Three factors for a possible USD revaluation

The November NFP report improved the USD position, however the rebound following a strong release from the level of 104.50 was quickly erased, with the aggressive sell-off that began near the 105.50 level on DXY, and the price returned to approximately the same level where the spike had begun:

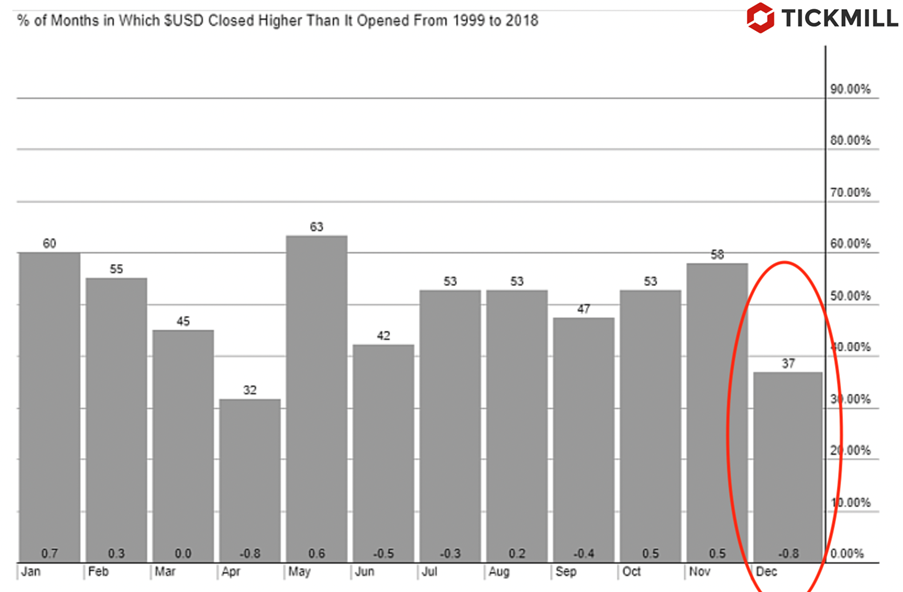

The weakness of the dollar is also explained by seasonality – the US currency often enters a bearish trend from mid-November and the decline lasts until the end of the year. From 1999 to 2018, the dollar rose in December only 37% of the time, while the average decline was 0.8%:

However, there are three factors that could contribute to a revaluation of the dollar early next year: a consistently hawkish stance by the Fed at next week's meeting, a decline in the optimism over the Chinese economy, and a bullish trend in the commodity markets, in particular in the energy market, which will again bring on the surface the problem of inflation and deficit in the trade balance of countries importing energy.

In more detail, rumors were gaining momentum in the market that, against the backdrop of a declining inflation, the Fed would move to a slower tightening of its policy. However, the NFP report last Friday showed that wages rose at a significant pace in November (0.6% on a monthly basis) and it is wage inflation that the Fed considers to be the main source of consumer inflation, so the risk that the Central Bank will not meet market expectations at a meeting in December is high.

Secondly, USDCNY is trading below 7 yuan per dollar for the first time since September amid easing of covid measures, but the trend could easily change would the growth in new cases of covid accelerate and the authorities slow down the restart of the economy. If this happens, the yuan will most likely begin to weaken again, and due to the correlation with the dollar index, a corresponding strengthening of the American currency could be expected.

Thirdly, Russia is threatening to retaliate against the oil price cap imposed by the EU, the G7 countries and Australia, which means that a new jump in energy prices is a major risk for countries importing energy resources. In this case, we can see a repetition of the episode of a large-scale dump of European currencies (Euro, pounds sterling) and the Japanese yen.

The economic calendar today includes data from the ISM for November. Later this week, US PPI data and a report on consumer sentiment and inflation expectations from U. Michigan are due.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.