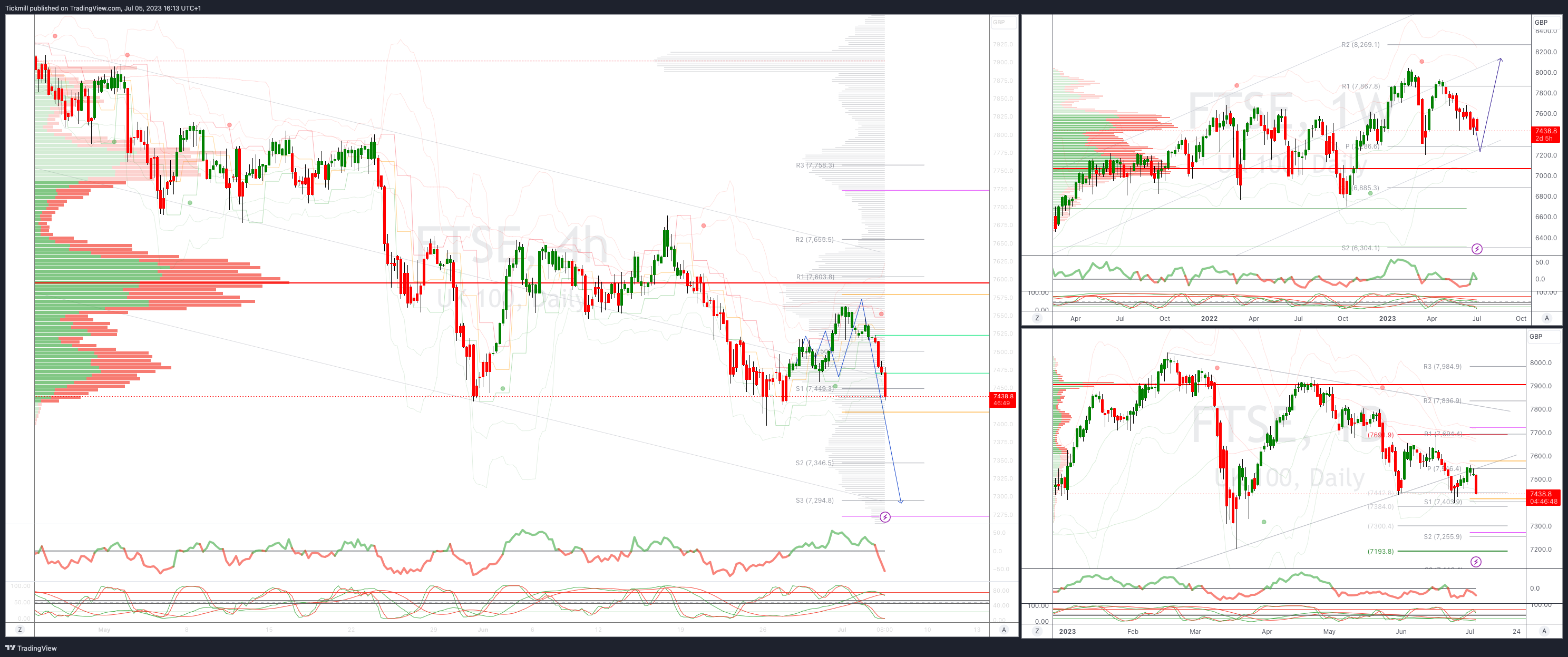

FTSE Bias: Intraday Bullish Above Bearish below 7510

Above 7550 opens 7660

Primary resistance is 7660

Primary objective 7330

20 Day VWAP bearish, 5 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!