The Risk of Fed’s 100 bp Move Drives Stocks and Bonds Lower, Greenback Higher

Greenback retains advantage ahead of the FOMC meeting with DXY consolidating around 110 points while demand for risk assets contracts on the back of two key drivers. First, investors are worried about the slowdown in global economy due to the rise of dollar borrowing costs and associated growth of uncertainty (risk) in expected returns on assets. Second, expectations of an increase in the risk-free rate which is used to calculate discount rates means they will also increase and therefore discounted cash flows, i.e., the price of risk assets, should be lower.

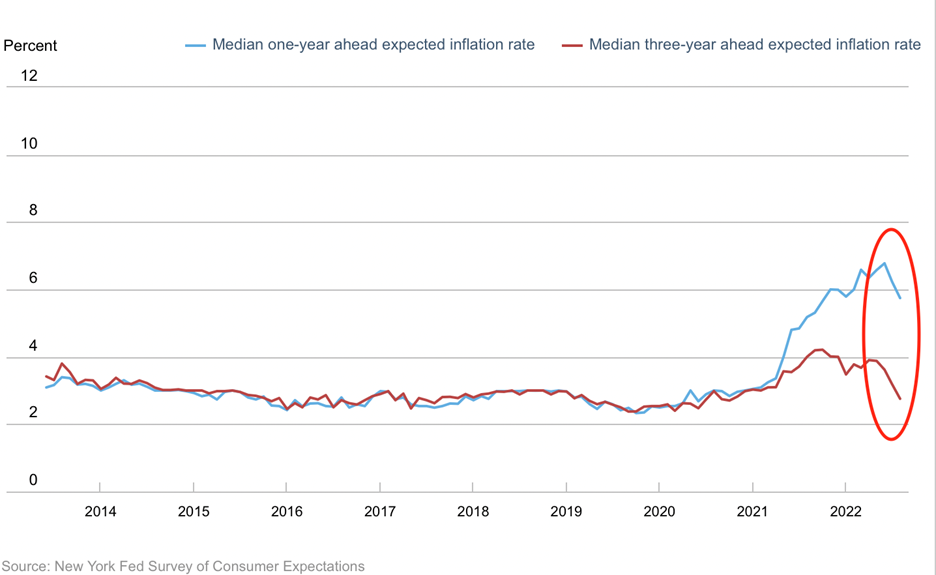

The market consensus on Wednesday’s FOMC decision is a 75 bp rate hike, but there is a moderate possibility of a more aggressive 100 basis point tightening. The market estimates the probability of such an outcome at 20%. In favor of the first outcome there are such data as inflation expectations of US households which seem to have passed the tipping point in June, as well as the intention of firms to raise prices. The latest data from the New York Fed shows that inflation expectations continued to decline in August - one-year to 5.7%, three-year - to 2.8%:

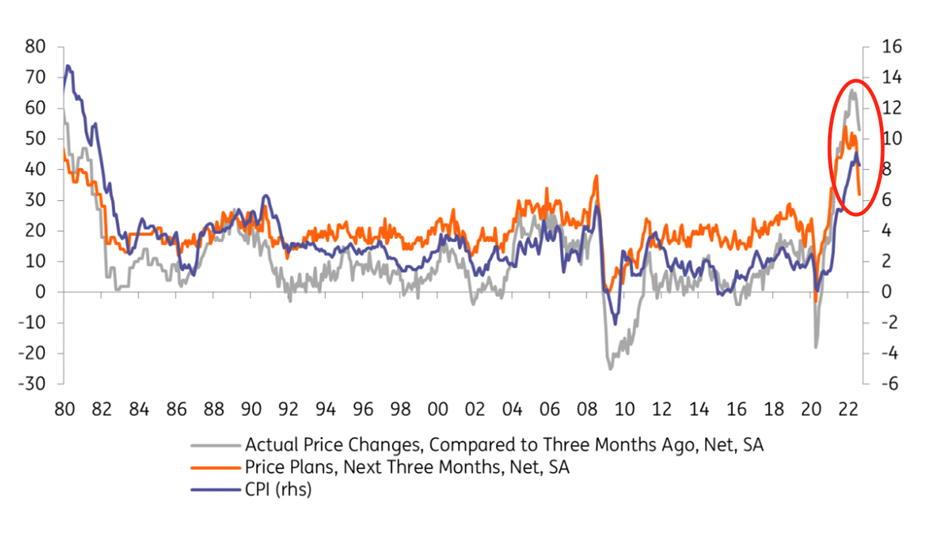

At the same time, NFIB data for August showed that a proportionof firms planning to raise prices over the next three months fell from 51% to32%:

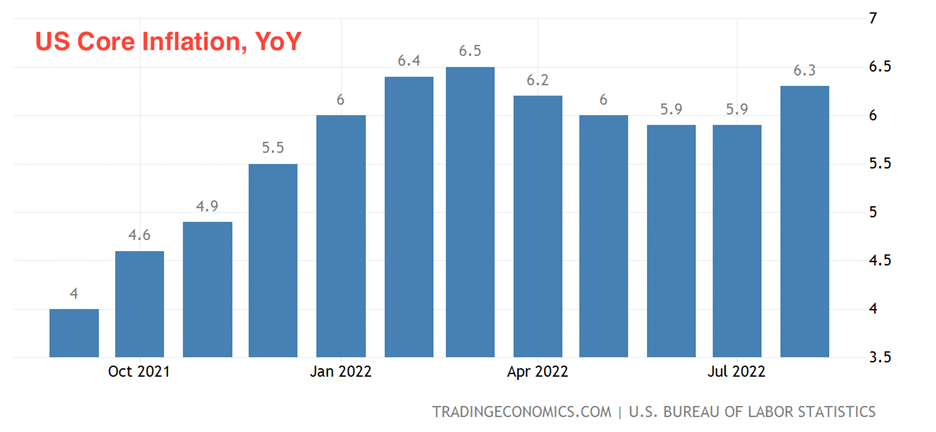

Persistent consumer inflation speaks in favor of a moreaggressive decision. Core inflation accelerated from 5.9% to 6.3% in August:

Market participants will also be watching to see how signs of inflation resilience have affected the Fed outlook for terminal rate, which the market assumes has moved into the 4.25%-4.5% range.

The Fed may also seek to use the welfare effect to dampen consumer demand, which in turn will have a key downward effect on consumer inflation. It lies in the fact that households, seeing a decrease in the value of wealth (which is largely represented by investments in equity markets), will decide to save more than to consume. It is for this reason that the Fed may now have little incentive to "rescue" falling stock market and adjust policy to contain development of bearish sentiment.

To assess the outcome of the Fed meeting on stock markets and the dollar, one needs to keep in mind the following: Current prices reflect the risks of an aggressive "100 bp" outcome and possibly a shocking 125bp move, so if the Fed raises rates by 75 basis points and avoids clear hints about a possible increase in the outlook for terminal rate then risk asset markets will likely bounce up and the dollar will likely see a short-lived bearish reaction.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.