The SVB Financial stock crash is a reminder of the steep price tag of the Fed tightening

The problems in the US banking system unexpectedly became the centre of attention for investors worldwide after shares of SVB Financial, a California-based bank specializing in venture investments, plummeted by 60%. The credit institution announced the sale of a bond portfolio, along with a stock issuance, to raise cash to pay depositors, which greatly increased suspicions that the bank was in danger of default. A wave of concern swept across the US stock market. SPX closed down 1.8% on Thursday, while Nasdaq and Dow lost about the same. European market investors also suffered losses, with major stock indices falling by about 1.5%. The crypto market also shook - Bitcoin broke the $20K mark, and the capitalization of major altcoins decreased by more than 10%.

SVB Financial Stock Price

The threat of default by a major Silicon Valley startup lender was a worrying warning that tightening monetary policy carries serious hidden risks. Credit institutions that bought long-term fixed-income instruments when US interest rates were at historic lows may now suffer significant losses due to the devaluation of securities. In addition, the number of depositors who could withdraw deposits prematurely to invest in more profitable instruments has increased; the same treasury bonds, which are considered a risk-free instrument, now offer a yield of over 5%. As a result, the likelihood of a bank run has increased, which, combined with asset devaluation, can significantly increase the risk of default, which ultimately surfaced in the example of SVB Financial.

However, considering that the Federal Reserve's task is to maintain stability in the financial market, signs of excess tension in the banking sector may force the regulator to be more cautious with aggressive rhetoric. In this sense, risky assets, as well as fixed-income instruments, may hope for some support from the central bank, and therefore, in my opinion, risks will be shifted towards an upward correction, both in the stock and bond markets.

Also, among the encouraging news regarding this situation, it is worth noting the statement by Morgan Stanley. The investment bank said that the financing problems faced by SVB Financial are "highly idiosyncratic," meaning that the risk of contagion should be low.

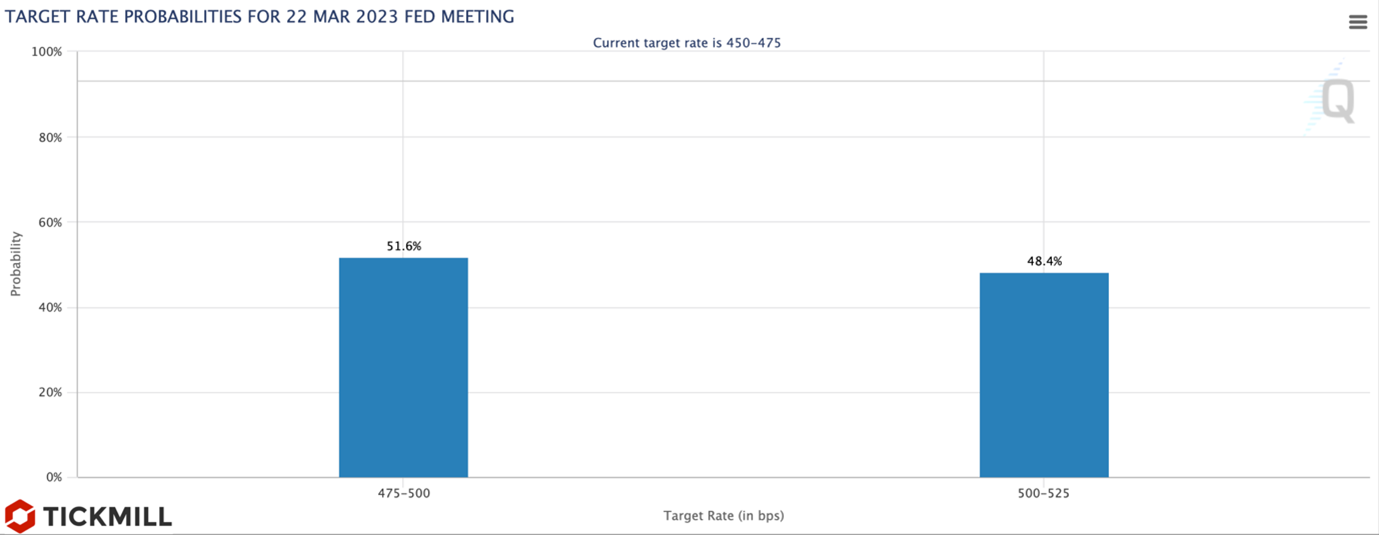

The NFP report had a mixed impact on the market. Although the number of jobs exceeded expectations (311K versus a forecast of 225K), the market reaction was positive - the dollar fell, and US stock indices bounced back up. Market participants probably preferred to focus on wage metrics and unemployment - wage growth fell short of expectations (0.2% versus a forecast of 0.3%), while unemployment rose from 3.4% to 3.6%. Futures on interest rates rose, reflecting the fact that market participants priced in a less aggressive Fed stance. The US 2-year/10-year bond yield curve flattened after the data on the change in US employment, to -94.91 basis points. Based on the dynamics of overnight interest rate swaps, the probability of a 50 basis points rate hike in March fell below 50%, although not long ago it exceeded 70%:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.