The NFP Report Keeps Markets on Edge Regarding Fed's Aggressive Policy

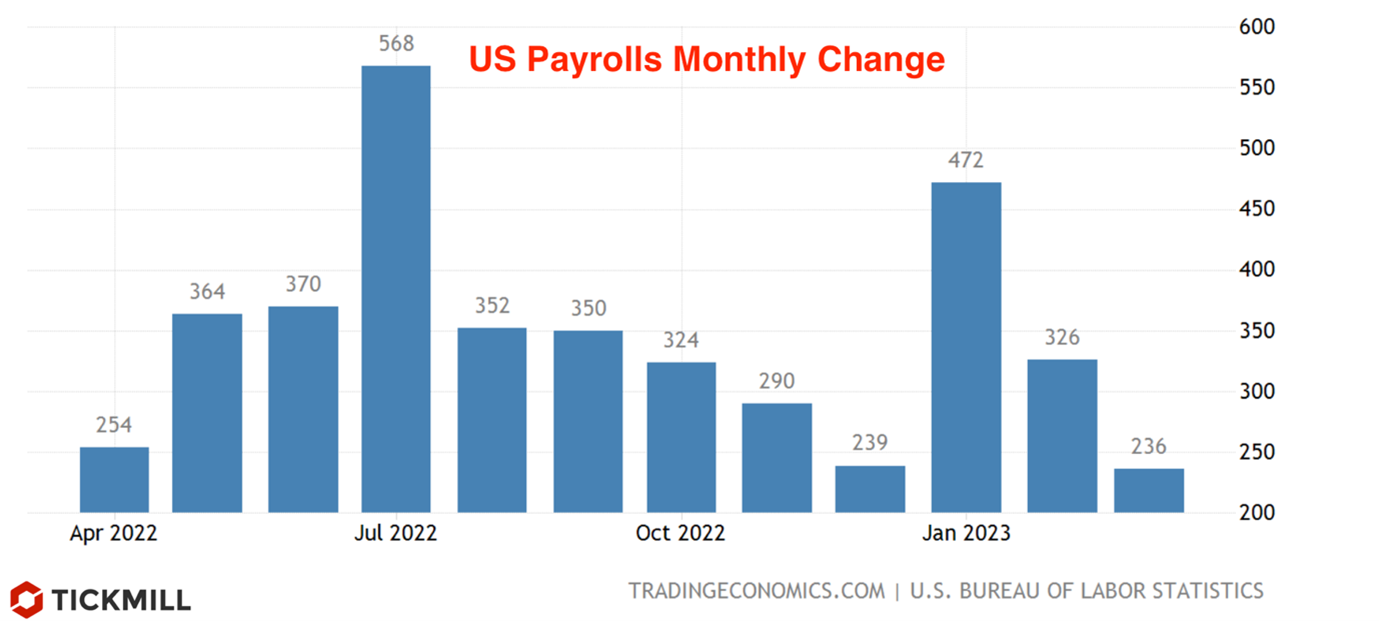

Employment in the US increased by 236K in March, and unemployment decreased to 3.5%, as shown by the NFP report on Friday. Considering that a fairly strong inflation report is expected this week (forecast 0.4% MoM), the consensus forecast for the Fed's decision at the upcoming meeting is likely to finally shift towards a 25 bps rate hike. Nevertheless, economic problems are mounting, increasing the chances of a hard landing of the economy due to rising consumer and firm servicing costs and overall credit expansion slowing down.

The NFP report left a mixed impression. The headline figure exceeded the forecast by 36K, but job growth over the previous two months was revised down by 17K. The increase in private sector jobs, however, fell short of expectations, at 189K (forecast 218K). The positive was that most of the added jobs were full-time. Until last month, all jobs (in general) over the previous 11 months had been part-time, and the number of full-time jobs had not increased. The primary sectors generating jobs remain government (+47K), leisure and hospitality (+72K), and private education/healthcare (+65K). On the negative side, jobs were lost in the construction, manufacturing, finance, retail, and temporary help sectors.

Wages rose 0.3% per month as expected, and the unemployment rate dropped to 3.5%. Thus, the active labour market and a good pace of job creation increase the likelihood of a 25 basis point rate hike on May 3. The CPI report next Wednesday is expected to show that consumer inflation rose by 0.4% per month, more than twice the necessary pace (0.17%) that brought inflation to the target 2% YoY by the end of 2023. If this happens, it is hard to imagine that the US Federal Reserve will halt tightening in May, except for a resumption of stress in the financial system.

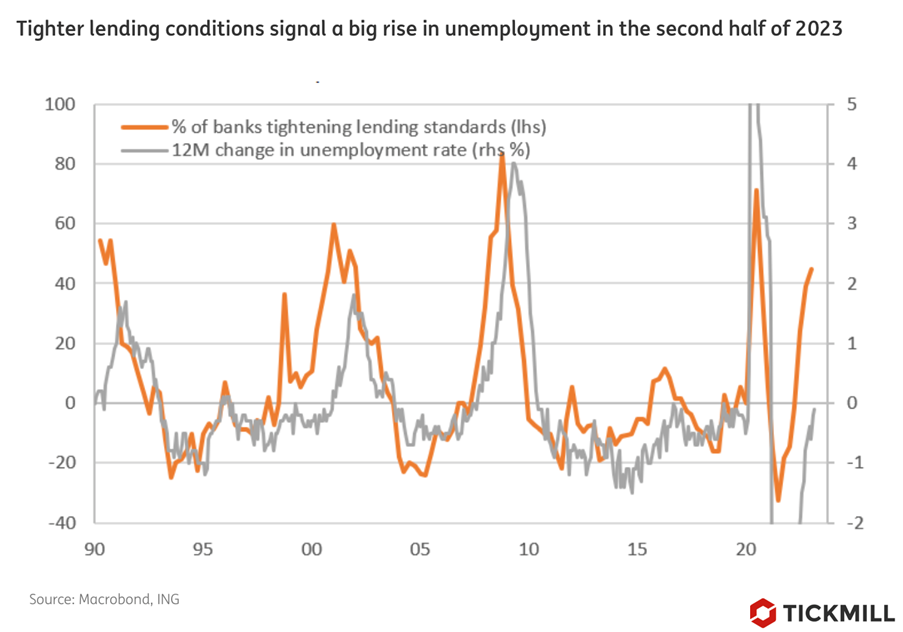

Nevertheless, employment data is a lagging indicator, the last data point that changes in the cycle, and the outlook is becoming increasingly complex. The economy has experienced the most aggressive period of monetary policy tightening in the last 40 years, and recent banking stresses are likely to disrupt the flow of credit in the economy. Business confidence, whether it's the Conference Board's consumer confidence index or the NFIB's index, is at recession levels, and the real estate market is also under pressure from unaffordable mortgage rates.

This is a very "toxic" combination for creating jobs. Indeed, even before the events at Silicon Valley Bank, a Federal Reserve survey conducted in January among senior credit managers showed that banks are becoming more cautious and lending is likely to be restricted. This will inevitably worsen, putting struggling companies and households under increasing pressure. The chart below shows that unemployment is likely to creep up from the end of the second quarter/beginning of the third.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.